Good morning!

Stocks were quiet yesterday, eeking out a small gain. And futures have stocks reversing a little lower this morning, but nothing dramatic. Stocks are seemingly in a wait-and-see (and go sideways) mode still. There’s been a lot written about the effect of 0DTE (zero days to expiry) options on realized vol in the market and it may be true. Many 0dte and 1dte trades are selling premium in the form of straddles, Iron Condors etc, and that can have a suppressing effect on the market because it reloads it each day with gamma.

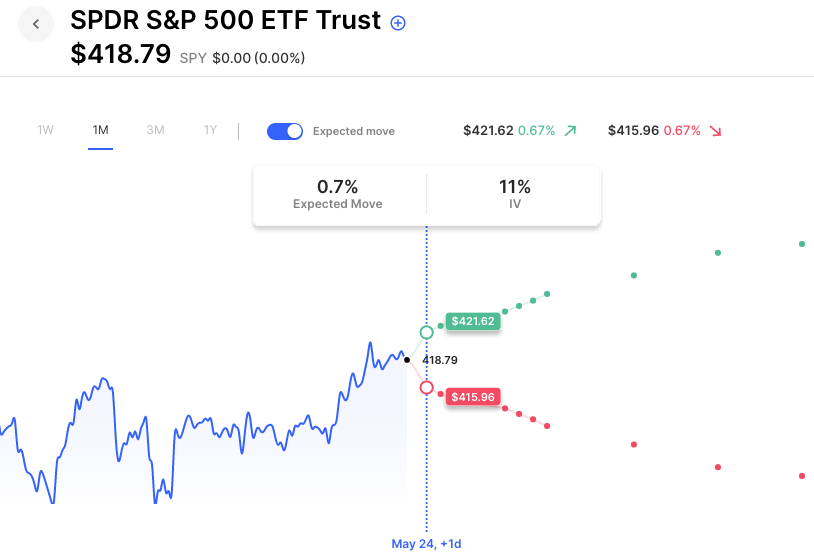

As mentioned ad nauseam in this space, when market makers are long gamma it can act as a governor on market moves, and when market makers are short gamma, it can act as an accelerant. 0dte and 0dte traders tend to be “selling the move” each day. SPY IV for today is about 10-11, for Friday it is 13. The same is true for next week following the Monday holiday. That sort of contango curve (where daily IV is much lower than 5-30 days out has been pretty significant over the past 2 months and may be somewhat reflective of active traders selling premium near term.

Fed minutes hit this afternoon and could potentially cause a late-day move.

Pre-Market Movers:

- Heartcore Enterprises Inc (HTCR) +57.81%

- Pacwest Bancorp (PACW) +15.77%

- Cohbar Inc (CWBR) +98.71%

- Tesla Inc (TSLA) -0.60%

- Microbot Medical Inc (MBOT) -10.97%

- Microsoft Corp (MSFT) +0.22%

- Pfizer Inc (PFE) -0.72%

- Kingsoft Cloud Holdings Ltd ADR (KC) -6.11%

- Zoom Video Communications Cl A (ZM) -2.39%

Today’s Earnings Highlights:

- Intuit Inc. (INTU) Expected Move: 4.10%

- Lowe’s Companies, Inc. (LOW) Expected Move: 4.05%

- Palo Alto Networks, Inc. (PANW) Expected Move: 6.37%

- AutoZone, Inc. (AZO) Expected Move: 4.00%

- Agilent Technologies, Inc. (A) Expected Move: 5.80%

- DICK’S Sporting Goods, Inc. (DKS) Expected Move: 7.00%

- BJ’s Wholesale Club Holdings, Inc. (BJ) Expected Move: 8.49%

- Vipshop Holdings Limited (VIPS) Expected Move: 11.54%

- V.F. Corporation (VFC) Expected Move: 10.48%

- Williams-Sonoma, Inc. (WSM) Expected Move: 6.50%

- Toll Brothers, Inc. (TOL) Expected Move: 4.28%

- IHS Holding Limited (IHS) Expected Move: 19.80%

- Urban Outfitters, Inc. (URBN) Expected Move: 8.50%

Full list here: Options AI Earnings Calendar.

Economic Calendar:

- At 09:00 AM (EST) Fed Logan Speech Impact: Medium

- At 10:00 AM (EST) New Home Sales (Apr) Estimates: 0.665, Prior: 0.683

- At 10:00 AM (EST) New Home Sales MoM (Apr) Estimates: -2, Prior: 9.6

- At 12:10 PM (EST) Fed Waller Speech Impact: Medium

- At 02:00 PM (EST) FOMC Minutes Impact: High

Options AI Scanner Highlights:

- Overbought (RSI): NU (82), GOOGL (80), PLTR (80), XP (76), FTCH (76), UPST (75), DDOG (74), ZS (73), MSFT (73), META (73), QQQ (72)

- Oversold (RSI): CGC (6), FYBR (24), MULN (24), NKE (27), VOD (28), IEP (28), BTI (29), SAVE (29), IQ (30), T (30), AMGN (30)

- High IV: BTG (+370%), MMAT (+292%), FFIE (+214%), GOEV (+214%), AIV (+214%), IEP (+205%), NKLA (+198%), VMW (+163%), OZK (+148%), VXX (+144%)

- Unusual Options Volume: MQ (+1389%), UPST (+1051%), ZM (+1017%), LVS (+958%), PFE (+848%), ZIM (+828%), DNA (+813%), GME (+750%), LOW (+734%), TWLO (+701%), FTCH (+576%), DKNG (+565%)

Full lists here: Options AI Free Tools.

Chart of the Day:

IV in 1DTE SPY options is as low as 11

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.