The dynamics of an options trade change constantly between the time of entry and as it moves towards expiration. A trader can continually compare metrics that guided the initial entry to better understand the remaining risk reward of a trade. Understanding those metrics, and the time value left in a trade helps inform the timing of an exit.

An easy way to think about trade management outside of the greeks is to compare the remaining risk reward of a trade versus the updated probability of profit, max gain probability, and max loss probability, and knowing if time value is against you, or in your favor.

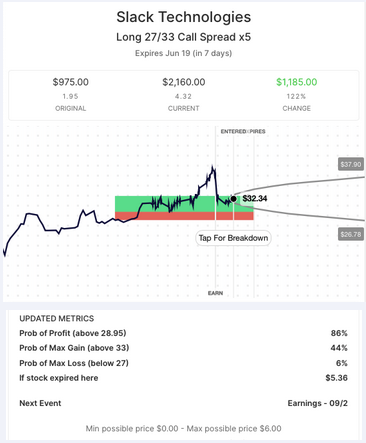

Here’s an example of an updated chart of a debit call spread:

Analyzing the updated metrics

In this case the trade is 1 week from expiration, with a very high probability of profit (86%), a decent shot at max gain (44%) and a very small chance of a max loss (6%).

- The gains on the trade stand at 122% and it is currently worth 4.32, with a maximum possible value $6.00.

- Time value is on its side, “if stock expired here” the 4.32 would be worth 5.36.

- But it is risking 4.32, the entire current value, plus the existing profits, for the remaining profit potential.