Hello!

The indices are getting pulled in a couple different directions this morning due to some big-cap stocks going in different directions on earnings. Microsoft and Boeing are both higher, both slightly inside the expected move at this point. Alphabet is lower and by slightly more than what options were pricing. That mix has the DJIA going one way and the QQQs going the other. And the SPY/SPX is saying “Waddya want from me?” (bonus points if you got that).

This afternoon we have Meta earnings. Currently, META options are pricing an almost 7.5% move. That’s more than the +4.5% the stock moved last earnings but oh boy, the ones before that? +14%, +23%, and -25%. Massive moves for a company of that size/market cap.

The stock itself has been volatile over the past few months but finds itself in essentially the same place it was in early August. The stock is down about 4% from its mid-Summer highs and up about 10% from its mid-August lows.

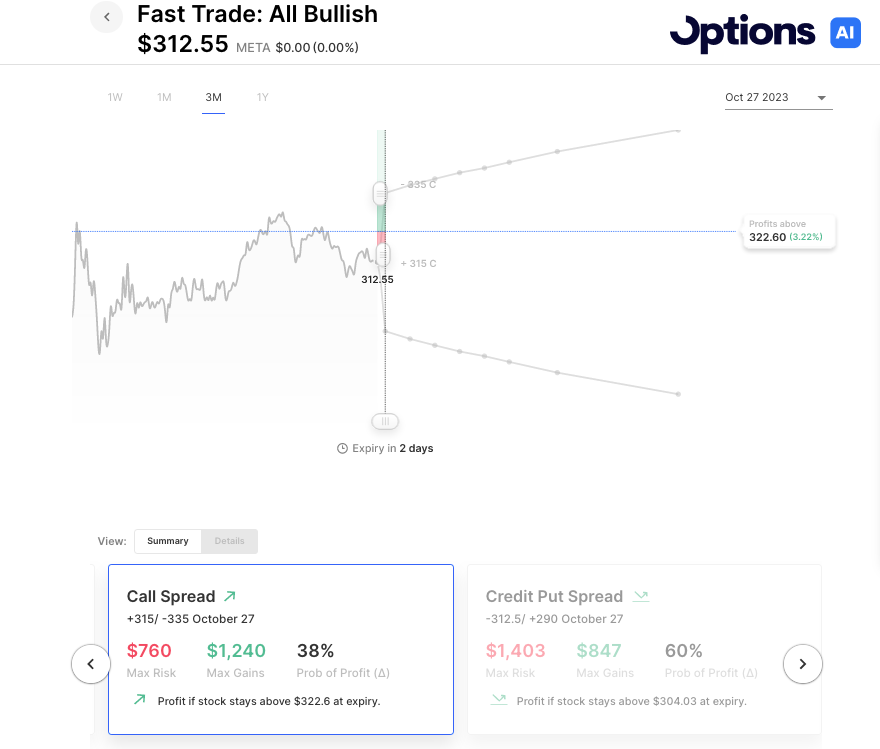

One particular thing of note, the weekly options (expiring Friday) are 135 IV or so. The 30day IV is 50. That’s a pretty big difference and it results in an expected move chart that is much straighter/flatter than normal meaning a breakeven 30-45 days on a spread trade may only be a small difference in the stock. Here’s an example. A call spread expiring this week, targeting the expected move to the upside. It is 25 wide and maxes out at 337.50 to the upside. Its breakeven is 322.60 in the stock:

