Good morning!

Options AI mobile is now available in the Apple app store! Go find it here.

As market participants await words from Jay Powell, stock futures have slipped slightly into the red with tech pulling back from its recent rally. Chip stocks like Nvidia are leading the way lower following a report in the WSJ that the U.S. is considering restricting AI-focused chips from being exported to China. Powell’s remarks will be interesting considering the economic data of late like consumer confidence and housing starts showing the economy still plugging away. He is speaking at an ECB / Central banker gathering with Christine Lagarde also appearing. The 1-year treasury is around 5.30, higher than before the SVB mess, and the 2-year yield is 4.74, still below its pre-SVB peak but has been moving towards those levels.

The VIX remains below 14 with SPY at the money vol about 11.

On the earnings front Micron (MU) is set to update with Nike reporting tomorrow.

Expected moves today (0DTE)

SPY: 0.4%

QQQ: 0.7%

Expected moves this week (Friday’s close)

SPY: 0.8%

QQQ: 1.2%

Pre-Market Movers:

- Black Diamond Therapeutics Inc (BDTX) +6.80%

- Nvidia Corp (NVDA) -3.86%

- Adv Micro Devices (AMD) -3.28%

- Ast Spacemobile Inc (ASTS) -24.49%

- Xponential Fitness Inc Cl A (XPOF) +22.58%

- Robinhood Markets Inc Cl A (HOOD) +2.01%

- Pinterest Inc (PINS) +3.98%

- Alibaba Group Holding ADR (BABA) -1.07%

- Lordstown Motors Corp (RIDE) -8.73%

- Carvana Company Cl A (CVNA) -1.56%

- Alphabet Cl A (GOOGL) -0.46%

Today’s Earnings Highlights:

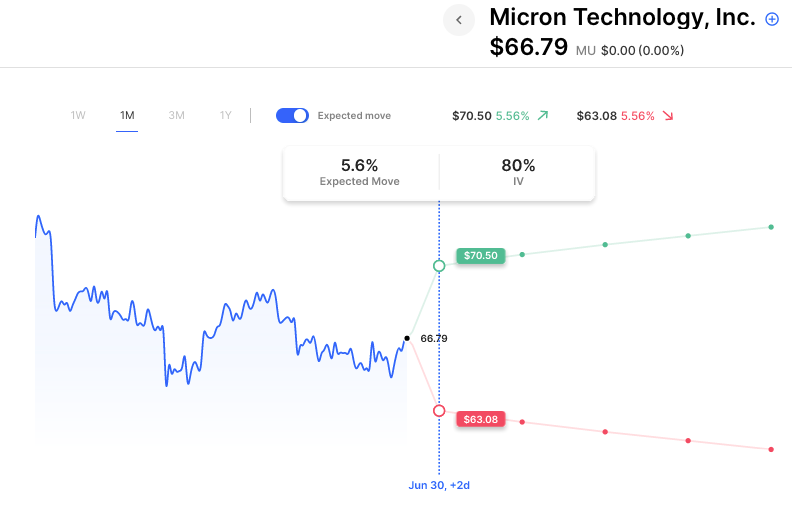

- Micron Technology, Inc. (MU) Expected Move: 5.55%

- General Mills, Inc. (GIS) Expected Move: 4.11%

- Concentrix Corporation (CNXC) Expected Move: 13.51%

- H.B. Fuller Company (FUL) Expected Move: 27.60%

- Worthington Industries, Inc. (WOR) Expected Move: 7.78%

- BlackBerry Limited (BB) Expected Move: 10.84%

- Franklin Covey Co. (FC) Expected Move: 35.88%

- American Outdoor Brands, Inc. (AOUT) Expected Move: 42.20%

- Aethlon Medical, Inc. (AEMD) Expected Move: 476.35%

Full list here: Options AI Earnings Calendar

Economic Calendar:

- At 07:00 AM (EST) MBA 30-Year Mortgage Rate (Jun/23) Impact: Medium

- At 08:30 AM (EST) Wholesale Inventories MoM (May) Estimates: 0.1, Prior: -0.1

- At 08:30 AM (EST) Goods Trade Balance (May) Estimates: -91, Prior: -96.8

- At 04:30 PM (EST) Bank Stress Tests Impact: Medium

- At 02:30 AM (EST) Fed Chair Powell Speech Impact: High

Scanner Highlights:

- Overbought (RSI): RCL (82), UAL (78), JBLU (78), JETS (77), AAL (77), LUV (76)

- Oversold (RSI): DOCU (40), MRNA (40), SBUX (42), PTON (43), GOOGL (44)

- High IV: INTC (+107%), MU (+106%), IBM (+106%), NKE (+100%), DNA (+99%)

- Unusual Options Volume: BB (+527%), COIN (+492%), AAL (+478%), UAL (+457%), FDX (+433%), OPEN (+432%), AMAT (+413%), JBLU (+363%)

Full lists here: Options AI Free Tools.

Chart of the Day

Micron (MU) options are pricing about a 5.5% move for earnings.

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.