Options AI mobile is now available in the Apple app store! Go find it here.

Good morning!

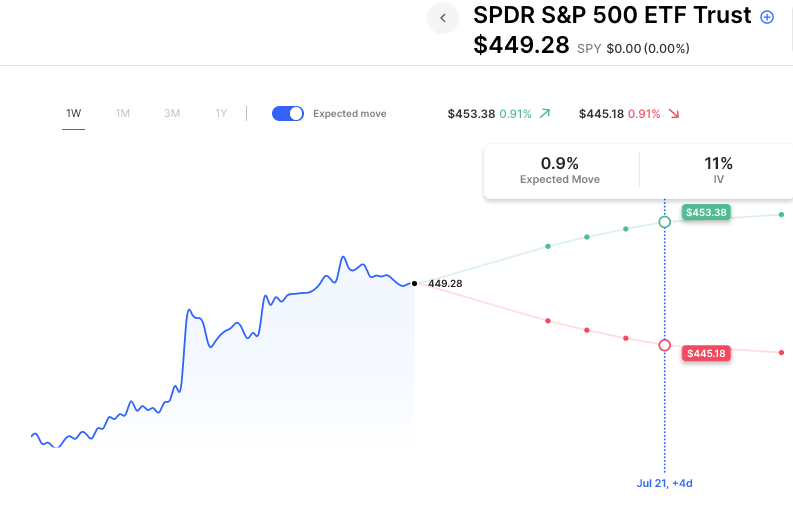

SPY was higher by 2.5% last week. A much larger move than options were pricing. Vol remains low across the board. To start this week the futures are pulling back a bit and with that, the VIX is starting the week off around 14 (the historical mean is around 19). This is the first full week of earnings season. Tomorrow we get a second round of big bank reports when we hear from Bank of America and Morgan Stanley (Goldman is a day later) as well as a look into online brokerage with Schwab and Interactive Brokers. On Wednesday two of the popular trading names take center stage with both Tesla and Netflix reporting after the close. We also hear from more airlines like United and get an early look at the chip sector with Taiwan Semi on Thursday. And finally a look at consumer credit and spending with American Express on Friday.

A pretty packed Tuesday through Friday so make sure to check the calendar each day. Next week things heat up even more with some mega-cap tech. On the economic front, this week is lighter than the past few. We get a speech today from ECB president Lagarde, retail sales on Tuesday, and then housing data and initial jobless claims later in the week. Some expected moves for notable earnings this week. Check back in to see updated moves and prices:

Pre-Market Movers:

- Acumen Pharmaceuticals Inc (ABOS) +85.67%

- Bridgebio Pharma Inc (BBIO) +54.50%

- Rivian Automotive Inc Cl A (RIVN) -4.67%

- Greenpower Motor Company (GP) +20.11%

- Apellis Pharmaceuticals Inc (APLS) -26.39%

- Nvidia Corp (NVDA) +0.80%

- Apple Inc (AAPL) +0.24%

Today’s Earnings Highlights:

- Equity LifeStyle Properties, Inc. (ELS) Expected Move: 4.50%

- FB Financial Corporation (FBK) Expected Move: 5.68%

- CrossFirst Bankshares, Inc. (CFB) Expected Move: 28.36%

- Guaranty Bancshares, Inc. (GNTY) Expected Move: 10.12%

- Republic First Bancorp, Inc. (FRBK) Expected Move: 204.90%

Economic Calendar:

- At 08:30 AM (EST) NY Empire State Manufacturing Index (Jul) Estimates: -4.3, Prior: 6.6

Scanner Highlights:

- Overbought (RSI): MSTR (82), COIN (81), HOOD (79), MTCH (78), DASH (78), NKLA (78)

- Oversold (RSI): FGEN (15), TGT (42), DIS (43)

- High IV: RIVN (+125%), UPST (+123%), RIOT (+122%), SOFI (+118%), PLTR (+118%)

- Unusual Options Volume: UNH (+659%), T (+564%), Z (+556%), NKLA (+503%), NVDA (+492%), AMD (+474%)

Full lists here: Options AI Free Tools.

Chart of the Day:

SPY options are pricing only a 1% move for the week, a very low vol backdrop to the start of earnings season.

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.