The Broader Markets

Last Week – SPY was lower by just 0.4% last week, less than the 3.1% move options were pricing. The markets however were quite volatile day to day with large swings higher and lower of more than 5% intra-week. Implied volatility was lower on the week.

This Week – SPY options are pricing about a 2.8% move for the upcoming week (about $12 in either direction).

Implied Volatility / VIX – The VIX closed the week near 30, down from 33 to start the week and lower than the 36+ intra-week.

Expected Moves for This Week (via Options AI)

- SPY 2.8% (+/- $12)

- QQQ 3.7% (+/- $12)

- IWM 3.4% (+/- $6)

- DIA 2.4% (+/- $8)

In the News

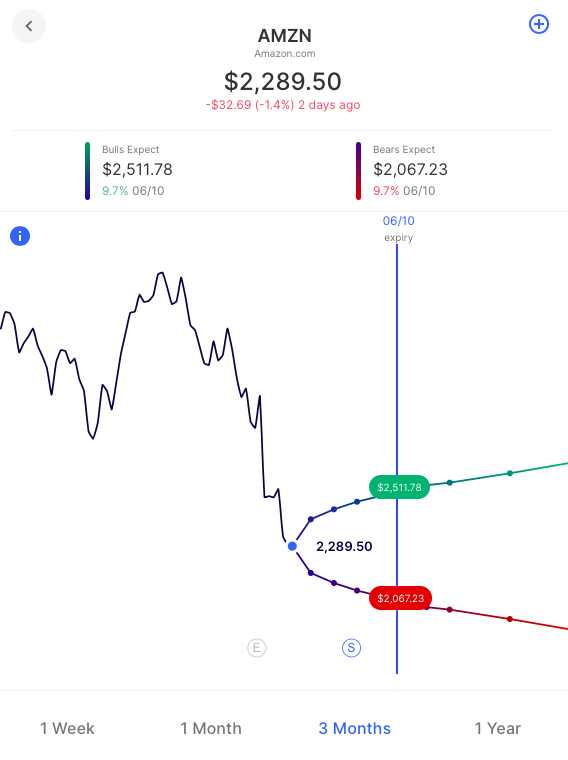

Amazon (AMZN) and Alphabet are set for 20-1 stock splits in the beginning of June, less than a month from now. With both stocks currently near $2300, that would mean a roughly $115 price for each post split. A recent CBOE study showed that large cap stocks tend to see initial increased (split adjusted) volume, volatility, and implied volatility but that effect tapers off over time. Pre split options in AMZN are currently pricing in about a 10% move for the June 10th expiry. That aligns with a post-split levels of about $103 on the downside and about $126 on the upside. Here’s how that expected move looks pre-split:

Alphabet options are pricing slightly less of a move to 5/10 expiry, around 8%.

Earnings

Links below go to the Options AI calendar where you can see the other companies each day and click through to see charts (free to use). Recent earnings moves (actual) start with the most recent:

- Palantir PLTR / Expected Move: 14.1% / Recent moves: -16%, -9%, +11%

- Upstart UPST / Expected Move: 22.4% / Recent moves: +36%, -18%, +26%

- AMC AMC / Expected Move: 6.7% / Recent moves: +1%, -11%, -6%

- Peloton PTON / Expected Move: 19.9% / Recent moves: +4%, -35%, -9%

- Sofi SOFI / Expected Move: 13.9% / Recent moves: -14%

- Oxy OXY / Expected Move: 7.6% / Recent moves: -0%, -1%, -3%

- Coinbase COIN / Expected Move: 15.5% / Recent moves: -2%, -8%, +3%

- Disney DIS / Expected Move: 6.6% / Recent moves: +3%, -7%, +1%

- Rivian RIVN / Expected Move: 16.1% / Recent moves: -8%, -10%,

- Beyond Meat BYND / Expected Move: 14.7% / Recent moves: -9%, -13%, +2%

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.