Good morning!

- QQQ -0.70%, SPY -0.25%

- Tesla and Netflix are both lower, but both within the expected move (thus far)

One of the things to look for as earnings season heats up is whether companies that miss see buyers below. We’re about to get a test of underlying strength in the market with both Netflix and Tesla are lower on earnings. The two companies were the first mega-cap tech stocks to report this cycle. And most mega-cap stocks rallied into earnings season. If these companies miss, and find buyers below, the stocks will stay above their expected move levels, indicating an underlying bid in these stocks, folks that may have missed some of this rally, and now see a chance to get in. Obviously, support levels are interesting spots to watch, but the options market provides another consistent one, the expected move. If the stocks continue lower, and close the day below their expected move (into earnings) it may indicate some buyer exhaustion, with buyers unwilling to step in or defend levels that were expected on a miss.

Chart of the Day:

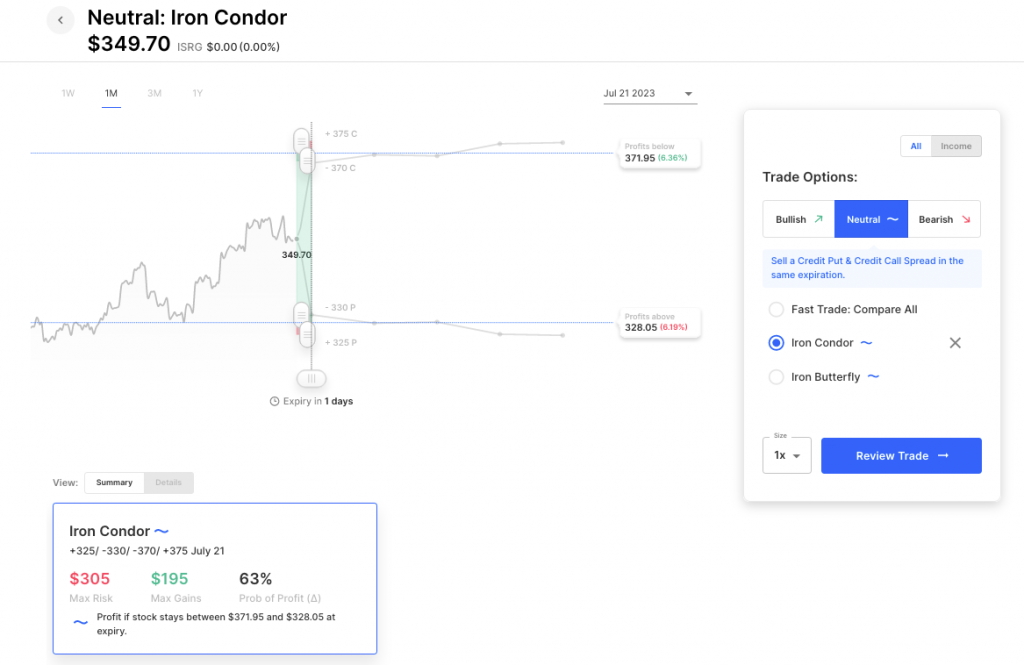

Often, expected moves line up with recent resistance and support. Here’s an example in ISRG, reporting today, and an Iron Condor based on Friday’s expected move that leans on a very recent low in the stock:

Pre-Market Movers:

Tesla Inc (TSLA) -4.27%

Netflix Inc (NFLX) -6.22%

Painreform Ltd (PRFX) +28.27%

American Airlines Gp (AAL) -1.45%

Carvana Company Cl A (CVNA) +1.54%

Today’s Earnings Highlights:

Taiwan Semiconductor Manufacturing Company Limited (TSM) Expected Move: 4.67%

Johnson & Johnson (JNJ) Expected Move: 2.08%

Abbott Laboratories (ABT) Expected Move: 3.14%

Intuitive Surgical, Inc. (ISRG) Expected Move: 5.60%

CSX Corporation (CSX) Expected Move: 2.76%

Capital One Financial Corporation (COF) Expected Move: 4.20%

Nokia Oyj (NOK) Expected Move: 4.34%

American Airlines Group Inc. (AAL) Expected Move: 4.27%

KeyCorp (KEY) Expected Move: 7.40%

Full list here: Options AI Earnings Calendar

Economic Calendar:

At 08:30 AM (EST) Philadelphia Fed Manufacturing Index (Jul) Estimates: -10, Prior: -13.7

At 08:30 AM (EST) Initial Jobless Claims (Jul/15) Estimates: 242, Prior: 237

At 08:30 AM (EST) Continuing Jobless Claims (Jul/08) Estimates: 1729, Prior: 1721

At 08:30 AM (EST) Jobless Claims 4-week Average (Jul/15) Estimates: 241, Prior: 246.75

Scanner Highlights:

Overbought (RSI): CVNA (83)

Oversold (RSI): JNJ (42)

High IV: MANU (+155%)

Unusual Options Volume: CVNA (+840%), PG (+584%), AAPL (+463%), AXP (+295%)

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.