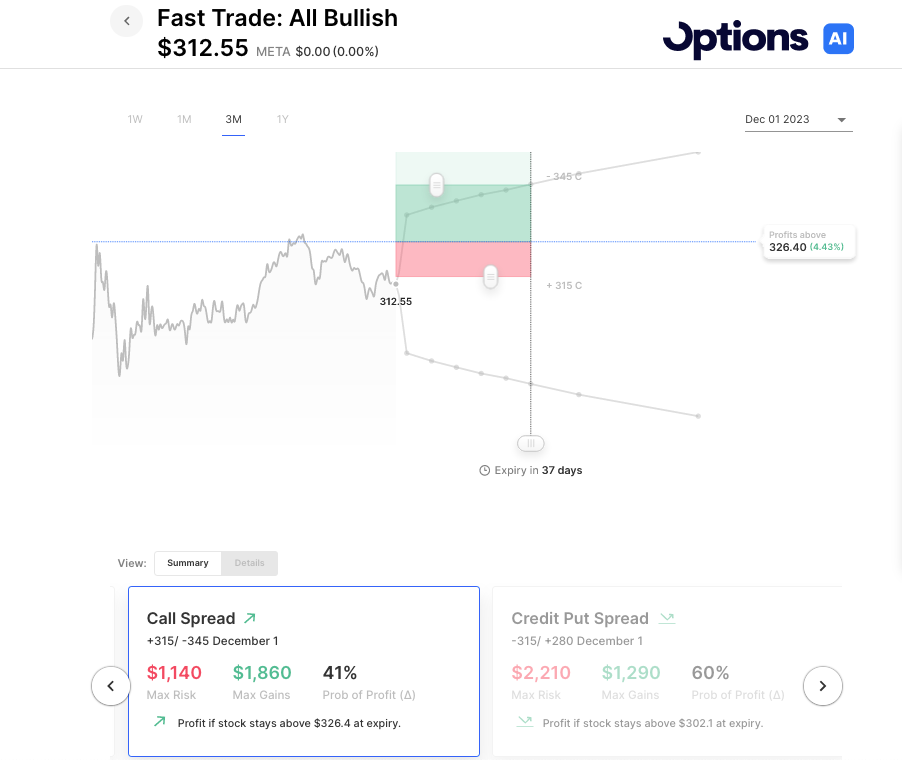

Compare that to a call spread targeting a level $10 higher in the stock on Dec 1st expiry:

The breakeven is less than $4 higher (about 1.2% in the stock), has more room to run to the upside, and an additional 35 days or so to do it. This is just a bullish example, the same would be true looking to the downside. This set-up is very similar to Netflix last week, where the earnings expiry was nearly 3x 30-day IV. As a comparison, MSFT and GOOGL yesterday were 2x. This is just one thing to look out for when choosing expiry, those IV differences can be informative, and one way to compare is via expected move levels and trade breakevens.

Today’s Earnings Expected Moves:

- Meta Platforms, Inc. (META) Expected Move: 7.24%

- International Business Machines Corporation (IBM) Expected Move: 3.45%

- ServiceNow, Inc. (NOW) Expected Move: 5.20%

- KLA Corporation (KLAC) Expected Move: 3.90%

- O’Reilly Automotive, Inc. (ORLY) Expected Move: 5.20%

- Annaly Capital Management, Inc. (NLY) Expected Move: 3.31%

- Mattel, Inc. (MAT) Expected Move: 6.74%

- QuantumScape Corporation (QS) Expected Move: 11.13%

Searchable list here: Options AI Earnings Calendar

Movers this Morning:

- Alphabet Cl A (GOOGL) -5.95%

- Snap Inc (SNAP) +3.19%

- Microsoft Corp (MSFT) +4.36%

- Boeing Company (BA) +3.15%

- Meta Platforms Inc (META) -0.18%

- Texas Instruments (TXN) -6.25%

- Verizon Communications Inc (VZ) +0.32%

Economic Calendar:

- At 10:00 AM (EST) New Home Sales MoM (Sep) Impact: Medium

- At 04:35 PM (EST) Fed Chair Powell Speech Impact: High

Unusual Activity (yesterday’s option volume compared to 30d avg.):

- SPOT (+1105%), SNAP (+1033%), COIN (+960%), MSTR (+924%), MARA (+820%), RIOT (+706%), SNOW (+400%), NFLX (+372%), TSLA (+368%), QQQ (+343%), META (+294%)

Follow The Orbit on Twitter and Youtube

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC