Options AI mobile is now available in the Apple app store! Go find it here.

Good morning!

Non-Farm Payrolls drop at 8:30 ET and suddenly take on new significance after the market reaction yesterday to ADP employment data. As pointed out in this space a few times recently, stocks have largely ignored rising treasury yields (higher interest rate assumptions) over the past few months as the fears of a bad recession faded a little. But with recent strong data and hawkish words from the Fed, yields have plowed higher and traders showed some concern for the first time in a while the past 2 days. The 1-year yield is now at its highest level since 2000, the 2yr traded yesterday at its highest level since 2006 and the 10yr is at its highest level since 2007. Where yields go next are likely to affect the market’s next moves and the NFP this morning will be the last data point in a slew of news we received in the second part of this week. The VIX got as high as 17 yesterday, indicating some renewed interest in option buying. It pulled back a bit late and is now 15.80. But this is the first bit of life option buyers have shown in months. Futures are basically unchanged into the NFP print. The expected move for SPY today is about 0.5% with the QQQ about 0.8%.

Pre-Market Movers:

- Gorilla Technology Group Inc (GRRR) +59.33%

- Prestige Wealth Inc (PWM) +116.67%

- Rivian Automotive Inc Cl A (RIVN) +3.38%

- Zhong Yang Financial Group Limited (TOP) +13.64%

- Tesla Inc (TSLA) -0.30%

- Alibaba Group Holding ADR (BABA) +2.81%

- Xpeng Inc ADR (XPEV) -2.69%

- Nio Inc ADR (NIO) -0.42%

- Apple Inc (AAPL) -0.03%

- Levi Strauss & Company Cl A (LEVI) -7.17%

- Alphabet Cl A (GOOGL) -0.17%

Today’s Earnings Highlights:

- ImmunoPrecise Antibodies Ltd. (IPA) Expected Move: 15.66%

Full list here: Options AI Earnings Calendar

Economic Calendar:

- At 08:30 AM (EST) Nonfarm Payrolls Private (Jun) Estimates: 200, Prior: 283

- At 08:30 AM (EST) Average Hourly Earnings MoM (Jun) Estimates: 0.3, Prior: 0.3

- At 08:30 AM (EST) Average Hourly Earnings YoY (Jun) Estimates: 4.2, Prior: 4.3

- At 08:30 AM (EST) Unemployment Rate (Jun) Estimates: 3.6, Prior: 3.7

- At 08:30 AM (EST) Non Farm Payrolls (Jun) Estimates: 225, Prior: 339

- At 08:30 AM (EST) U-6 Unemployment Rate (Jun) Estimates: 6.7, Prior: 6.7

- At 08:30 AM (EST) Participation Rate (Jun) Estimates: 62.6, Prior: 62.6

Scanner Highlights:

- Overbought (RSI): LUV (81), RIVN (80), HUT (78), DAL (77), CCL (76)

- Oversold (RSI): CGC (10), FGEN (15), AU (18), GIS (26), VRAY (26), GFI (26)

- High IV: MULN (+320%), NKLA (+237%), SOFI (+116%), BUD (+116%)

- Unusual Options Volume: VZ (+1213%), JETS (+803%), TDOC (+625%), META (+523%), SQ (+441%), RIVN (+430%), LOW (+374%)

Full lists here: Options AI Free Tools.

Chart of the Day:

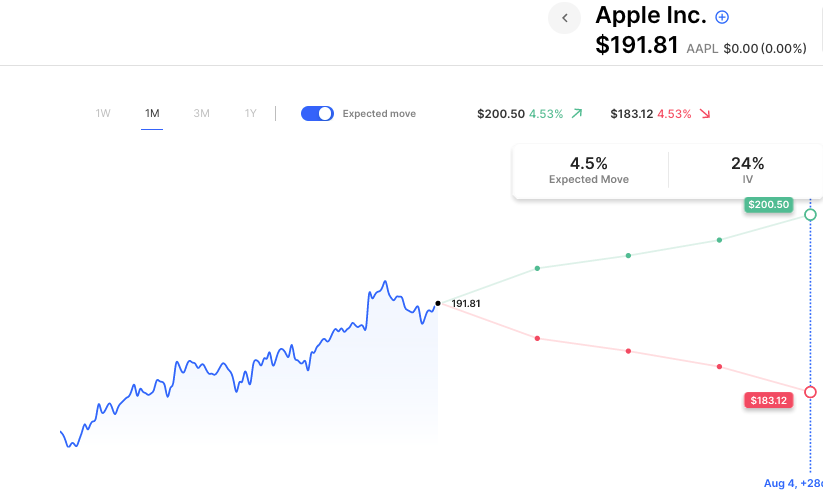

Apple’s expected move over the next month is about 5%, that time period includes an earnings report.

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.