A Call Spread is a directionally bullish strategy that buys a call, while simultaneously selling a higher strike call in the same expiration.

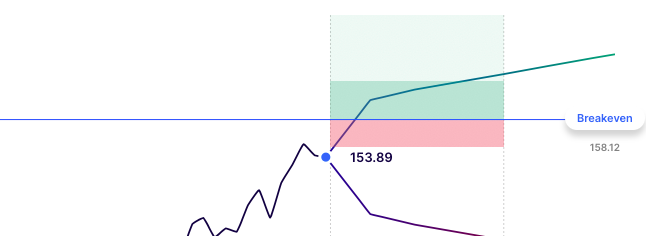

An investor might use a Call Spread instead of an outright Call to risk less capital and lower their Breakeven, in exchange for capping potential upside gains. The investor would see increasing gains if the stock moves above their breakeven, and Maximum Gain if the stock finishes above the spread.

Losses would occur if the stock stays below the Breakeven. A Maximum Loss would occur with the stock below the spread at expiration.