The Broader Markets

Last Week – SPY finished last week 2.3% higher (or about $10). Following a week it was 2.3% lower. That was more than the 1.5% (or $7) options were pricing for the week. Implied volatility was lower to end the week. SPY closed Friday just shy of its all time high.

This Week – SPY options are pricing a 1.1% move (about $5.50 in either direction) for the upcoming week. With the SPY just shy of $471 that is a range of about $465 to $476

Implied Volatility – The VIX ended Friday around 18, down from about 21.50 the prior week. Expected moves for this week are slightly less than historical averages.

Expected Moves for This Week (Via Options AI)

- SPY 1.1% (about $5.50)

- QQQ 1.5% (about $6)

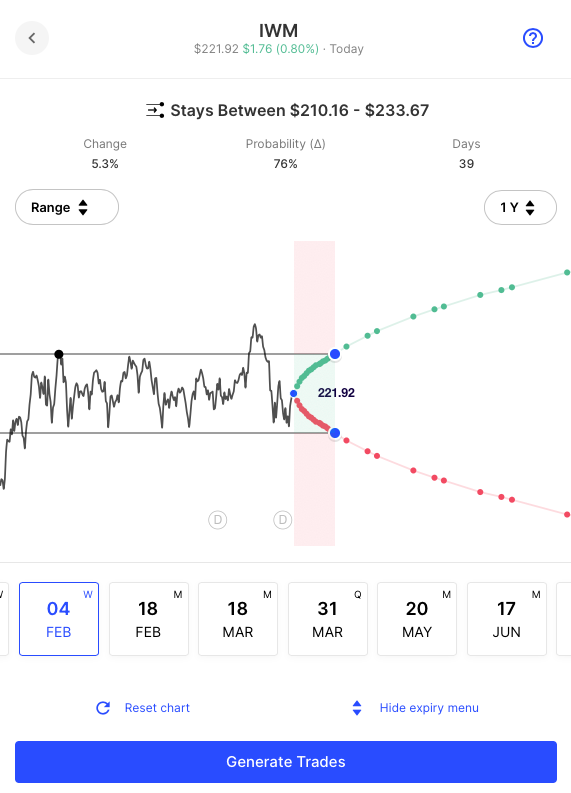

- IWM 2.1% (about $5)

- DIA 1.2% (about $4.50)

This is a full 5 day week despite New Years. The expected moves this week are actually less for the 5 day week than they were for last’s week’s 4 days. That’s a result of lower implied volatility.

In the News

Last week we highlighted the interesting range in IWM throughout 2021:

IWM (Russell 2000 etf) has been in a range for most of 2021 with a failed breakout in November. It has been testing the lower end of that range as recently as Friday. The expected move-in IWM into year-end is about $9, which to the downside would mean a breakdown below its 2021 range, the bullish expected move of about $225 would put IWM right back in in the middle of that range:

IWM tested the lower end of that range to start the week before rebounding with the rest of the market. It is now close to the center of that range (that discounts the failed November breakout). With the lower band having held (just a few trading days ago) and implied volatility compressing, options now aren’t pricing a breakout or breakdown until early February. What a difference a few days make. (via Options AI):

Crypto

BTC bounced this week and now is just below 51k. Options are pricing about a 5% move into year end. ETH options are pricing about a 6.5% move.

Earnings

Earnings announcements are basically non-existent this week but the next round of earnings begins in mid-January.

Most of the big financial companies report the week of the 17th, and some of the big tech names including most of FAANG report the week of the 24th. We’ll circle back when the dates are confirmed and expected moves come into focus.

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC a registered broker-dealer.