Market View

Last Week – SPY was lower by about 1.5% last week. That was inside the 2.9% move options were pricing. Similar to the 1.5% move higher 2 weeks ago, markets were much more volatile intra-week than the final result would indicate. Thursday saw a big rally that broke a 6 day losing streak, but those gains were short-lived as stocks were once again steeply lower on Friday. Treasury yields and the dollar continue to be the main drivers of the day-to-day swings. Earnings season picks up in intensity the next few weeks and that may begin to move the broader markets as well.

Implied volatility remained near the highs of the year with the VIX once again closing the week near 32.

This Week – SPY options are pricing about a 2.7% move for the upcoming week. That implies a move of just under $11 in either direction.

Expected Moves for This Week (via Options AI)

- SPY 2.7% (+/- $10.50)

- QQQ 3.3% (+/- $9)

- IWM 3.2% (+/- $5.50)

- DIA 2.4% (+/- $7)

Economic Calendar

- Wednesday – Housing Starts, Beige Book

- Thursday – Initial Jobless Claims, Fed Speech (Bowman)

- Friday – Fed Speech (Williams)

Bullish by Not Being Bearish

The past few weeks we’ve detailed a few strategies for a high-vol environment, including selling high IV (and wide expected moves) via Iron Condors as well using credit put spreads in potentially oversold stocks while not needing a rally to hold (just the stock to stop going lower). We’ll check in first with the credit put spread examples from Oct 2nd’s post that expire this week.

The first was the GOOGL -96/+91 credit put spread (expiring Oct 21st), which could be sold at around 1.90 at the time, with the stock trading 95.80 It could be bought to close for about 1.40 at Friday’s close. The second was the GOOGL -91/+90 credit put spread (expiring Oct 21st), also with the stock trading 95.80. At the time it could be sold at roughly 0.26, it could be bought to close this past Friday for about 0.12.

GOOGL stock is only higher by about a dollar since then and hasn’t been much lower than where the stock was when those trade examples were detailed. The key point here is that buying calls or even call spreads in a high implied vol environment is difficult because rallies in the stock have not been sustainable. Buying premium needs a large sustained move to be right when vol is this high. But selling premium in high vol allows for some wiggle room, and can be best described in this case as being bullish, by not being bearish.

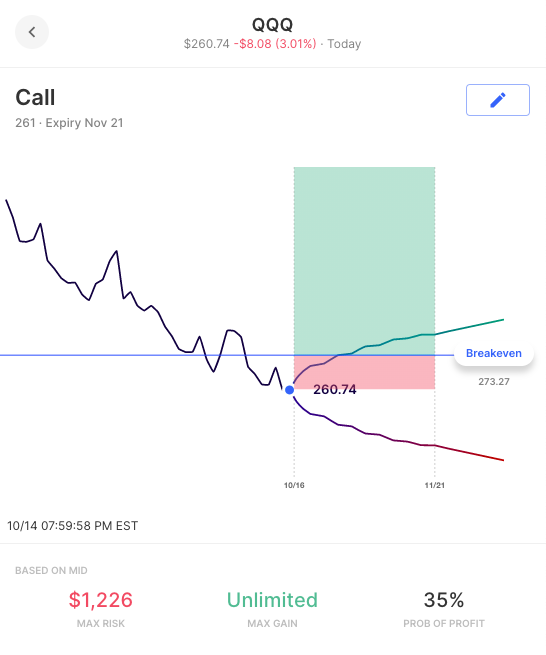

Continuing on that theme, here’s a comparison of an at-the-money call, and an at-the-money credit put spread in QQQ, expiring Nov 21st:

As you can see, the two trades risk about the same amount. However, buying the call needs QQQ above $273.25, while the credit put spread needs QQQ to not be below $254.45. Obviously, the credit put spread can only make $657, while the potential gains on the call are unlimited. But… The call needs QQQ to be nearly $19 higher from its current level before it would make the same.

Again, this is just an example. QQQ will see some of its biggest names report earnings over the next few weeks and that credit put spread could easily be underwater. But the risk is defined, and the chances of it being a complete loss are much lower than buying calls, especially with implied vol so high.

Earnings This Week

Expected moves for companies reporting this week. Recent moves indicate what the stock did its past few reports (starting with the most recent). Data is via the Options AI Earnings Calendar and other companies can be found at the link (free to use).

Monday

- Bank of America BAC / Expected Move: 4.4% / Recent moves: 0%, +3%, 0% (projected EPS: $0.78)

- Charles Schwab SCHW / Expected Move: 5.5% / Recent moves: -2%, -9%, -4% (projected EPS: $1.08)

Tuesday

- Goldman Sachs GS / Expected Move: 4.7% / Recent moves: +3%, 0%, -7% (projected EPS: $7.75)

- Netflix NFLX / Expected Move: 11% / Recent moves: +7%, -35%, -22% (projected EPS: $2.14)

Wednesday

- Tesla TSLA / Expected Move: 8.3% / Recent moves: +10%, +3%, -12% (projected EPS: $1.01)

- IBM IBM / Expected Move: 5.3% / Recent moves: -5%, +7%, -6% (projected EPS: $1.91)

Thursday

- Snap SNAP / Expected Move: 16.3% / Recent moves: -40%, +1%, +59% (projected EPS: -$0.03)

Friday

- American Express AXP / Expected Move: 5.2% / Recent moves: +2%, -3%, +9% (projected EPS: $2.45)

Our options trading videos teach you everything you need to learn options trading, covering buying and selling options, spreads and more.

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.