Hello!

SPY/SPX was higher by about 1% in holiday-shortened trading last week, slightly more than what options were pricing. The gamma we’ve discussed in these posts that held SPX near the 4500 level mostly expired after Nov monthly expiration the week before but the Thanksgiving week saw low volumes and not a ton of volatility to give an indication of what type of option backdrop we’ll see over the next few weeks. If we were to see some volatility before year end it would most likely come in the next two weeks while the gamma forces are not as significant, and, there’s a decent amount of economic data and Fedspeak.

Implied Vol is VERY low across the board. The VIX closed Friday near 12.50. At the money IV in SPY/SPX is below 10 for several days this week. The VIX has been a straight line down from 22 in late October. As discussed previously that can have a self-fulfilling crush on both implied vol AND realized vol, loading the market up with gamma while market makers drastically lower option bids across the board to stop drowning in long premium. Those conditions often lead to a slow creep higher where the risk on option selling each day is to the upside with expected moves so narrow. The conditions would most likely flip with an accelerating sell-off in stocks where investors finally looked to buy protection again. Whether that occurs in any way this week or next remains to be seen. If it does not we then re-enter a holiday period at year-end and a December expiry that could once again be loaded with gamma. Before now and then there are this week’s GDP, PCE and a Powell Speech. Next week is an important Jobs Number, and after that is CPI. So some things to watch for on the calendar.

Earnings season is coming to an end but some interesting names remain. This week sees Crowdstrike, Salesforce, Snowflake and a few others.

Expected Moves This Week

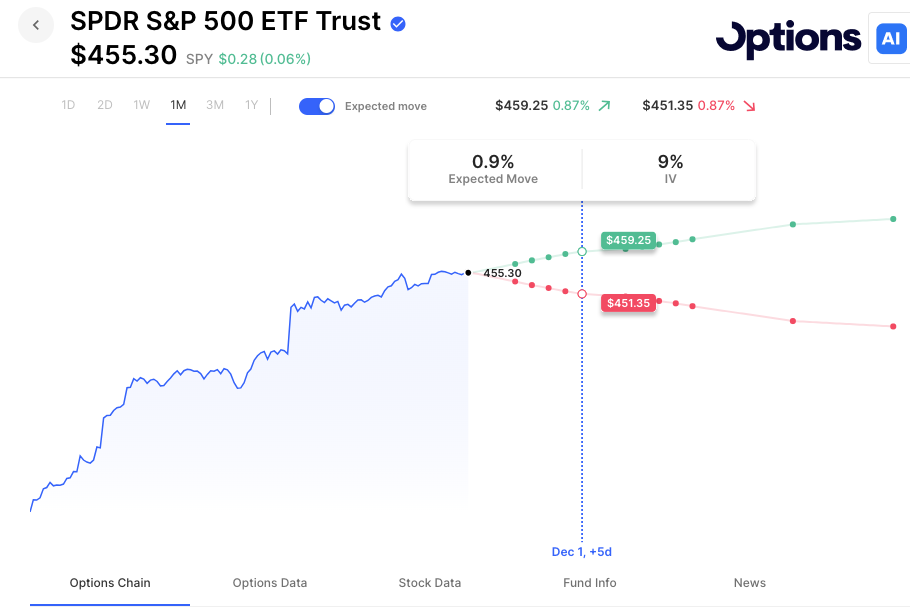

- SPY/SPX: 0.9%

- QQQ: 1.3%

- IWM: 1.7%

0DTE Expected Moves

- SPY/SPX: 0.4%

- QQQ: 0.6%

Here’s an example of how low IV got into Friday’s early close, SPY vol in single digits into this week (look for it to pop a bit out of the weekend of course):

Economic Calendar

- Monday – New Home Sales

- Tuesday – Housing Prices, Goolsbee/Waller/Bowman speeches

- Wednesday – GDP, Beige Book

- Thursday – PCE, Pending Home Sales, OPEC meeting

- Friday – ISM Manufacturing PMI, Powell Speech

Earnings Expected Moves

Monday

- ZS Zscaler, Inc. 7.6%

- SDRL Seadrill Limited 7.8%

Tuesday

- INTU Intuit Inc. 4.2%

- BNS The Bank of Nova Scotia 3.5%

- CRWD CrowdStrike Holdings, Inc. 6.4%

- SPLK Splunk Inc. 1.1%

- NTAP NetApp, Inc. 5.2%

- WDAY Workday, Inc. 6.0%

Wednesday

- CRM Salesforce, Inc. 4.7%

- SNPS Synopsys, Inc. 4.9%

- SNOW Snowflake Inc. 8.0%

- OKTA Okta, Inc. 10.7%

- FIVE Five Below, Inc. 6.0%

- BILI Bilibili Inc. 8.5%

Thursday

- RY Royal Bank of Canada 3.9%

- TD The Toronto-Dominion Bank 3.7%

- DELL Dell Technologies Inc. 5.6%

- MRVL Marvell Technology, Inc. 6.7%

- PATH UiPath Inc. 9.6%

- KR The Kroger Co. 4.7%

Follow The Orbit on Twitter and Youtube

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC