A Put Spread is a directionally bearish strategy that buys a put, while simultaneously selling a lower strike put in the same expiration.

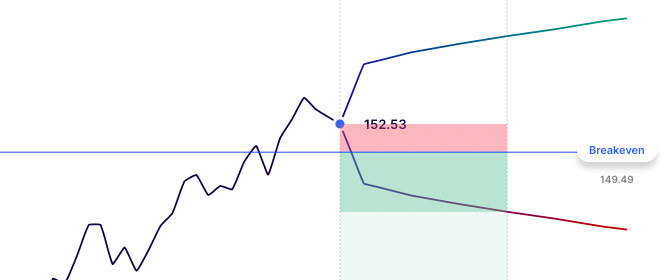

An investor might use a Put Spread instead of an outright Put to risk less capital and and have a closer Breakeven to the current stock price, in exchange for capping potential gains. The investor would see increasing gains if the stock moves below their breakeven, and Maximum Gain if the stock finishes below the spread.

Losses would occur if the stock stays above the Breakeven. A Maximum Loss would occur with the stock above the spread at expiration.