Hello!

The VIX closed 19.30 on Friday and was bid most of the day. It was higher the first two hours even while the market was up on the day, an unusual occurrence, especially on a Friday. Some of that can probably be attributed to worries about the Middle East into the weekend but out-of-the-money puts are certainly being bought as hedges, with vol below the 20 delta level now above 20IV in the next two months. Keep an eye on the VIX as it’s been asleep for so long it wouldn’t take much for people short vol to get caught offsides. (they also could be completely correct and the market slow grinds higher into year-end, but the point is the VIX is not “broken” and still tells a story when it gets above 20).

The expected move for this week in SPY is a bit more than 1.5%. QQQ is about 2%. 0DTE expected moves in SPY has been pretty consistently near the 0.7% range, and QQQ 0DTE expected moves have been closing in on 1% a day. That’s alot more than over the Summer when SPY 0DTE expected moves were consistently below a half a percent a day.

The big story on the stock front this week is earnings, with the regional banks starting to report (as well as the rest of the big Wall Street banks, and then tech reports start to heat up, led by Netflix and Tesla this week. Expected moves based on how options closed on Friday below. Check back in for updates on Options AI’s Calendar as they may change slightly, and obviously for updated stock levels.

Monday

- SCHW The Charles Schwab Corporation 6.6%

Tuesday

- JNJ Johnson & Johnson 2.7%

- BAC Bank of America Corporation 4.6%

- GS Goldman Sachs 3.7%

- LMT Lockheed Martin Corporation 3.3%

- IBKR Interactive Brokers Group, Inc. 4.1%

- BK The Bank of New York Mellon Corporation 4.9%

- JBHT J.B. Hunt Transport Services, Inc. 3.7%

- OMC Omnicom Group Inc. 4.0%

- UAL United Airlines Holdings, Inc. 6.2%

- GNRC Generac Holdings Inc. 4.2%

- PNFP Pinnacle Financial Partners, Inc. 5.3%

- WTFC Wintrust Financial Corporation 5.1%

Wednesday

- TSLA Tesla, Inc. 6.0%

- PG The Procter & Gamble Company 3.4%

- ASML ASML Holding N.V. 4.5%

- NFLX Netflix, Inc. 7.1%

- MS Morgan Stanley 4.2%

- LRCX Lam Research Corporation 5.8%

- USB U.S. Bancorp 5.3%

- LVS Las Vegas Sands Corp. 4.8%

- EFX Equifax Inc. 4.9%

- DFS Discover Financial Services 5.4%

- FHN First Horizon Corporation 4.7%

- ZION Zions Bancorporation, National Association 5.8%

Thursday

- TSM Taiwan Semiconductor Manufacturing Company Limited 4.4%

- PM Philip Morris International Inc. 3.0%

- BX Blackstone Inc. 4.3%

- UNP Union Pacific Corporation 3.4%

- ISRG Intuitive Surgical, Inc. 7.4%

- T AT&T Inc. 4.4%

- FCX Freeport-McMoRan Inc. 4.5%

- TFC Truist Financial Corporation 4.9%

- NOK Nokia Oyj 6.3%

Friday

- AXP American Express Company 3.8%

- SLB Schlumberger Limited 3.9%

Chart of the Day

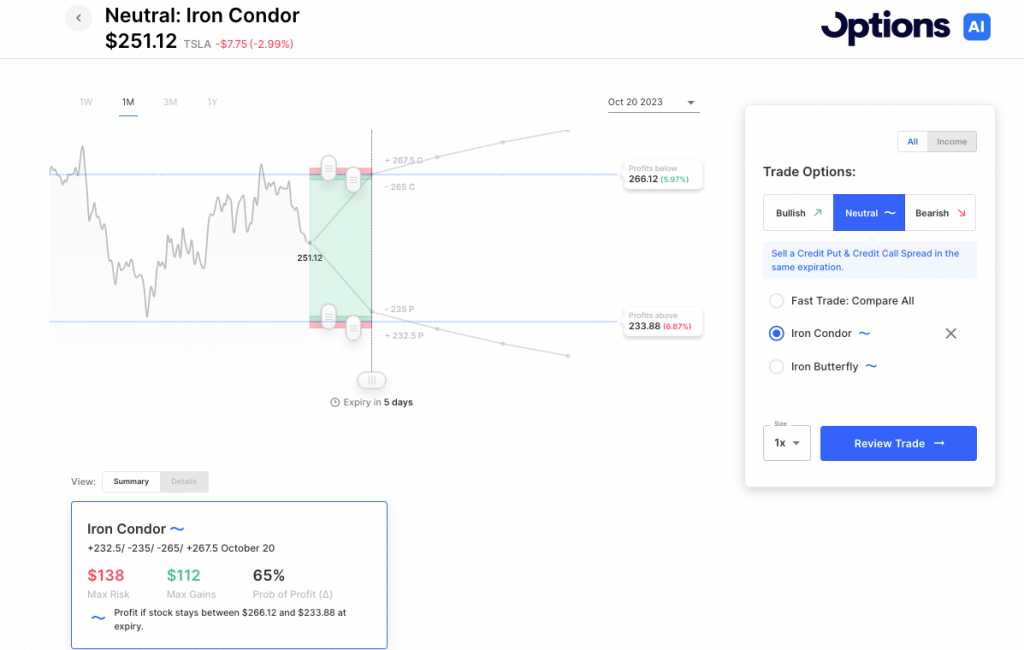

The one-month range in Tesla more or less lines up with the expected move for earnings this week. Here’s how an Iron Condor at the expected move’s breakevens line up, positioning for the chance that TSLA stays within that range following its report:

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC