Good morning!

Options AI mobile is now available in the Apple app store! Go find it here.

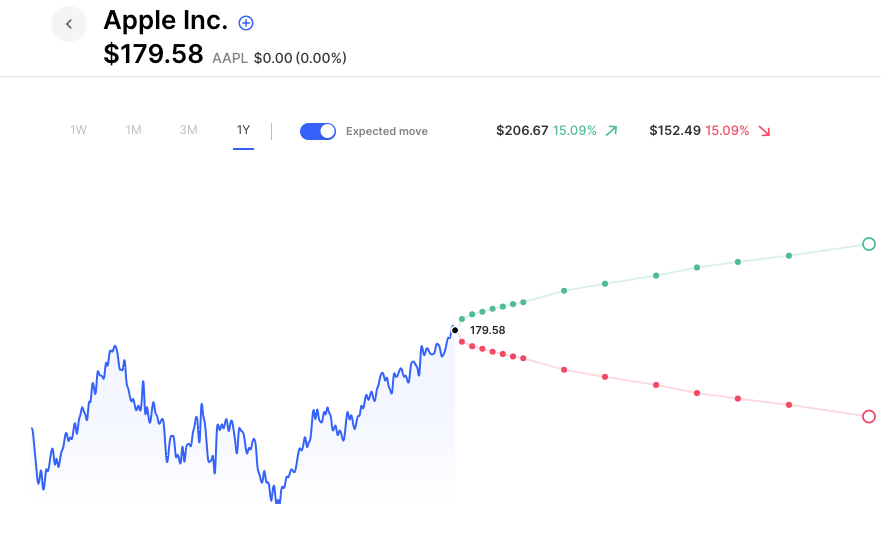

Futures are slightly lower. This follows yesterday’s nearly 1% from intra-day highs. Apple’s mid-day selloff was partly responsible for that reversal, as they launched their new VR/AR goggles at their WWDC. The sticker shock was the headline, $3500 (that does not come with $3001 in cash in the box, apparently) and most pointed to that for the reversal. But likely more salient to the situation is that AAPL opened and made a new all-time high into the WWDC, before the reversal. Apple is up 40% on the year, a massive move for a massive company, and accounts for a significant portion of the overall market gains of 2023. It’s one to keep an eye on.

It’s fairly quiet on the economic data front today, and earnings as well. IV remains low. The VIX is below 15, its lowest level since pre-pandemic.

Pre-Market Movers:

- Forza X1 Inc (FRZA) +32.19%

- Apple Inc (AAPL) -0.47%

- Gitlab Inc Cl A (GTLB) +26.55%

- Coinbase Global Inc Cl A (COIN) +0.15%

- Shopify Inc (SHOP) +4.24%

- Pds Biotechnology Corp (PDSB) +17.92%

- U Power Limited (UCAR) -10.05%

- Anheuser-Busch Inbev S.A. ADR (BUD) +0.07%

- Alphabet Cl A (GOOGL) +0.18%

- Mobileye Global Inc Cl A (MBLY) -5.59%

Today’s Earnings Highlights:

- Ferguson plc (FERG) Expected Move: 5.50%

- The J. M. Smucker Company (SJM) Expected Move: 4.40%

- Casey’s General Stores, Inc. (CASY) Expected Move: 5.70%

- Ciena Corporation (CIEN) Expected Move: 9.57%

- Thor Industries, Inc. (THO) Expected Move: 8.46%

- Academy Sports and Outdoors, Inc. (ASO) Expected Move: 10.00%

- ABM Industries Incorporated (ABM) Expected Move: 8.61%

- Cracker Barrel Old Country Store, Inc. (CBRL) Expected Move: 9.10%

- Hello Group Inc. (MOMO) Expected Move: 11.17%

- Dave & Buster’s Entertainment, Inc. (PLAY) Expected Move: 9.48%

Full list here: Options AI Earnings Calendar.

Economic Calendar:

- At 10:00 AM (EST) IBD/TIPP Economic Optimism (Jun) Estimates: 45.2, Prior: 41.6

- At 04:30 PM (EST) API Crude Oil Stock Change (Jun/02) Estimates: 1.5%, Prior: 5.202%

- At 07:00 AM (EST) MBA 30-Year Mortgage Rate (Jun/02) Impact: Medium

- At 08:30 AM (EST) Imports (Apr) Estimates: 325.2% Prior: 320.4

- At 08:30 AM (EST) Exports (Apr) Estimates: 247, Prior: 256.2

- At 08:30 AM (EST) Balance of Trade (Apr) Estimates: -75.2, Prior: -64.2

- At 10:30 AM (EST) EIA Crude Oil Stocks Change (Jun/02) Estimates: 1.5%, Prior: 4.488%

- At 10:30 AM (EST) EIA Gasoline Stocks Change (Jun/02) Estimates: 1.5%, Prior: -0.207%

Options AI Scanner Highlights:

- Overbought (RSI): ETRN (93), MDB (85), PLTR (84), META (81), ZS (81), DDOG (78), PANW (78), TSLA (78), ADBE (77), QQQ (76), TTD (76), SPOT (68), AAPL (68), DOCU (67), MTCH (67)

- Oversold (RSI): CGC (6), TGT (23), FL (24), MULN (25), BUD (27), VOD (27), TLRY (28), S (28), PEP (40), UPS (40), WYNN (41)

- High IV: MMAT (+244%), VMW (+177%), NKLA (+177%), DISH (+168%), TMUS (+107%), BYND (+102%), NKE (+102%), T (+98%), MRK (+97%)

- Unusual Options Volume: U (+1191%), AAPL (+716%), COIN (+688%), MSTR (+680%), DOCU (+582%), PANW (+545%), MRVL (+542%), GME (+526%), CHPT (+521%), TMUS (+517%)

Full lists here: Options AI Free Tools.

Chart of the Day:

Apple reversed after making a new all-time high yesterday:

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.