The Broader Markets

Last Week – SPY fell 2.4% last week, slightly less than the 2.8% move options were pricing. The markets rallied to end the week with a roughly +4% move higher from the lows on Thursday.

This Week – SPY options are pricing about a 2.7% move for the upcoming week (about $12 in either direction).

Implied Volatility / VIX – The VIX closed the week near 29. Its high of the week was near 35

Expected Moves for This Week (via Options AI)

- SPY 2.7% (+/- $11)

- QQQ 3.6% (+/- $11)

- IWM 3.3% (+/- $6)

- DIA 2.3% (+/- $8)

In the News

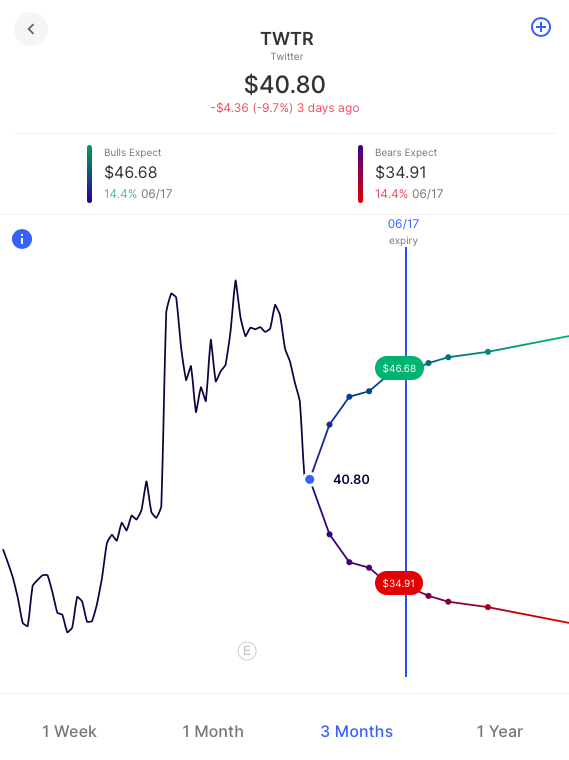

Twitter stock dropped last week as Elon Musk tweeted that the deal was temporarily on hold while he sought information on the prevalence of bots on Twitter. The stock was already trading at a steep discount to its deal price and new doubts about the deal further exacerbated that discount. The stock is now (roughly) 25% below its deal price and options are not pricing a move to the deal price anytime soon either. The expected move in the stock over the next month (June 16th expiry) is about 15%. Which corresponds to about $47 on the upside (and $35 on the downside).

Earnings

Links below go to the Options AI calendar where you can see the other companies each day and click through to see charts (free to use). Recent earnings moves (actual) start with the most recent:

- Walmart WMT / Expected Move: 3.8% / Recent moves: +4%, -3%, 0%

- Home Depot HD / Expected Move: 5.5% / Recent moves: -9%, +6%, -4%

- JD.com JD / Expected Move: 10.4% / Recent moves: -16%, +6%, +3%

- Target TGT / Expected Move: 6.1% / Recent moves: +10%, -5%, -3%

- Lowe’s LOW / Expected Move: 6.3% / Recent moves: 0%, 0%, +10%

- Cisco CSCO / Expected Move: 4.9% / Recent moves: +3%, -6%, +4%

- Applied Materials AMAT / Expected Move: 6.1% / Recent moves: -3%, -5%, -2%

- Palo Alto Networks PANW / Expected Move: 8.0% / Recent moves: 0%, +2%, +19%

- John Deere DE / Expected Move: 5.2% / Recent moves: -3%, +5%, -2%

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.