Market View

Last Week – Relatively Quiet, Now What?

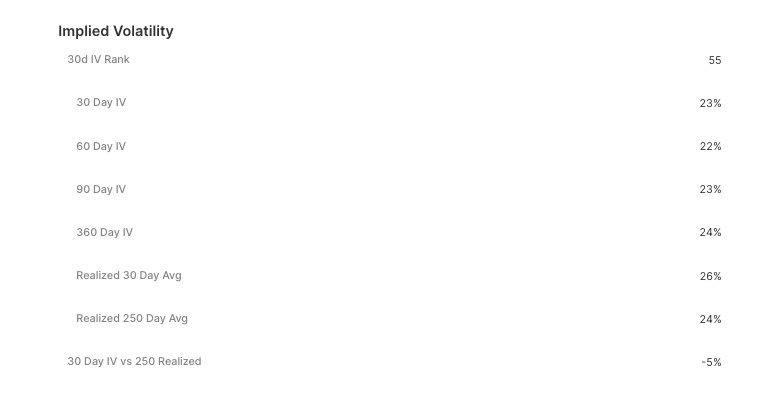

SPY fell 0.6% last week, its least volatile weekly move in some time. Not only was the close for the week well inside what options were pricing but the range of trading for the week was much more muted than what has been typical over the past month and a half with about a 1.8% move lower the extreme of the weekly range. Implied volatility was more or less unchanged on the week. The VIX sits around 23.

This Week – Will Traders Get Full of Turkey and Gamma?

SPY options are pricing about a 1.5% move for the upcoming holiday-shortened week, that move is down significantly from what options were pricing over the past few weeks.

File this under a “way too early to know” category, but one thing traders should be aware of is that falling implied volatility can be a self-fulfilling prophecy on realized (actual) market volatility The TLDR version is that it can load the market with gamma that may act as a governor on market moves as there are deltas to be bought lower and deltas to be sold higher.

The deeper dive version is this. Following an extended period of High IV (like we just saw), a lot of options are bought at higher premium levels. In fact, if you had been buying options the past month and half, you were buying historically high IV, but you also happened to be buying options that were underpriced vs how the market was moving day to day and week to week.

Part of that movement in the markets can be attributed to a really loaded news cycle. We had inflation data, FOMC, Earnings, an election, and more. But all those buyers of calls and puts were also affecting actual market volatility as all that short gamma (residing with market makers and institutions that had sold those calls and puts) can supercharge moves in the market (and individual stocks).

Here’s an example. A $100 stock is about to report earnings, options are pricing about a 10% move. A lot of investors get worried about losing 10% overnight and go out to buy puts, especially piling into the 90 put. The company misses on earnings, the stock is lower by about 10% but there’s a lot of short gamma around that 90 line and market makers need to sell a bunch of stock lower to remain delta neutral. They push the stock even lower, below the strike, and beyond the move the market was expecting. That causes a chain reaction among longs in the stock who start to panic because they don’t know how low the stock can go. That selling pushes the stock even lower, creating even more long deltas that market makers need to sell, etc etc.

Now let’s look at the flipside. Following an extended period of time with the VIX near 30, it is now in the low 20’s. Since IV just spent so much time historically high for so long, the average cost that someone has bought options over the past few months is quite high. They are clearly now selling those options, as they don’t want to be stuck holding a bunch of options at super high IV (they don’t even need to think of it that sophisticatedly, they just see that their options lose value each day and want out). So they have begun to sell those options. And the market makers who are short IV near 30 are happy to buy it back near 20. That’s how they make a significant portion of their money. However, a 23 VIX isn’t even that low, it just seems low compared to where we just were. 19 is actually the historical mean, and the VIX has been known to get as low as the low teens.

So market makers buy to close the options they sold higher, and the short gamma, which had been acting as a market accelerant, is gone. That effect could have begun last week, no one knows yet though. The interesting part is what comes next. This is a shortened holiday week, and another few holiday weeks are coming next month. The world will be watching the World Cup, there seems to be a consensus about the FOMC’s next move, and sellers may be a bit exhausted. If option selling continues the next few weeks, and market makers begin to get loaded up with options, not only will the short gamma be gone from the market, but it will have gamma working not as an accelerant, but as a governor, with market makers buying the dip, and selling the rip. And IV would go even lower.

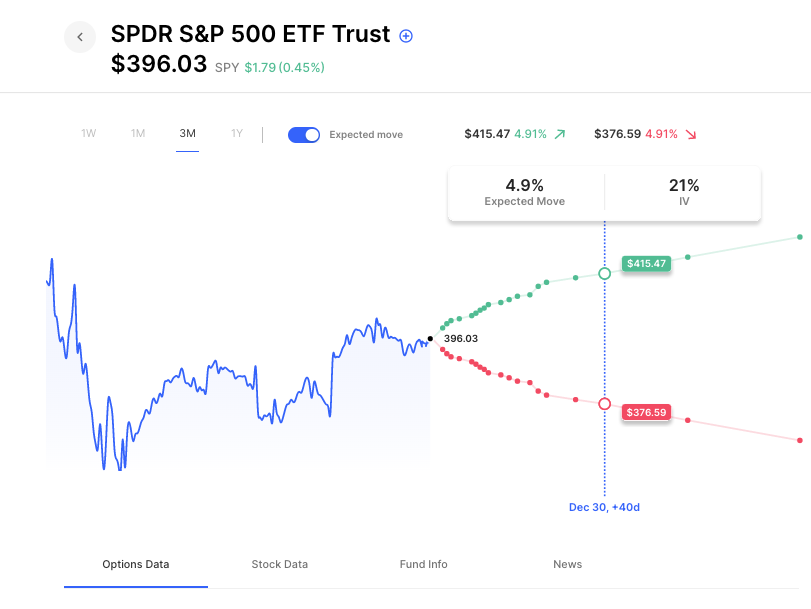

Options are pricing about a 5% move into year-end:

The economic calendar this week is pretty light with Thanksgiving, but FOMC minutes do drop Wednesday.

Expected Moves for This Week (via Options AI)

- SPY 1.5%

- QQQ 2%

- IWM 1.9%

- DIA 1.3%

Economic Calendar

- Wednesday – Durable Goods, FOMC Minutes

Earnings This Week

Expected moves for companies reporting this week. Recent moves indicate what the stock did in its past few reports (starting with the most recent). Also included is the 30-day (forward) IV vs the 1-year actual (realized, historical), which gives a sense of how options are pricing the moves relative to how the stock has traded over the past year.

Data is via the Options AI Earnings Calendar and other companies can be found at the link (free to use).

Monday

- Zoom ZM / Expected Move: 12.1% / Recent moves: -17%, +6%, -7%, -15% (30d IV vs 1yr: +31)

Tuesday

- Best Buy BBY / Expected Move: 8.6% / Recent moves: +2%, +1%, +9%, -12% (30d IV vs 1yr: +35)

- Dicks DKS / Expected Move: 8.3% / Recent moves: +1%, +10%, +2%, -4% (30d IV vs 1yr: +20)

- Baidu BIDU / Expected Move: 8.3% / Recent moves: -7%, +14%, +7% (30d IV vs 1yr: +4)

- Autodesk ADSK / Expected Move: 6.6% / Recent moves: +3%, +10%, +1%, -15% (30d IV vs 1yr: +6)

Wednesday

- John Deere DE / Expected Move: 4.5% / Recent moves: +1%, -14%, -3%, +5% (30d IV vs 1yr: –3)

Our options trading videos teach you everything you need to learn options trading, covering buying and selling options, spreads and more.

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.