Hello!

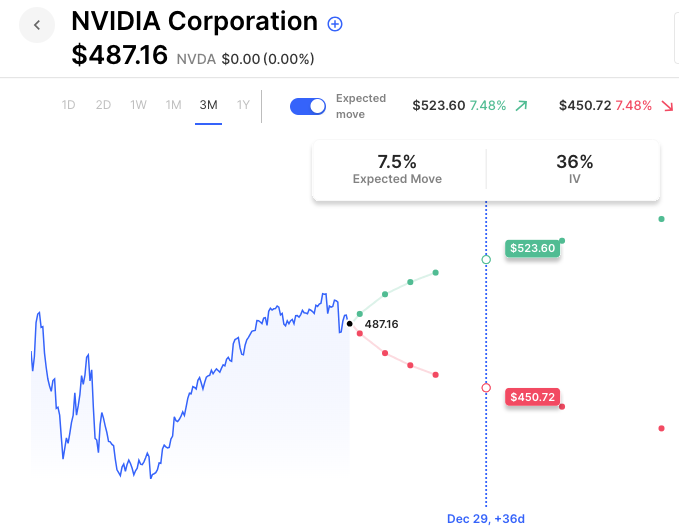

A reminder of today’s early close, which means weekly options will be expiring at 1pm eastern. Futures are basically flat into the open, with some of the big-cap tech stocks down slightly in the pre-market. Nvidia is about $484 following through slightly on its earnings pullback. The move was inside what options were expecting. Options are now pricing about an 8% move in NVDA into year-end. (Chart below).

SPY/SPX is up about 0.8% on the holiday-shortened week, about inline with what options were pricing so far. 0DTE options are pricing less than 0.5% for today’s shortened session in both SPX/SPX and QQQ, but it is a weekly expiry so traders need to be aware of the narrow ranges up to 1pm. Also, be aware of any expiring single-name positions as they will need to be closed earlier than normal. Trading volumes are typically low on a shortened day but expiry can mean late moves that could take stocks above or below tight strikes.

Trending:

Nvidia Corp (NVDA) -1.59%

Xpeng Inc ADR (XPEV) +5.17%

Irobot Corp (IRBT) +28.06%

Iclick Interactive Asia Group Ltd ADR (ICLK) +27.00%

Today’s Earnings Highlights:

Economic Calendar:

At 09:45 AM (EST) S&P Global Services PMI (Nov) Estimates: 50.4, Prior: 50.6

At 09:45 AM (EST) S&P Global Manufacturing PMI (Nov) Estimates: 49.8, Prior: 50

At 09:45 AM (EST) S&P Global Composite PMI (Nov) Impact: Medium

Unusual Options Volume:

ARM (+962%), DE (+937%), NVDA (+859%), HTZ (+550%), HPQ (+536%), JWN (+499%), BIDU (+496%), COIN (+452%)

If you missed it earlier in the week. Look for SPX and 0DTE trading on web/desktop as well as the iOS mobile app. Here’s a short video walk-thru on how to access:

Follow The Orbit on Twitter and Youtube

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC