Hello!

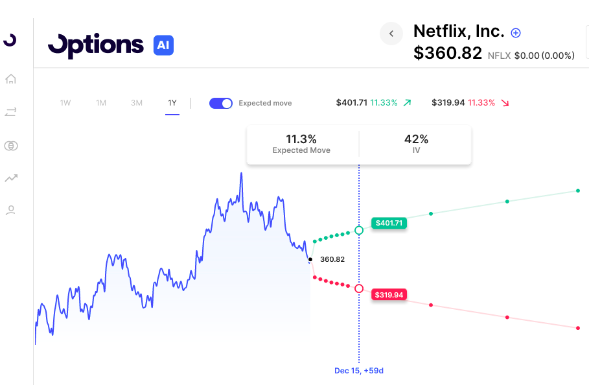

Chart of the Day: Netflix

Netflix NFLX reports after the close on Wednesday (alongside Tesla). Currently, options are pricing about a 7% move. The stock has moved on -8%, -3%, +8% and +13% on recent earnings.

NFLX is an example on the “earnings checklist” where the difference between expiry week IV and later month IV is quite a sharp contrast. It’s pretty typical to see twice the IV difference, but NFLX is nearly 3x. What that means from a trading perspective is those looking to position directionally may want to look out farther in time than near term, and also, may want to finance any directional bets out a few months with some earnings week option sales. Here are the weekly expected move, IV, and move levels:

Now compare that to December expiry:

You can see the difference in IV, but note the expected move for this week of 7% vs the expected move out 2 months of 11%. That’s an extra 2 months if you’re looking for NFLX to get back to $400 for instance, or to break down to $320. Something to keep an eye on for those looking to use earnings as a catalyst for a directional position.

Earnings Today (with Expected Moves)

- Interactive Brokers Group, Inc. (IBKR) Expected Move: 3.73%

- J.B. Hunt Transport Services, Inc. (JBHT) Expected Move: 3.70%

- Omnicom Group Inc. (OMC) Expected Move: 4.18%

- United Airlines Holdings, Inc. (UAL) Expected Move: 5.06%

- Wintrust Financial Corporation (WTFC) Expected Move: 7.57%

Tomorrow morning:

- Morgan Stanley 3.8%

- Abbot Labs 4%

- ASML Holdings 4.9%

- US Bankcorp 4.4%

Full list here: Options AI Earnings Calendar

Early Movers:

- Bank of America Corp (BAC) +1.52%

- Nvidia Corp (NVDA) -1.54%

- Tesla Inc (TSLA) -0.42%

- Amazon.com Inc (AMZN) -0.97%

- Vmware Inc (VMW) -5.30%

- Pfizer Inc (PFE) -0.09%

- Johnson & Johnson (JNJ) +0.62%

- Wyndham Hotels & Resorts Inc (WH) +12.23%

Stock Scanner:

- Overbought (RSI): LLY (74), VMW (74), AMGN (73), UNH (73), LULU (71), PANW (70)

- Oversold (RSI): RDFN (19), LUV (28), CCL (31), MCD (31), MRNA (31), BA (31), VFS (31)

- High IV: SRPT (+490%), VMW (+429%), UA (+206%), JBLU (+160%), IBM (+150%), MCD (+145%), LUV (+144%)

- Unusual Options Volume: LULU (+1061%), SNAP (+593%), COIN (+591%), VFS (+501%), RIOT (+449%), UAL (+444%), MARA (+444%), ZION (+443%), JETS (+380%), LOW (+368%), GS (+361%)

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC