Hello!

Today’s video orbit takes a look at what just happened in the market after a few days of a rally and how quickly the gamma and vol backdrop shifted. Also, what that could mean next. Is this “the year-end rally” already?

TL:DR version, we saw a pretty quick reversal from an area many traders were targeting as potential support. But we also just saw a steep decline in IV, and high IV is often the accelerant to a move to the upside, once that backdrop shifts that accelerant is gone and the market either finds itself at the end of a rally, or the beginning of a slow grind higher. Also a quick look at Apple’s $AAPL upcoming earnings. I hope you enjoy:

Trending/Movers:

- Palantir Technologies Inc Cl A (PLTR) +13.61%

- Shopify Inc (SHOP) +17.44%

- Paypal Holdings (PYPL) +6.48%

- Peloton Interactive Inc (PTON) -7.07%

- Crocs Inc (CROX) -16.49%

- Starbucks Corp (SBUX) +6.84%

- Qualcomm Inc (QCOM) +5.80%

- Roku Inc (ROKU) +18.93%

- Airbnb Inc Cl A (ABNB) -0.91%

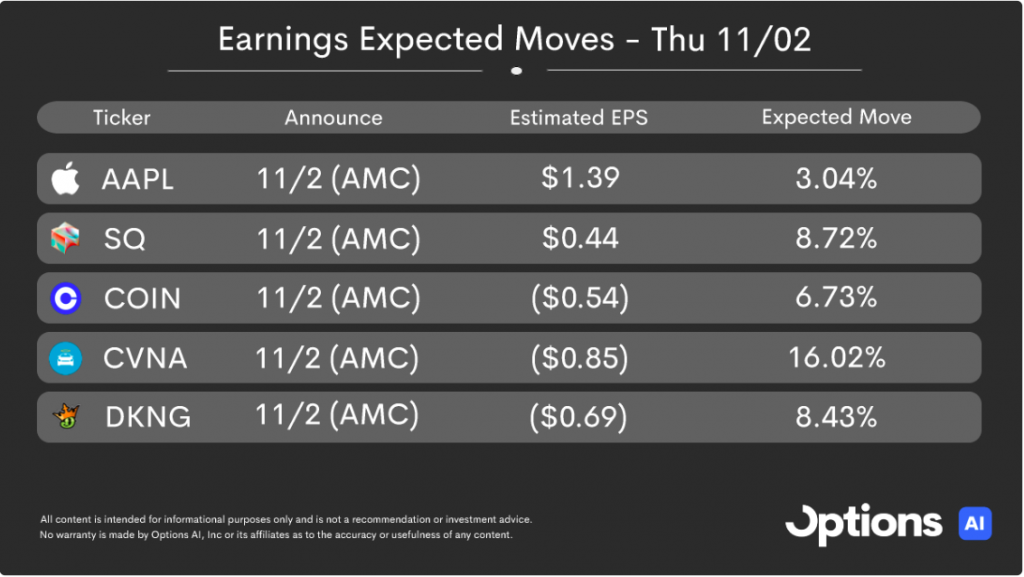

Today’s Earnings Highlights:

- Apple Inc. (AAPL) Expected Move: 3.04%

- Stryker Corporation (SYK) Expected Move: 4.90%

- Booking Holdings Inc. (BKNG) Expected Move: 3.80%

- EOG Resources, Inc. (EOG) Expected Move: 3.17%

- Pioneer Natural Resources Company (PXD) Expected Move: 1.21%

- Monster Beverage Corporation (MNST) Expected Move: 5.05%

- Atlassian Corporation Plc (TEAM) Expected Move: 9.20%

- Microchip Technology Incorporated (MCHP) Expected Move: 6.91%

- Block, Inc. (SQ) Expected Move: 9.97%

- Cloudflare, Inc. (NET) Expected Move: 9.72%

- Rocket Companies, Inc. (RKT) Expected Move: 5.64%

- American Homes 4 Rent (AMH) Expected Move: 5.61%

- Expedia Group, Inc. (EXPE) Expected Move: 7.17%

- DraftKings Inc. (DKNG) Expected Move: 9.17%

Full list here: Options AI Earnings Calendar

Unusual Activity:

EL (+1128%), SPLK (+1077%), UMC (+1009%), WE (+989%), Z (+786%), AMD (+715%), FSLR (+699%), VFC (+688%), CROX (+634%), ABNB (+629%), TXN (+625%), QCOM (+588%)

Full lists here: Options AI Free Tools.

Follow The Orbit on Twitter and Youtube

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC