The Broader Markets

Last Week – SPY finished last week 2.3% lower (or about $11). That was more than the 1.3% (or $6) options were pricing for the week. Implied volatility was higher to end the week.

This Week – SPY options are pricing a 1.5% move (about $7 in either direction) for the upcoming (4 day) week. With the SPY $460 that is a range of about $453 to $467.

Implied Volatility – The VIX ended Friday around 21.50, up from 18 the prior week. Expected moves are slightly more than historical averages.

Expected Moves for This Week (Via Options AI)

- SPY 1.5% (about $7)

- QQQ 2.1% (about $8)

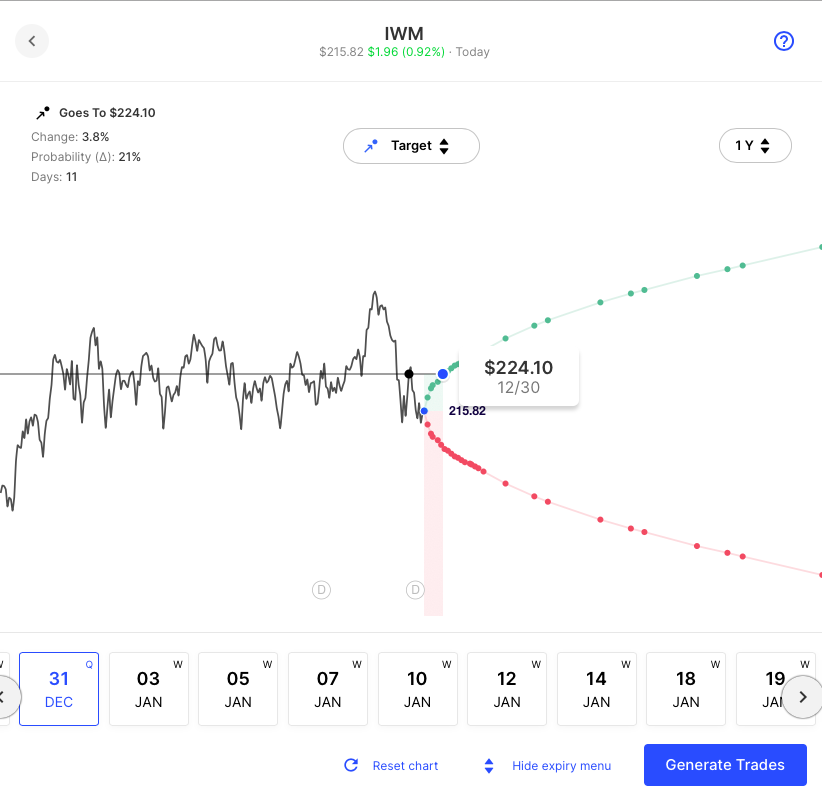

- IWM 2.7% (about $6)

- DIA 1.6% (about $6)

Implied volatility is higher than average entering a shortened holiday week and year-end. If volume falls and market moves quiet, options premium may quickly contract into a three-day weekend as market makers protect against theta risk. If large day-to-day market moves continue the three-day weekend just adds to the uncertainty and options volatility could see large moves higher and lower corresponding to equity moves. (there is no New Year’s day off for the market this year)

In the News

IWM (Russell 2000 etf) has been in a range for most of 2021 with a failed breakout in November. It has been testing the lower end of that range as recently as Friday. The expected move-in IWM into year-end is about $9, which to the downside would mean a breakdown below its 2021 range, the bullish expected move of about $225 would put IWM right back in in the middle of that range:

Expected Moves for Companies Reporting Earnings

The expected moves link to the Options AI Earnings Calendar. Recent moves on prior earnings start with the prior quarter. Earnings announcements are light this week as we’re in between earnings season and amidst the Holidays. Nike on Monday highlights the week

Monday

Carnival Cruise CCL / Expected Move: 6.3% / Recent moves: +3%, -2%, +1%

Micron MU / Expected Move: 6.7% / Recent moves: -2%, -6%, +5%

Nike NKE / Expected Move: 6.0% / Recent moves: -6%, +16%, -4%

Tuesday

Blackberry BB / Expected Move: 9.7% / Recent moves: +11%, -4%, -10%

Wednesday

Carmax KMX / Expected Move: 7.1% / Recent moves: -13%, +7%, -7%

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC a registered broker-dealer.