The probability of profit (POP) is the likelihood assigned by the options market of the stock closing at the breakeven point of a trade. Beyond or inside that breakeven will determine whether the trade is profitable or a losing trade at expiration. Credit spreads will often have a POP greater than 50% at entry, with most debit spreads a POP less than 50%. When entering a position a trader can use the probability of profit to compare potential trades. Once in an options position, the updated probability of profit (as well as probability of max loss or max gain) can help with trade management, entry and exits.

An easy way to think about probability of profit is a trade with a POP less than 50% (at entry) is a debit spread. A high POP will risk more, to make less, but is more likely.

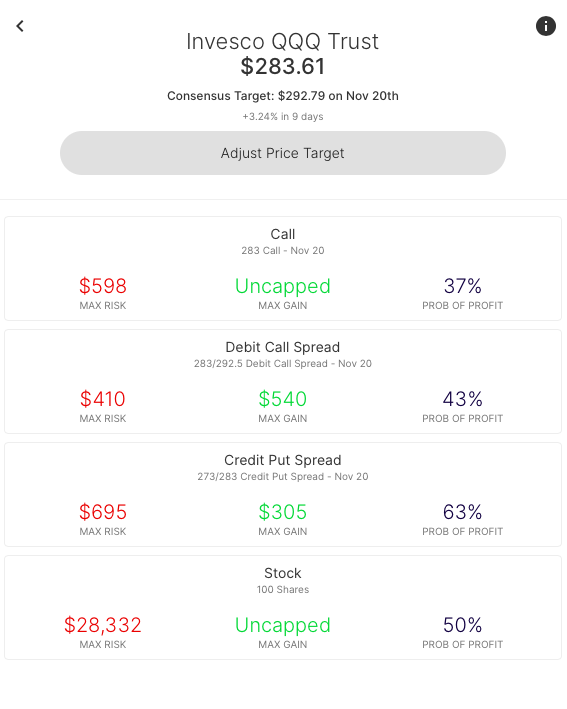

Here’s an example of a trade comparison, based on a bullish price target:

The stock trade at the bottom is obviously 50% probability, a coin flip. But going from the top one can see the difference between the call, the call spread, and the credit spread. A trader can compare those probabilities between the trades, but also within the trade, and how much is risked for the potential reward versus the overall probability.