Unlike an equity position where profit or loss is from the entry point, options positions have breakevens above or below the current stock price. Options can increase or decrease in value between trade entry and expiration, but at expiration, when time value of the option no longer remains, the position’s breakeven point determines whether that trade made or lost money.

An easy way to think about breakevens is that’s the level the stock needs to pass or not pass for a trade to make money. The odds assigned to those breakeven levels are at the heart of options pricing.

Here are some examples. Stock reference is $100.

Long Call – A trader buys a 100 strike call for $5.00. The breakeven is 105 (100 + $5.00) with losses below 105 and gains above 105 at expiration.

Long Call Spread (debit call spread) – A trader buys a 100 strike call for $5.00 and sells a 105 call at $2.00 for a net debit of $3.00. The breakeven is 103 (100 + $3.00) with losses below 103 and gains above 103 at expiration.

Bullish Short Put spread (credit put spread) – A trader sells a 100 strike put at $5.00 and buys a 95 put for $2.00 for a net credit of $3.00. The breakeven is 97 (100 – $3.00) with losses below 103 and gains above 103 at expiration.

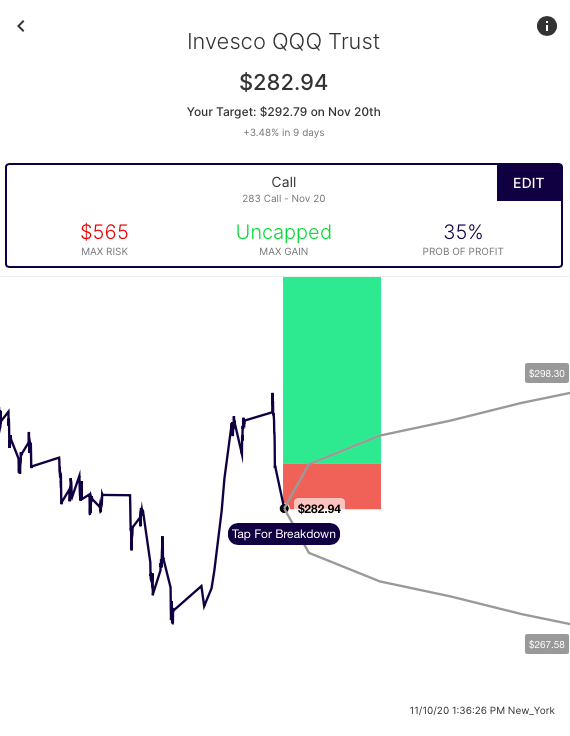

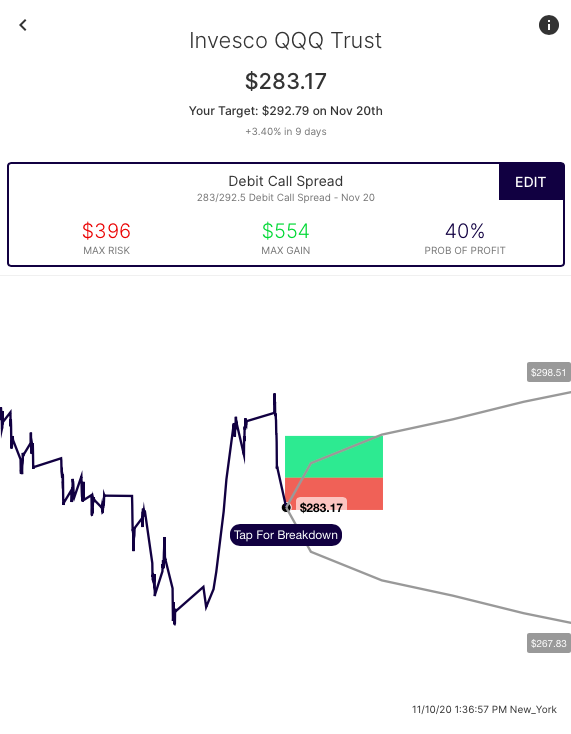

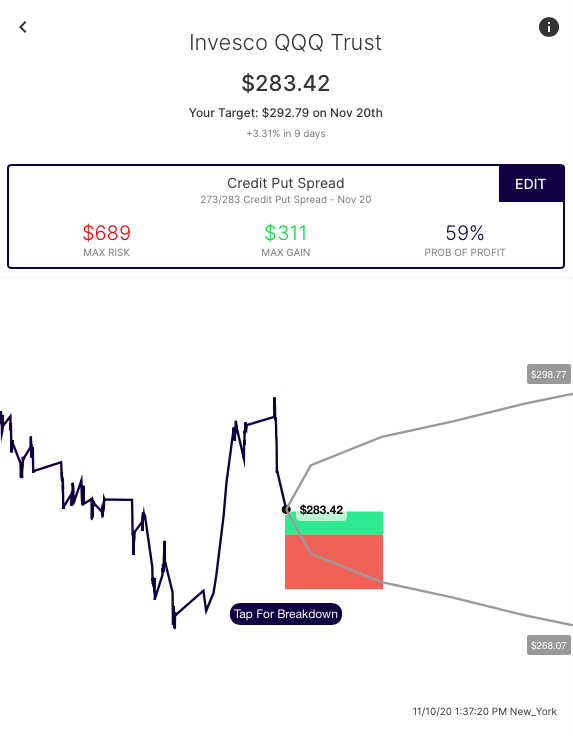

Here are three trades side by side on Options AI, a Call, a call spread, and a credit put spread. The line from red (loss) transitioning to green (gain) is the breakeven point. The call spread has a lower breakeven than the call, and the put spread even lower (lower than the stock).

The call has the lowest probability of profit, the call spread second best, and the credit put spread the best.