Market View

Last Week – Slightly higher for stocks put plenty of volatility.

SPY was up 1.1% on the week, a move less than half of what options were pricing. However, the market had multiple swings of more than 3% within the week and closed the week badly with a selloff on Friday. The VIX closed the week slightly higher but also saw large swings, nearly 30 on the upper end and 22 on the lower end. Last week’s volatile swings in the broader market were largely based on the wild swings in banks both large and small, with large bank Credit Suisse entering the conversation. Some of the best-performing stocks last week were in large-cap tech as a rotation to those names was spurred by lower interest rates and declining treasury yields.

Continuing signs of stress in the banking sector could spook stocks and confuse the options market, attempting to price both the downside market risk of bank runs and the potential for melt-ups happening elsewhere as rotations take place among investors eyeing declining yields (and a potentially dovish Fed). As one example among many, Microsft (MSFT) was higher by more than 12% last week, while KRE (the regional bank etf) was lower by 14%. Those type of competing moves resulted in an overall market that was almost flat on the week, but underneath the hood was some chaos.

Back to treasuries, short-term yields saw some of their wildest swings in years. For instance, the 2-year yield closed the week at 3.85%, down from 5% on March 7th. That’s a fast move. The bond market is essentially calling the Fed’s bluff on where rates will be in the near future. Speaking of the Fed…

This Week – A Big Decision by The Fed

A consortium of mid-sized banks sent a letter over the weekend to the FDIC requesting a rules change to guarantee deposits for the next two years in an attempt to stem further bank runs. Then, on Sunday, UBS agreed to take over troubled Credit Suisse. A couple of weeks ago it was assumed the Fed would keep its foot on the gas on rate hikes and the market was settling into an assumption of higher rates for longer as inflation numbers remained somewhat stubborn. All that has now changed and the Fed has big decisions to make in the next few meetings. The FOMC announcement is Wednesday and a Powell presser follows. The market still assumes a 25 basis point hike (after some thought 50 just a few weeks ago) but a pause wouldn’t be a shock at this point. The reaction by the market to any of those scenarios would be tough to read ahead of time because the reasons given by the Fed are arguably more important.

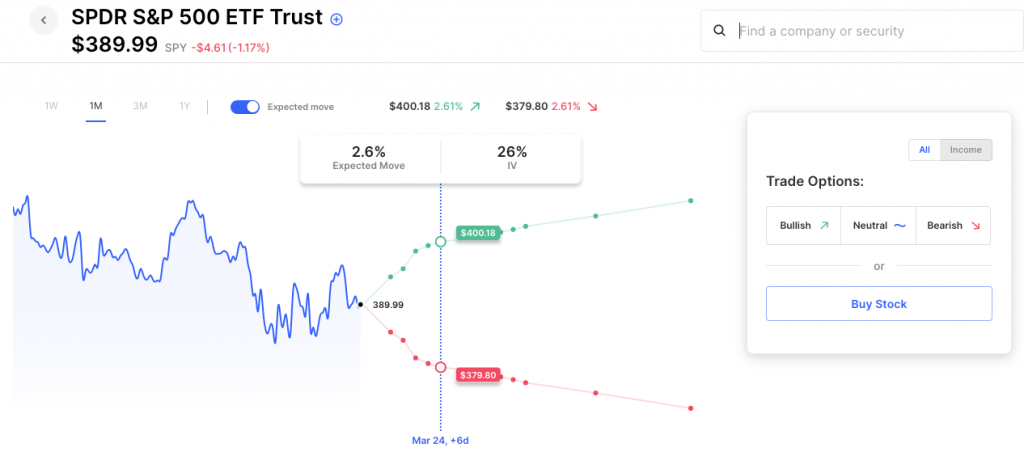

SPY options are pricing about a 2.6% move for the week, similar to last week. The majority of the move is being priced by options for the actual FOMC day. Here’s this week’s SPY levels for a 2.6% expected move, about $400 on the upside and $380 on the downside. Note the bulge in the expected move chart mid-week, as option IV jumps from about 19 before the meeting to 26 after:

Expected Moves for This Week (via Options AI free tools)

- SPY 2.6%

- QQQ 2.9%

- IWM 3.6%

- DIA 2.3%

Economic Calendar

- Monday – Lagarde (ECB) speech

- Wednesday – FOMC Interest Rate Decision, Powell Presser

- Friday – Durable Goods, Capital Goods

Weekly Expected Moves (in the News) (via Options AI free tools)

- XLF 4.3% (was down 6% last week)

- KRE 10% (was down 14% last week)

- TLT 2.4% (was up 1% last week)

Unusual Option Volume on FridayFRC, RIOT, MOS, DASH, ALT, GLD, BK, MSFT, NVDA, ICLN, COIN, MSTR

Earnings This Week

Via the Options AI Earnings Calendar. Expected move, weekly IV, and prior earnings moves (starting with most recent).

Tuesday

- Nike NKE / Expected Move: 7.5% / Recent moves: 0%, -3%, -2%

- GameStop GME / Expected Move: 13.5% / Recent moves: +11%, +7%, +10%

Wednesday

- Chewy CHWY / Expected Move: 10% / Recent moves: +4%, -8%, +24%, -16%

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.