The Broader Markets

Last Week – SPY was higher by about 1.9% last week, more than the 1.3% move options were pricing.

This Week – SPY options are pricing about a 1% move (or about $4.50 in either direction) for the upcoming week. With the SPY around $446 that corresponds to just above $450 on the upside and below $442 on the downside.

Implied Volatility – The VIX ended Friday around 16, down from 19 the week before. The VIX is now below its historical average entering this week. VIX futures remain upward sloping, but January futures were down from last week, now just under 23.

Expected Moves for This Week via Options AI:

With implied volatility slightly lower, options are pricing smaller market moves this week than they priced last week. Here are the expected moves for the week in the major ETFs, all slightly lower except the DIA which is about the same as last week:

- SPY 1%

- QQQ 1.3%

- IWM 1.6%

- DIA 1.1%

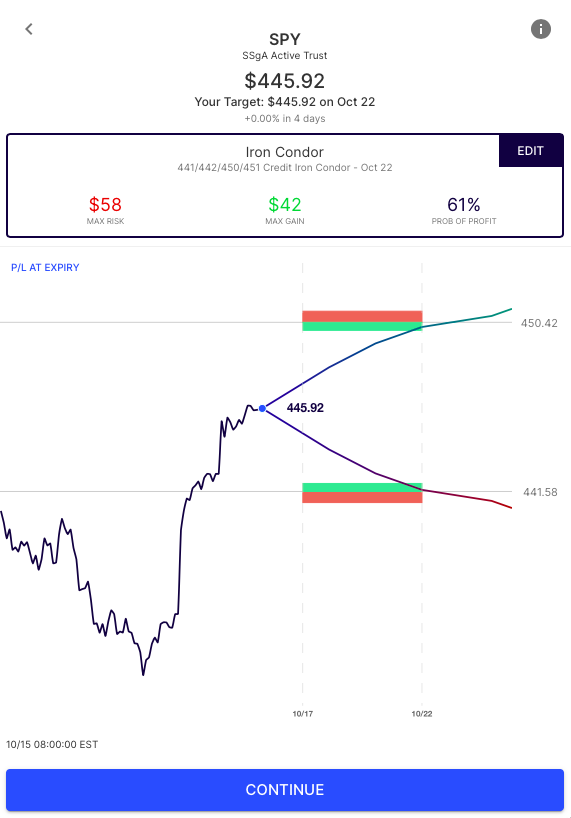

As an example of how the 1% expected move translates into strike selections, here’s an Iron Condor with short strikes set at the expected move (based on the close Friday). It would need the ETF to finish between $442 and $450 to see Max Gain:

Expected Moves for Companies Reporting Earnings

Options AI puts the expected move at the heart of its trading experience. Traders are able to quickly generate credit and debit trades based on the Expected Move, or to their own targets in context of the Expected Move. More education on Expected Moves and options trading can be found at Learn / Options AI.

Some earnings reports helped propel the market higher last week and this week we’ll see earnings from Tesla and Netflix among other stocks. The expected moves below are for this Friday and link to the Options AI Calendar. Recent moves are the one day moves the stock saw on prior earnings, starting with the most recent.

Tuesday

Johnson & Johnson JNJ / Expected Move: 2.4% / Recent moves: +1%, +2%, +3%

Netflix NFLX / Expected Move: 5% / Recent moves: -3%, -7%, +17%

United Airlines UAL / Expected Move: 4.5% / Recent moves: +4%, -9%, -6%

Wednesday

Tesla TSLA / Expected Move: 4.2% / Recent moves: -2%, -5%, -3%

Thursday

Snap SNAP / Expected Move: 9.4% / Recent moves: +23%, +7%, +9%

Intel INTC / Expected Move: 4.2% / Recent moves: -5%, -5%, -9%

Chipotle CMG / Expected Move: 3.9% / Recent moves: +12%, -2%, -2%

Crocs CROX / Expected Move: 11.5% / Recent moves: +10%, +15%, -4%

Friday

American Express AXP / Expected Move: 3.3% / Recent moves: +1%, -2%, -4%

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC a registered broker-dealer.