The Broader Markets

Last Week – Equities caught options sleeping as SPY was lower by around 5%, a significantly larger move than the 2% options were pricing. SPY closed near its mid-March lows. QQQ and IWM are still slightly above those March lows.

This Week – Implied volatility spiked on the move lower and now SPY options are pricing about a 3% move for the upcoming week (about $8.50 in either direction).

Implied Volatility / VIX – The VIX closed the week near 28, up from 25 the prior week. Implied vol is still lower than the spikes in March and early May that saw the VIX above 35.

Expected Moves for This Week (via Options AI)

- SPY 3% (+/- $11.50)

- QQQ 3.5% (+/- $10)

- IWM 3.2% (+/- $6)

- DIA 2.3% (+/- $7.50)

In the News

Crypto had a rough weekend following the equity sell-off on Friday. Both are back to levels they haven’t seen since 2020. BTC options are pricing about a 10% move into Friday. ETH options are pricing about an 14% move.

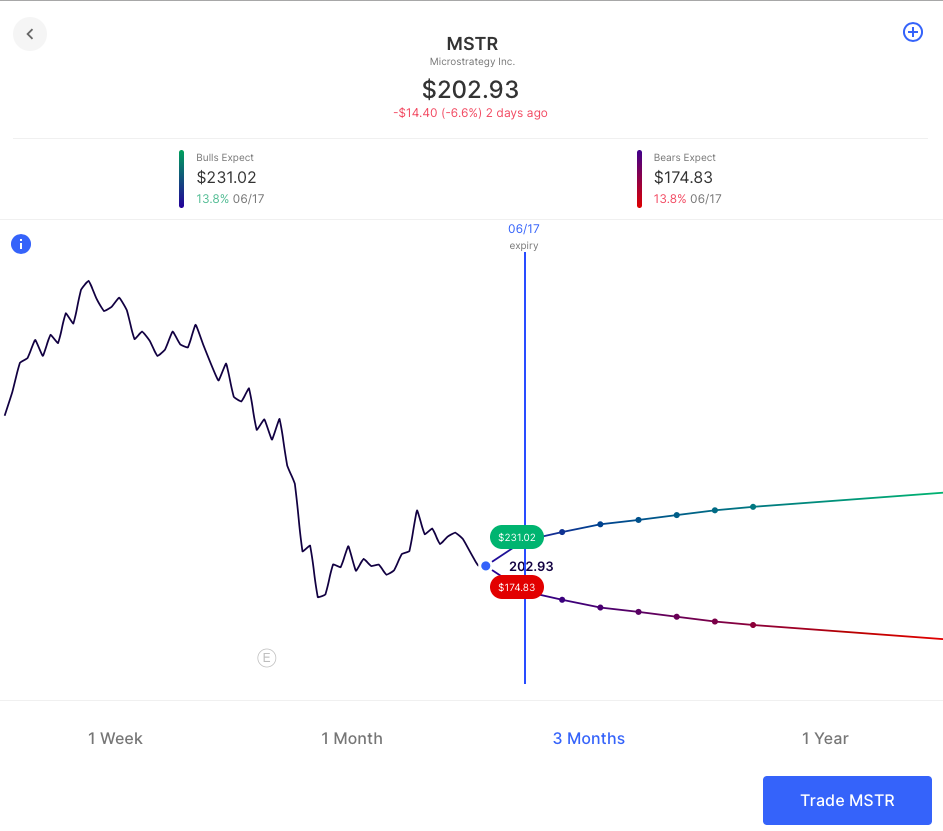

On the crypto-affected equities side of things, Coinbase (COIN) options were pricing about a 13% move this week. The stock is down 17% pre-,arket. Microstrategy (MSTR) options were pricing about a 14% move, the stock is down 25% pre-market.

The expected move in MSTR for the week was around $26, which based on Friday’s close, lined up at about $174 on the downside, near its early May lows. Pre-market prices have it well below that level, near $155. IV in crypto-related equities was not pricing the possibility of a move like this in crypto. MSTR at the close Friday:

Earnings

Links below go to the Options AI calendar where you can see the other companies each day and click through to see charts (free to use). Recent earnings moves (actual) start with the most recent:

- Oracle ORCL / Expected Move: 6.7% / Recent moves: +2%, +16%, -3%

- Adobe ADBE / Expected Move: 7.1% / Recent moves: -9%, -10%, -3%

- Kroger KR / Expected Move: 8.4% / Recent moves: +12%, +11%, -8%

- Jabil JBL / Expected Move: 5.7% / Recent moves: +10%, +1%, -6%

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.