Options AI mobile is now available in the Apple app store! Go find it here.

Good morning!

The second round of big bank earnings are out with Bank of America, PNC and Morgan Stanley reporting this morning. The results have not been market-moving as of yet. MS is unched as of now, with BAC down slightly, both with moves less than options were pricing. PNC is down about 3% vs a 3.5% expected move. So the reactions are pretty muted all things considered. The broader market thinks the same, with futures all red but very slightly. Most of the bank stocks were lower over the past 3 months with the exception of JPM. JPM has also performed the best from the bank stocks that reported last week, initially giving up its earnings move gains but recovering much of them with a strong up day yesterday. Goldman reports tomorrow and then the focus shifts quickly to mega-cap tech after the bell tomorrow with Netflix and Tesla kicking things off. On the economic data front advance retail sales missed estimates this morning.

- 0DTE SPY expected move: 0.4%

- 0DTE QQQ expected move: 0.6%

(You may have noticed that the sum of the 0DTE expected moves for the trading days of a week is more than the expected move for the entire week, more on that soon)

- Netflix expected move: 7.5% (more on NFLX below)

- Tesla Expected move: 6.7%

Pre-Market Movers:

Some notable stocks making moves this morning.

- Biophytis Sa ADR (BPTS) +55.20%

- Palantir Technologies Inc Cl A (PLTR) +2.93%

- Abbvie Inc (ABBV) +0.01%

- Nvidia Corp (NVDA) +0.72%

- Ford Motor Company (F) -1.00%

- Xpeng Inc ADR (XPEV) +2.91%

- Meta Platforms Inc (META) -0.40%

- Greenpower Motor Company (GP) -1.59%

- Adv Micro Devices (AMD) -0.66%

- Alibaba Group Holding ADR (BABA) -1.78%

- Teladoc Health Inc (TDOC) +5.49%

- Masimo Corp (MASI) -30.35%

- Opendoor Technologies Inc (OPEN) +1.85%

- Recursion Pharmaceuticals Inc Cl A (RXRX) +4.10%

Today’s Earnings Highlights:

- Bank of America Corporation (BAC) Expected Move: 3.49%

- Lockheed Martin Corporation (LMT) Expected Move: 2.70%

- Prologis, Inc. (PLD) Expected Move: 2.60%

- The Charles Schwab Corporation (SCHW) Expected Move: 4.27%

- Interactive Brokers Group, Inc. (IBKR) Expected Move: 4.07%

- The Bank of New York Mellon Corporation (BK) Expected Move: 4.78%

Full list here: Options AI Earnings Calendar

Economic Calendar:

- At 11:30 AM (EST) Retail Sales YoY (Jun) Estimates: 1.1, Prior: 1.6

- At 11:30 AM (EST) Retail Sales MoM (Jun) Estimates: 0.5, Prior: 0.3

- At 11:30 AM (EST) Retail Sales Ex Autos MoM (Jun) Estimates: 0.3, Prior: 0.1

- At 11:30 AM (EST) Retail Sales Ex Gas/Autos MoM (Jun) Estimates: -0.3, Prior: 0.4

- At 12:15 PM (EST) Industrial Production MoM (Jun) Estimates: -0.1, Prior: -0.2

Scanner Highlights:

- Overbought (RSI): BBIO (87), TTD (82), COIN (81), HOOD (79), UPST (79), MTCH (79), SPOT (78), MSTR (77)

- Oversold (RSI): FGEN (15), T (18), VZ (20)

- High IV: NKLA (+219%), RAD (+196%), AMC (+188%), VMW (+172%), HOOD (+122%), BUD (+121%), TMUS (+121%), RIVN (+120%), AMGN (+118%), ETSY (+115%), ABBV (+115%), MRK (+114%), SNAP (+113%)

- Unusual Options Volume: T (+740%), SPWR (+719%), CHWY (+628%), VZ (+584%), UPST (+566%), AI (+335%), F (+326%), BAC (+324%), COST (+321%), AAPL (+311%), SPOT (+311%)

Full lists here: Options AI Free Tools.

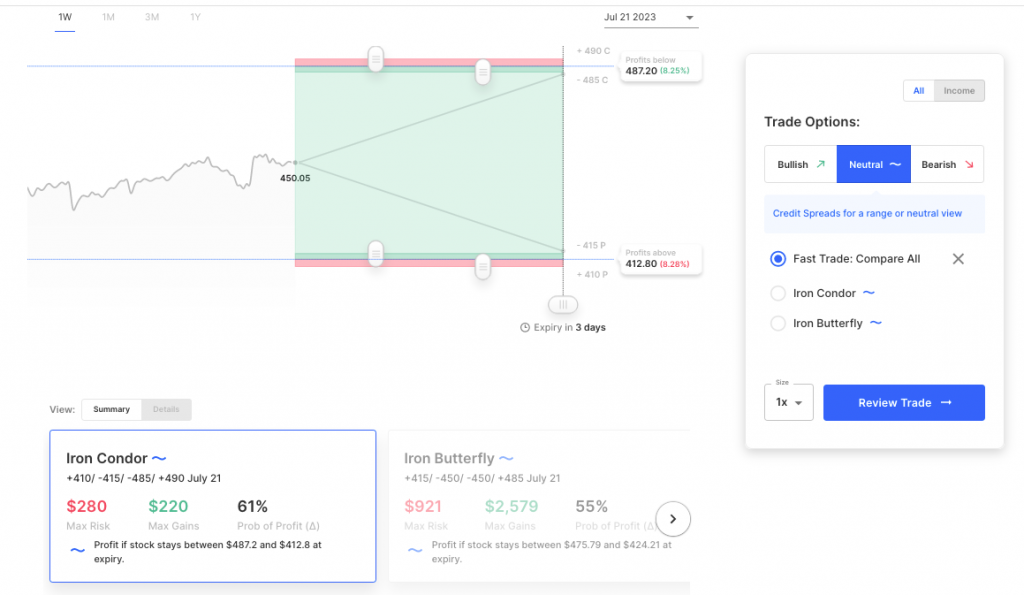

Chart of the Day: Netflix options are pricing about a 7.6% move, a move larger than 4 out of its last 8 earnings moves (2 moves were 20%+). A $5 wide Iron condor expiring Friday, set at the expected move would need the stock to stay between about $413 and $487 to see profits. That $413 level is pretty much the low end of the range NFLX has traded in the past month.

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.