The Broader Markets

Last Week – The market took a bit of a breather from volatility as SPY was lower by about 1.2%, less than the 2% options were pricing. The highs and lows intra-week were also in a much tighter range than the past few weeks.

This Week – SPY options are pricing about a 2.1% move for the upcoming week (about $8.50 in either direction).

Implied Volatility / VIX – The VIX closed the week near 25, down from 26 the prior week. It is now at its lowest level since late April although still above historical averages. VIX futures are upward sloping with October above 28.

Expected Moves for This Week (via Options AI)

- SPY 2% (+/- $8.50)

- QQQ 2.8% (+/- $9)

- IWM 2.6% (+/- $5)

- DIA 1.7% (+/- $5.50)

In the News

Amazon stock has a new look Monday following a 20 for 1 split. Options positions from Friday will be x20 contract-wise on strikes now divided by 20. New trades going forward will be using the new strikes. There’s no general rule for how a stock and its options trade following a split. Studies have shown some differences between small and large-cap stock volatility post-split. Many stocks will see a period of increased volatility (also reflected in the option IV) following the split that takes a period of time to settle down into a new normal. However, AMZN’s split occurs in a market that has been volatile and IV that is still somewhat elevated vs historical averages. The only thing traders can look for is any increased retail interest in what are now much more reasonably priced (dollar-wise) options. This could affect things like upside skew and the potential for spreads or selling options vs stock that can benefit from skew in a way that retail was previously unable to affect due to the large dollar prices of most options in a $2000+ stock. Something to keep an eye on.

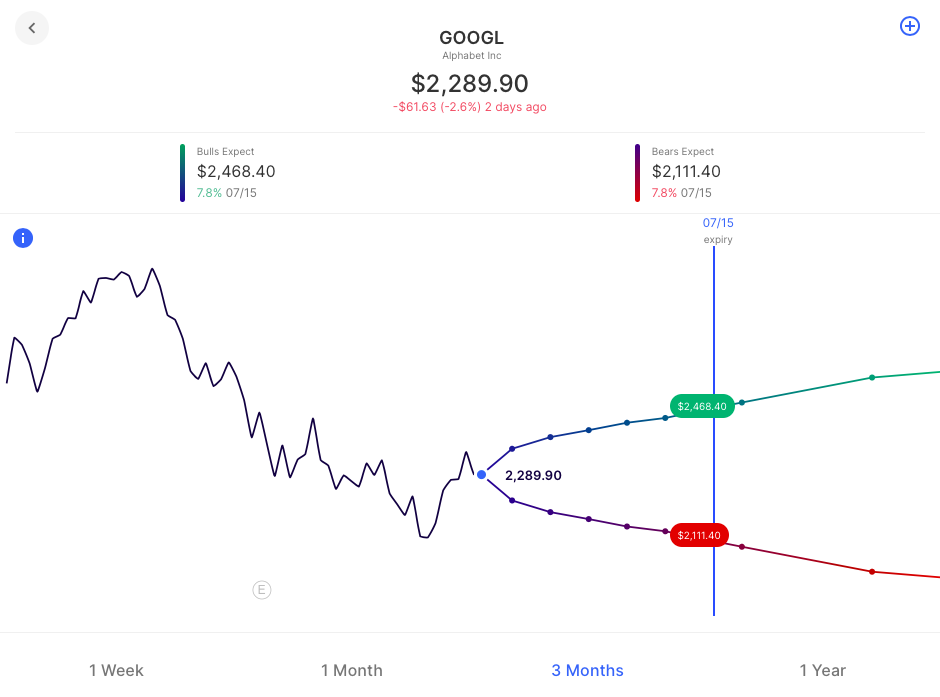

It initially looked like Alphabet would do its announced 20 for 1 split this week as well but it is now likely mid-July. Amazon shares saw a fairly decent run-up into its split. GOOGL options are pricing about an 8% move out to July 15th:

Earnings

Links below go to the Options AI calendar where you can see the other companies each day and click through to see charts (free to use). Recent earnings moves (actual) start with the most recent:

- Coupa COUP / Expected Move: 14.9% / Recent moves: -19%, -3%, -4%

- Five Below FIVE / Expected Move: 8.4% / Recent moves: -7%, +5%, -13%

- NIO NIO / Expected Move: 9.7% / Recent moves: -9%, -3%, -3%

- Docusign DOCU / Expected Move: 15.2% / Recent moves: -20%, -42%, +5%

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.