Hello!

Applied Materials (AMAT) reports after the close today. The options market is pricing in about a 4% move in either direction. That’s a larger move than the past 4 earnings which have seen the stock move -2%, 0%, 0% and -3%. The stock has been fairly volatile recently, backing down 10% in August after a Summer rally of about 25% from May to Aug. Its realized 30 day vol of 40 is less than the 69iv in the weekly options, but about inline with the 30 day option IV of about 41. But with expiry tomorrow on the weeklies, the IV is really just about the expected move, pricing in a move of about $6 in either direction by tomorrow’s close.

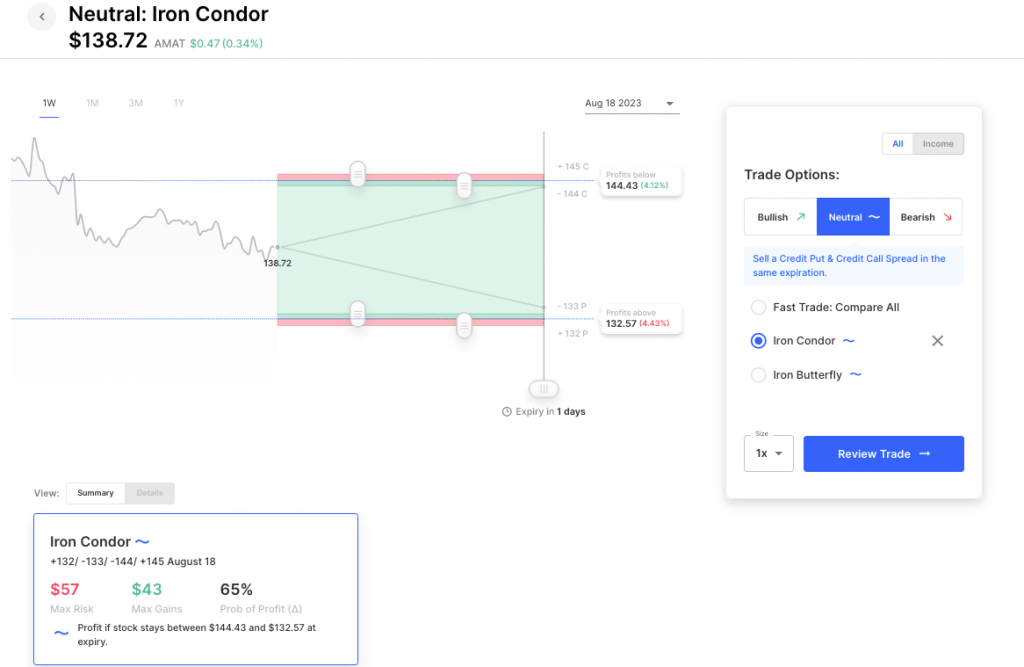

For those that like selling the move, the set-up would rest on the fact that recent earnings have not seen large moves, while somewhat discounting the fact that the stock has been moving around on its own recently. As always, defining risk makes the situation binary and merely a matter of risk/reward. Looking at an Iron Condor expiring tomorrow set roughly at the expected move (vs stock at 138.70) we see breakevens of about 132.50 and 144.50. The risk-reward on the trade is about 45 (potential reward) to 55 (risk) if the stock is outside the trade (below 132 or above 145).

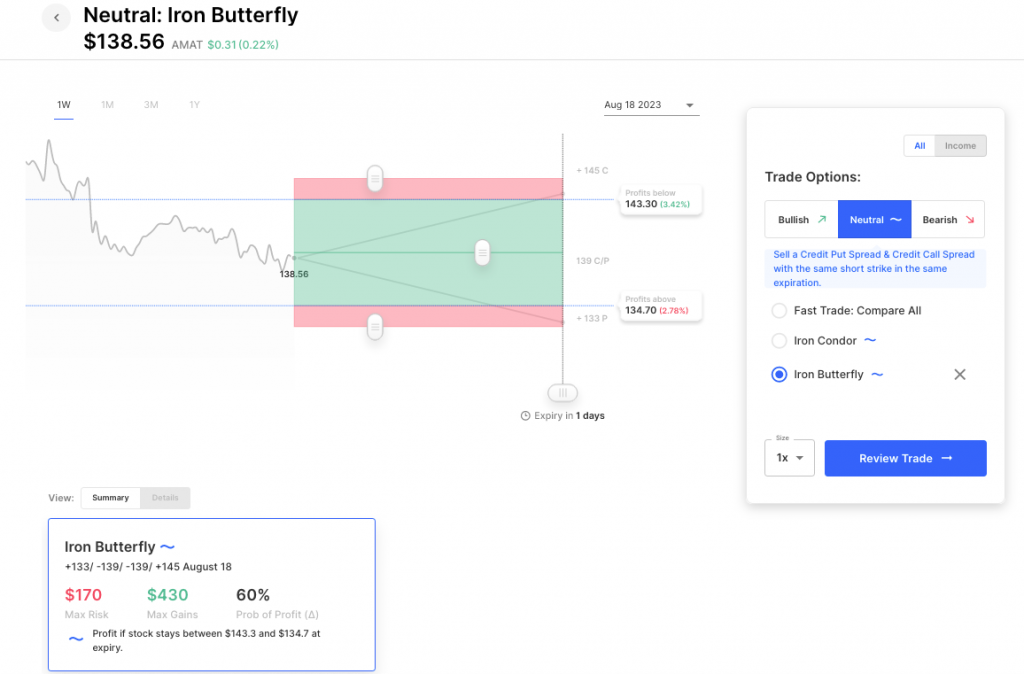

Next, let’s look at an Iron Butterfly, also a neutral / range trade but in this case looking for a larger payout if the stock does what it has done in 2 of the prior 4 earnings, not moved at all.

In this case, the risk is higher, but so is the potential reward. The breakevens are also a bit tighter. Flies also need to be managed on exit more frequently than a condor. For instance, if the stock only moved small, well inside the expected move, both wings of the condor would be out of the money, and potentially max gain. Whereas with the Fly in that scenario, you’d be paying to take the trade-off before expiry to avoid assignment on either the short put, or short call at the center of the trade.

Both trades need the stock to stay within its expected move, but the Fly in particular positions for its biggest win if the stock does not move at all. A low probability scenario, especially given the recent volatility in the sector, but one that has happened twice in the past four reports.

Actively traded names reporting today:

Applied Materials, Inc. (AMAT) Expected Move: 4.15%

Ross Stores, Inc. (ROST) Expected Move: 4.76%

Keysight Technologies, Inc. (KEYS) Expected Move: 5.30%

Bill.com Holdings, Inc. (BILL) Expected Move: 12.90%

Globant S.A. (GLOB) Expected Move: 5.89%

Farfetch Limited (FTCH) Expected Move: 13.81%

Full list here: Options AI Earnings Calendar

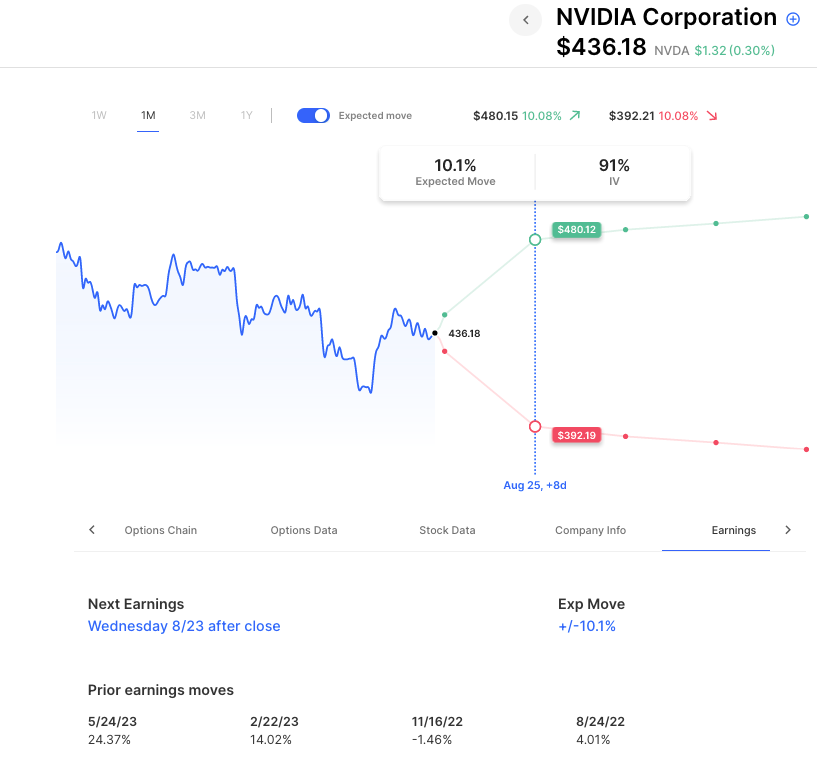

Next week is another packed earnings report week, the marquee name to report is Nvidia (NVDA). Here’s a quick look at how options are pricing that move, currently around 10%

As you can see below the chart, NVDA’s last two earnings have been wild, moving +25% and +14%, but with the two prior to that very muted. NVDA has been extremely volatile of late and we’ll check back in on that stock before its report.

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.