The first big week of earnings season continues after the close. You can keep up to date with what’s upcoming and expected moves with the Options AI earnings calendar.

We’ll focus on two large tech names that report after the bell, IBM and Intel

Intel Expected Move

At the time of writing, with Intel near $59, options are pricing approximately 4.8% up or down on earnings. That means an expected move implying a bullish consensus around $62 and a bearish consensus near $56.

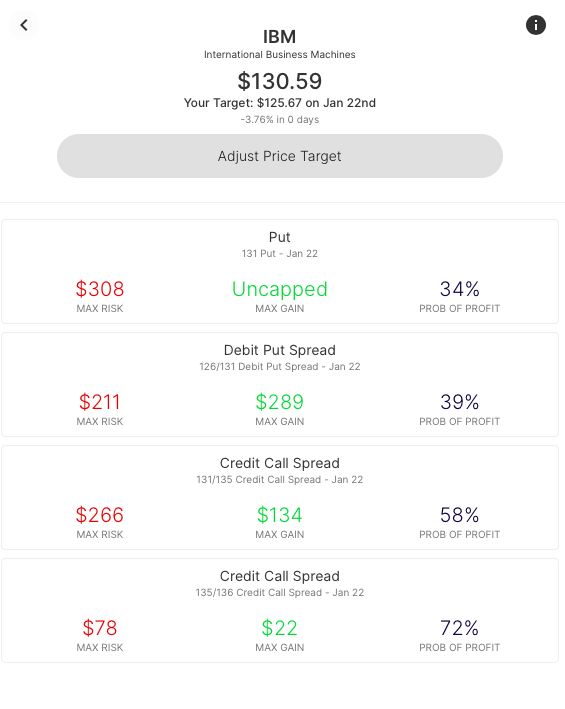

IBM Expected Move

At the time of writing, with Intel near $131, options are pricing approximately 3.8% up or down on earnings. That expected move implies a bullish consensus around $135.50 and a bearish consensus near $125.80.

Starting with the scenario where a trader believes that the options market is overestimating the move in either direction, let’s first look at ‘selling the move’ to both the bulls and bears, using the expected move to help inform strike selection.

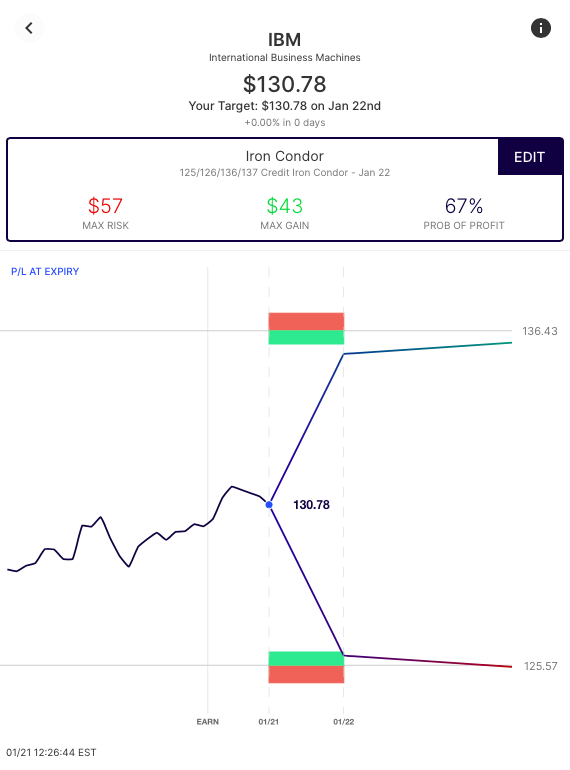

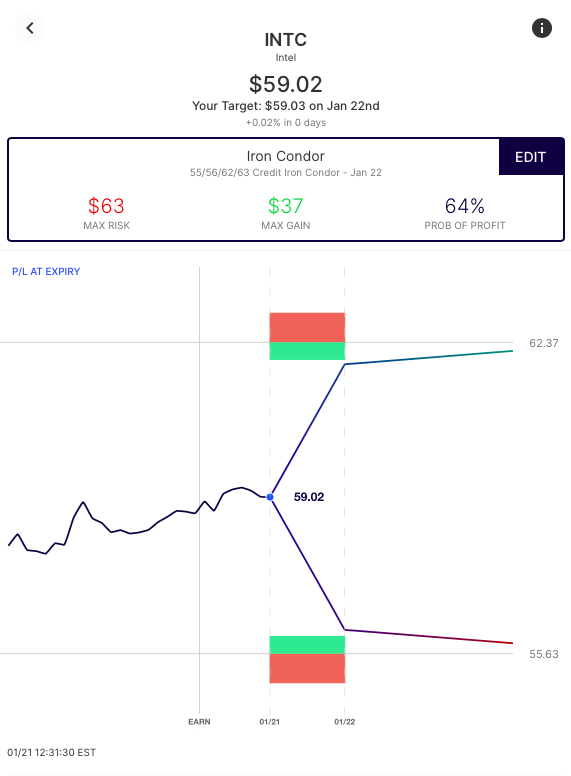

IBM, INTC – Using the Move for Income Generating Strategies

When ‘selling the move’, Premium (or income) received from selling options is kept if the stock stays within a specific range. Here’s a look at an Iron Condor for this week’s expiration in each stock. An Iron Condor sells both a call spread and a put spread.

IBM +125p/-126/-136c/+137c Iron Fly:

The Iron Condor results in max. gain at expiry (tomorrow) if the stock stays anywhere between $126 and $136. A move outside of that range, beyond the long strikes, means max. loss.

While by no means the only basis for strike selection, on Options AI, an Iron Condor based on the expected move from the options market can be generated in a couple of clicks. Strikes can also be easily edited, allowing for straightforward comparison between different versions of the strategy.

Here’s the same strategy based on Intel’s expected move, the +55p/-56p/-62c/+63c Iron Condor:

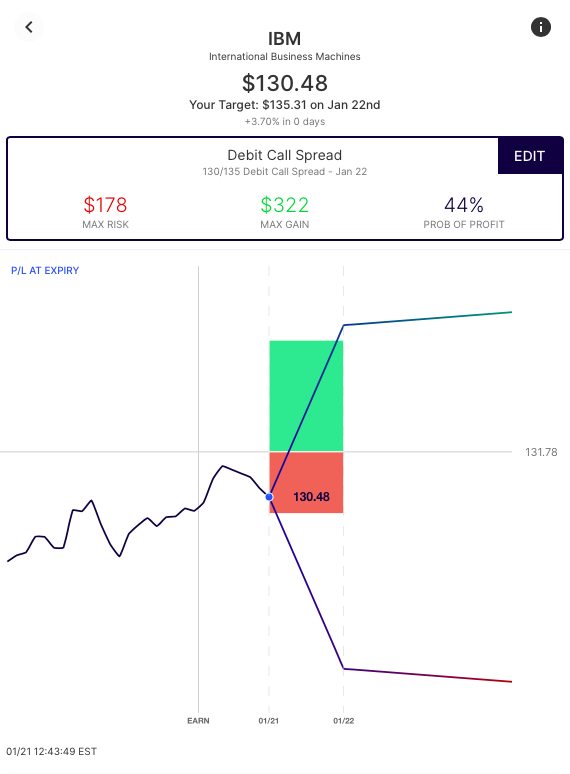

Using the Move for Bullish Strategies

With a bullish view, a trader can consider and compare a few spread trades, again using expected move strikes. With a debit spread, a call is bought, but then a spread might be created by selling a call at the expected move. A Debit Call Spread creates a range of profitability between the trade’s breakeven and its short call. It lessens the cost of the long call (and therefore increases the probability of profit by lowering the breakeven). In many cases a call spread to the expected move will have a similar price to an out of the money call, yet with a greater probability of profit. Here’s an example in IBM, with strikes based on the expected move, creating a breakeven just below $132 in the stock with a max profit if the stock is above $135:

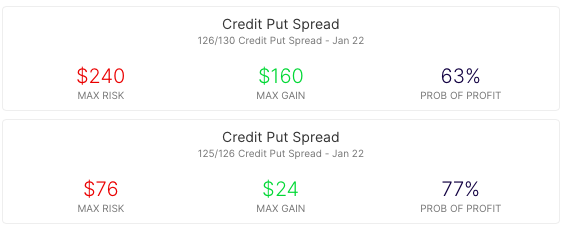

Also available to a bullish trader is a credit put spread. The trade comparison below shows two different potential credit put spreads. One at-the-money and the other out-the-money. Both are essentially ‘selling to the bears’.

Note that a far out-the-money Credit Put Spread (the second trade shown) has the highest Probability of Profit (likelihood of the stock expiring higher than the breakeven level) but it also presents a relatively high risk to reward ratio (nearly 4 to 1). It can be thought of as selling to those that are extremely bearish.

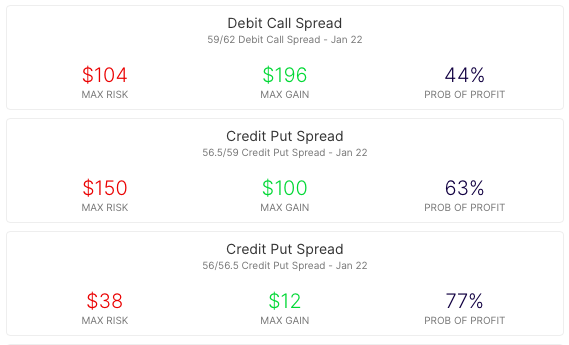

Here is how those same trade strategies look in Intel:

Whether a trader chooses a debit or a credit spread might depend on their own level of bullishness, compared to the crowd.

Using the Move for Bearish Strategies

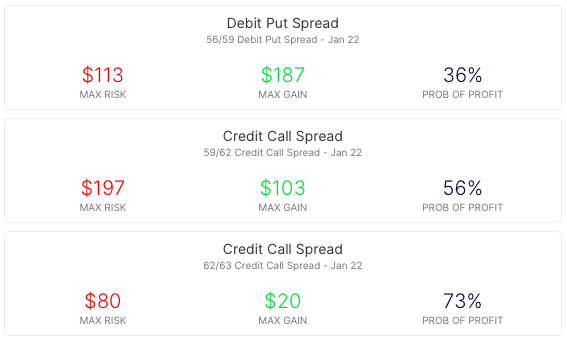

The same concepts apply to spreads with a bearish view. Here’s an example using the expected move in Intel, generating a Debit Put Spread, but also Credit Call Spreads:

And in IBM, using the 3.8% expected move for bearish spreads:

Summary

The expected move can provide actionable insight to consider before making any trade, particularly into an uncertain event. Whether gut-checking your own expectations versus the options crowd, generating trade ideas from option market signals, or for more informed strike selection. That’s why Options AI puts the expected move at the heart of its chart-based platform. Learn / Options AI has a couple of free tools as well as education on expected moves and spread trading. The concepts shown in IBM and Intel can apply to any stock and it is simply used here for illustrative purposes.