The Broader Markets

Last Week – SPY rose nearly 7% last week, a much larger move than the 2.7% options were pricing. Implied volatility fell but remains elevated from historical averages.

This Week – SPY options are pricing about a 2% move for the upcoming 4 day week (about $8.50 in either direction).

Implied Volatility / VIX – The VIX closed the week near 26, down from 29 the prior week.

Expected Moves for This Week (via Options AI)

- SPY 2% (+/- $8.50)

- QQQ 2.6% (+/- $8)

- IWM 2.4% (+/- $4.50)

- DIA 1.6% (+/- $5.50)

In the News

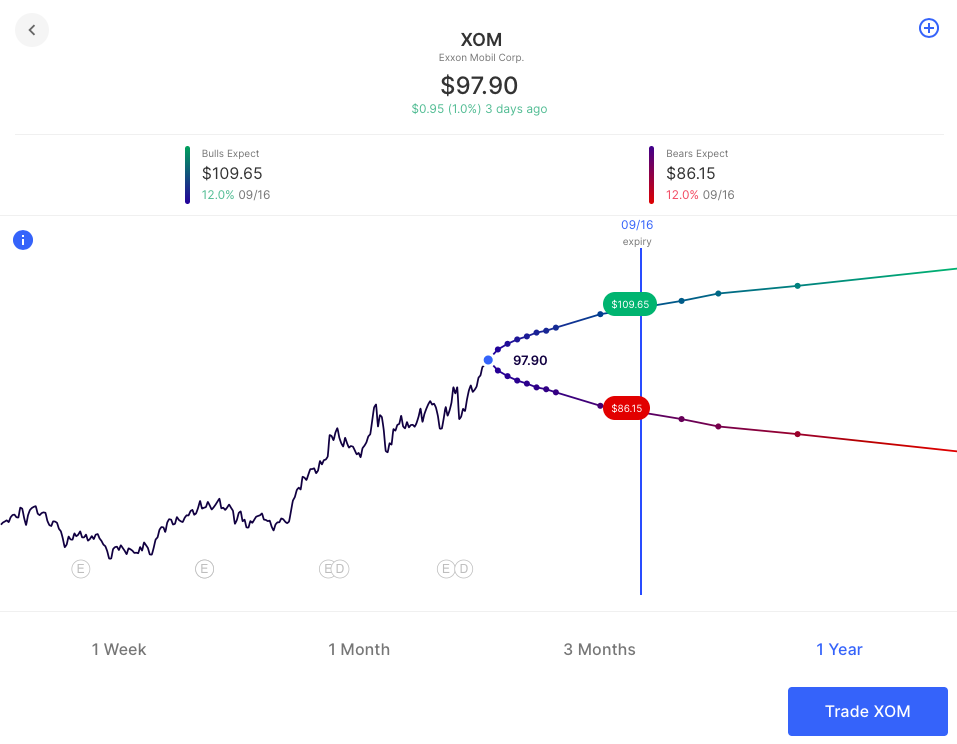

Oil, gas and energy companies are some of the best-performing stocks over the past few months, with some at our near all-time highs. Many top the high RSI (overbought) lists after seeing multi-year lows during the pandemic. For example, OXY was a $10 stock in Summer 2020 and a $28 stock to start 2022. It is now $70. Exxon Mobil started 2022 near $60 and is now approaching an all-time high near $100.

Despite a move from under $85 to $98 in the past 3 weeks, XOM options aren’t pricing that sort of move, higher or lower until September. OXY is up $15 in the past month yet options are not pricing that sort of move until September either. There are a lot of moving parts for these stocks right now, the war in Ukraine, a potential recession to name a few. These stocks have seen investors pour in and the stocks have “crashed higher” towards all-time highs alongside oil itself, but the implied volatility of options in the single names are acting more like a stock near highs and less like a volatile commodity near highs where one typically sees IV increase as the commodity price goes higher. Meaning Puts and Put Spreads in particular may cost less than might otherwise be expected. Something to keep an eye on, especially for those looking to hedge.

Earnings

Links below go to the Options AI calendar where you can see the other companies each day and click through to see charts (free to use). Recent earnings moves (actual) start with the most recent:

- Salesforce CRM / Expected Move: 7.2% / Recent moves: +1%, -12%, +3%

- Gamestop GME / Expected Move: 16.7% / Recent moves: +4%, -10%, 0%

- Chewy CHWY / Expected Move: 16% / Recent moves: -16%, -8%, -9%

- Mongo DB MDB / Expected Move: 14% / Recent moves: +19%, +16%, +26%

- Crowdstrike CRWD / Expected Move: 9.8% / Recent moves: +12.5%, +4%, -4%

- Lululemon LULU / Expected Move: 7.9% / Recent moves: +10%, -2%, +10%

- Okta OKTA / Expected Move: 11.5% / Recent moves: -8%, +12%, +3%

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.