Market View

Last Week – Late week rally sends stocks higher and IV lower

A late-week rally powered the SPY higher by 2%, a slightly larger move than options were pricing. The VIX fell sharply on the rally, finishing the week near 18.50 (down from 22 the week before)

This Week – Powell and Jobs

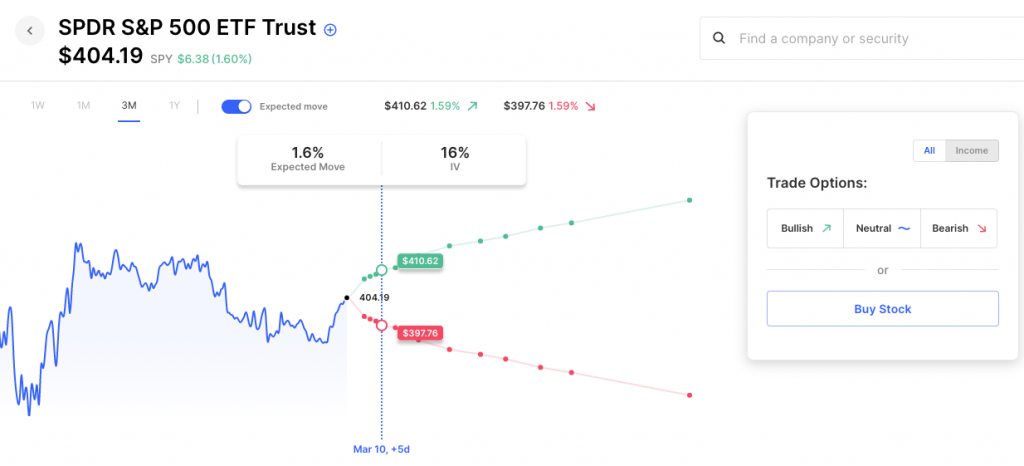

SPY options are pricing about a 1.6% move for the week. IV is on the low end of the range we’ve seen lately as earnings season winds down but we will get congressional testimony from Jerome Powell early in the week, the release of the Beige Book midweek, and the NFP jobs number on Friday. Here’s this week’s SPY levels for a 1.6% expected move, about $397 on the downside and $411 on the upside:

Expected Moves for This Week (via Options AI free tools)

- SPY 1.6%

- QQQ 2.1%

- IWM 1.9%

- DIA 1.4%

Economic Calendar

- Tuesday – Powell Testimony

- Wednesday – Powell Testimony, Beige Book, ADP Employment

- Friday – Non-Farm Payrolls

High Options Volume Friday – EWJ, COST, AVGO, MRVL, PTON, FSLR, META

Earnings This Week

Via the Options AI Earnings Calendar. Expected move, weekly IV, and prior earnings moves (starting with most recent).

Tuesday

- Dick’s DKS / Expected Move: 7.8% / Recent moves: +10%, +1%, +10, +2%

- Crowdstrike CRWD / Expected Move: 9.3% / Recent moves: -15%, -6%, -7%, +13%

Wednesday

- MongoDB MDB / Expected Move: 13.4% / Recent moves: +23%, -25%, +19%, +19%

Thursday

- JD.com JD / Expected Move: 6% / Recent moves: -3%, +3%, +4%, -16%

- Ulta Beauty ULTA / Expected Move: 6% / Recent moves: 0%, -2%, +12%, -3%

- DocuSign DOCU / Expected Move: 11% / Recent moves: +12%, +10%, -25%, -20%

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.