A vertical debit spread is an option strategy that involves buying one strike (call or put) while simultaneously selling another strike (in the same expiration). The strategy requires paying a net debit.

An easy way to think about a vertical debit spread is by selling a more out of the money call or put (to someone even more bullish or bearish) versus the long call or put, the trader betters their breakeven, and establishes a profitability range between two points, the breakeven and the short strike.

For example with stock XYZ trading 100:

Debit call spread – A trader buys a 100 strike call for $5.00 and sells a 105 call at $3.00 for a net debit of $2.00. The resulting position would be risking $2.00, to make up to $3.00. The breakeven fn the trade is $102 (100 strike + 2.00). The trade has a max gain if the stock is above $105 on expiration, and a max loss if the stock expires below $100.

Debit Put Spread – A trader buys the 100 put for $5.00 and sells the 95 put at 3.00. They risk $2.00 for a $3.00 potential reward in a $5 wide spread. Max gain is if the stock is below 95 on expiration, max loss above 100 and a breakeven on the trade at 98 (100 strike – $2.00) with profits below.

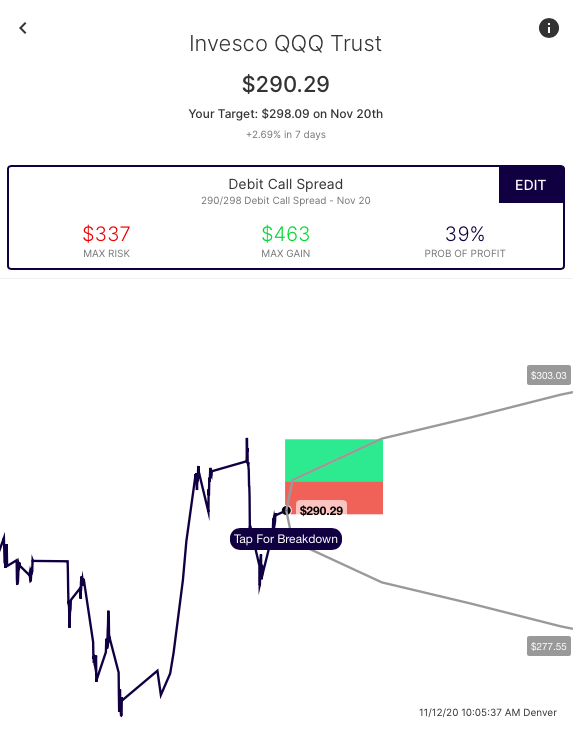

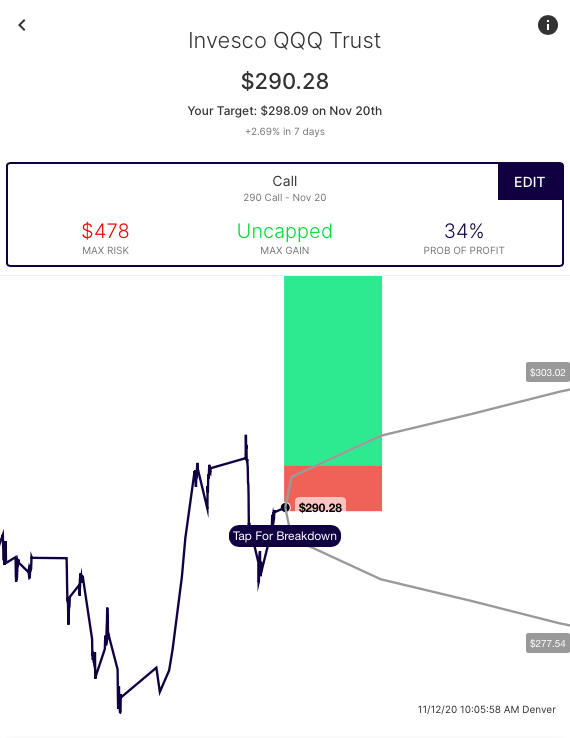

A comparison of a call, versus a debit call spread, note the lower breakeven for the spread: