Good morning!

Options AI mobile is now available in the Apple app store! Go find it here.

Futures are higher this morning. The market still has to digest the Fed’s preferred inflation measure of core PCE which drops before the open. It’s been a positive week for SPY, up about 1.1% coming into this morning (not counting the futures being higher). That’s about in line with the move options were pricing for the week, so a positive day today would take stocks beyond what options had priced. That slow grind in a low-vol environment can be frustrating for option sellers as upside calls are really cheap and really close to the money when a trade is entered… so trade management on a slow creep higher is important. Option vol remains low and may get lower into the close preceding what is a quasi 3-and-a-half day weekend that market makers will not want to be owning a ton of premium into.

Today’s (0DTE) expected moves:

- SPY: 0.5%

- QQQ: 0.7%

Pre-Market:

- Renalytix Ai Plc ADR (RNLX) +41.06%

- Genfit S.A. ADR (GNFT) +27.16%

- Xpeng Inc ADR (XPEV) +7.19%

- Apple Inc (AAPL) +0.72%

- Nvidia Corp (NVDA) +0.82%

- Adv Micro Devices (AMD) +0.63%

- Alibaba Group Holding ADR (BABA) -0.67%

- Aurinia Pharm Ord (AUPH) +18.89%

- Trupanion Inc (TRUP) -15.14%

- Nike Inc (NKE) -3.03%

Today’s Earnings Highlights:

- Constellation Brands, Inc. (STZ) Expected Move: 2.98%

Full list here: Options AI Earnings Calendar

Economic Calendar:

- At 08:30 AM (EST) Core PCE Price Index MoM (May) Estimates: 0.3, Prior: 0.4

- At 08:30 AM (EST) Personal Spending MoM (May) Estimates: 0.2, Prior: 0.8

- At 08:30 AM (EST) PCE Price Index YoY (May) Estimates: 3.9, Prior: 4.4

- At 08:30 AM (EST) Personal Income MoM (May) Estimates: 0.3, Prior: 0.4

- At 08:30 AM (EST) PCE Price Index MoM (May) Estimates: 0.2, Prior: 0.4

- At 09:45 AM (EST) Chicago PMI (Jun) Estimates: 44, Prior: 40.4

- At 10:00 AM (EST) Michigan Consumer Sentiment (Jun) Estimates: 63.9, Prior: 59.2

Scanner Highlights:

- Overbought (RSI): DAL (85), LUV (79), AAL (79), JBLU (78), RCL (77), OSTK (77), JETS (76), CCL (74), AAPL (72)

- Oversold (RSI): DIS (41), BUD (41), DOCU (42), SBUX (42), MU (43), MRNA (43)

- High IV: MANU (+191%), OSTK (+133%), NKE (+104%), TSLA (+99%), NFLX (+99%), MS (+98%)

- Unusual Options Volume: JOBY (+1199%), BYND (+356%), SNOW (+356%), MSTR (+354%), AA (+349%), UAL (+330%), GLD (+303%), UPS (+288%), KO (+262%), AAL (+258%), DAL (+235%)

Full lists here: Options AI Free Tools.

Chart of the Day:

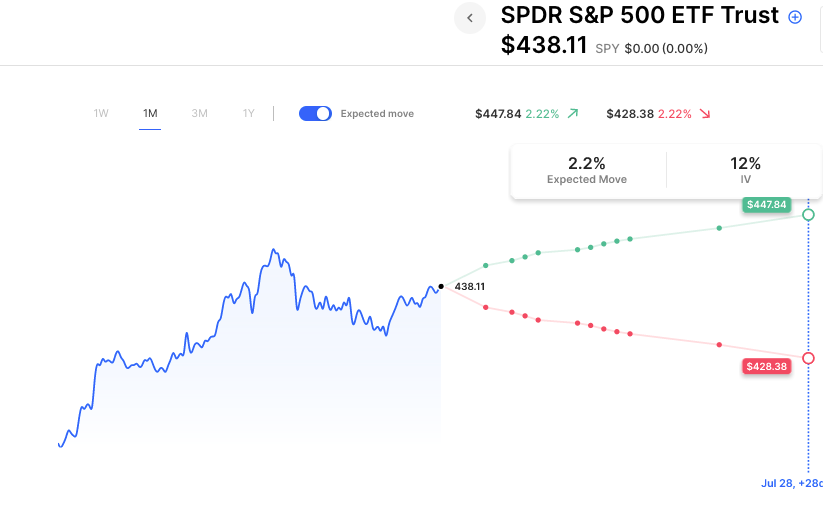

SPY option vol is so low the expected move for the next month is under 2.5%:

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.