Good morning!

Options AI mobile is now available in the Apple app store! Go find it here.

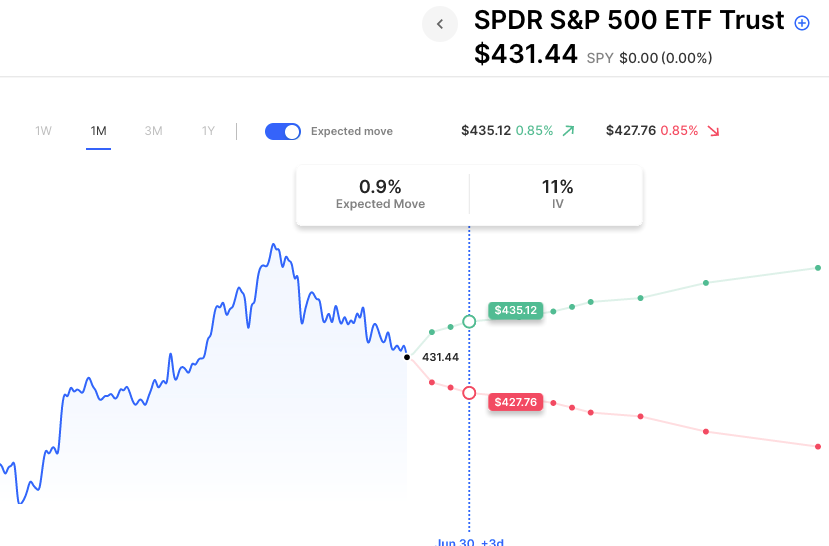

Futures are mixed to higher with low vol again the story of the day. As is typical IV ticked up a bit yesterday out of the weekend but SPY vol remains just 11 or so this week (at-the-money) pricing just under a 1% move for the balance of the week. Once again, the market can be weighed down with long gamma. In that environment up opens will get sold and down opens bought, as gamma creates buyers below and sellers above. That often needs a powerful move to breakout from that range or an event that turns option sellers into buyers, either via fear or FOMO. The market will perhaps have more to digest tomorrow as we get speeches from central bank heads including Jay Powell.

Pre-Market Movers:

Lucid Group Inc (LCID) +5.23%

Marathon Digital Hldgs Inc (MARA) +3.05%

Hut 8 Mining Corp (HUT) +7.14%

Trxade Health Inc (MEDS) -18.15%

Soundhound Ai Inc Cl A (SOUN) +5.19%

Kingsoft Cloud Holdings Ltd ADR (KC) +7.40%

Meta Platforms Inc (META) +1.95%

Microsoft Corp (MSFT) +0.47%

Sofi Technologies Inc (SOFI) +1.71%

Today’s Earnings Highlights:

Walgreens Boots Alliance, Inc. (WBA) Expected Move: 6.34%

TD SYNNEX Corporation (SNX) Expected Move: 5.79%

Manchester United plc (MANU) Expected Move: 10.01%

Schnitzer Steel Industries, Inc. (SCHN) Expected Move: 8.14%

Economic Calendar:

At 08:30 AM (EST) Durable Goods Orders MoM (May) Estimates: -1, Prior: 1.1

At 08:30 AM (EST) Durable Goods Orders Ex Transp MoM (May) Estimates: -0.1, Prior: -0.2

At 08:30 AM (EST) Durable Goods Orders ex Defense MoM (May) Estimates: 0.5, Prior: -0.6

At 09:00 AM (EST) S&P/Case-Shiller Home Price YoY (Apr) Estimates: -2.6, Prior: -1.1

At 09:00 AM (EST) S&P/Case-Shiller Home Price MoM (Apr) Estimates: 1.5, Prior: 1.5

At 10:00 AM (EST) New Home Sales (May) Estimates: 0.675, Prior: 0.683

Options AI Scanner Highlights:

Overbought (RSI): DAL (82), RCL (78), UBER (72), UAL (71), LUV (70)

Oversold (RSI): AMC (28), ZIM (29), LCID (32), SPWR (34), GS (34)

High IV: LUMN (+128%), NOK (+109%), RIVN (+99%), TMUS (+96%)

Unusual Options Volume: LCID (+661%), AZN (+536%), SOUN (+478%), RIOT (+404%), MSTR (+397%), TSLA (+383%), SPOT (+379%), SNAP (+321%), DAL (+316%), MANU (+297%), RBLX (+296%), ROKU (+264%)

Chart of the Day

SPY options are pricing just a 0.9% move for the rest of the week.

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.