Market View

Last Week – Some selling ahead of the Fed

SPY fell 3.4% last week, a much larger move than options were pricing. The majority of the move lower happened on Monday and Tuesday and the market went sideways to close out the week. With the combination of the move lower and with the market now looking ahead to this week’s FOMC decision, implied volatility rose across the board. The VIX rose from 19 to nearly 23 and SPY IV for this week nearly 30. More on that IV anomaly below.

This Week – Options are pricing movement this week

SPY options are pricing a nearly 3% move for the upcoming week. About twice what options were pricing last week. The Fed rate announcement is this Wednesday of course, and option vol is high for this week relative to after. How high? SPY options this week are 29 IV compared to 21 IV for options expiring Dec 30th. QQQ vol is 34 for this week and 27 for Dec 30th. In other words, options are pricing the majority of the move for the balance of 2022 to happen this week. The expected move in QQQ this week is 3.4%, which is the majority of its expected move of 4.4% into year end.

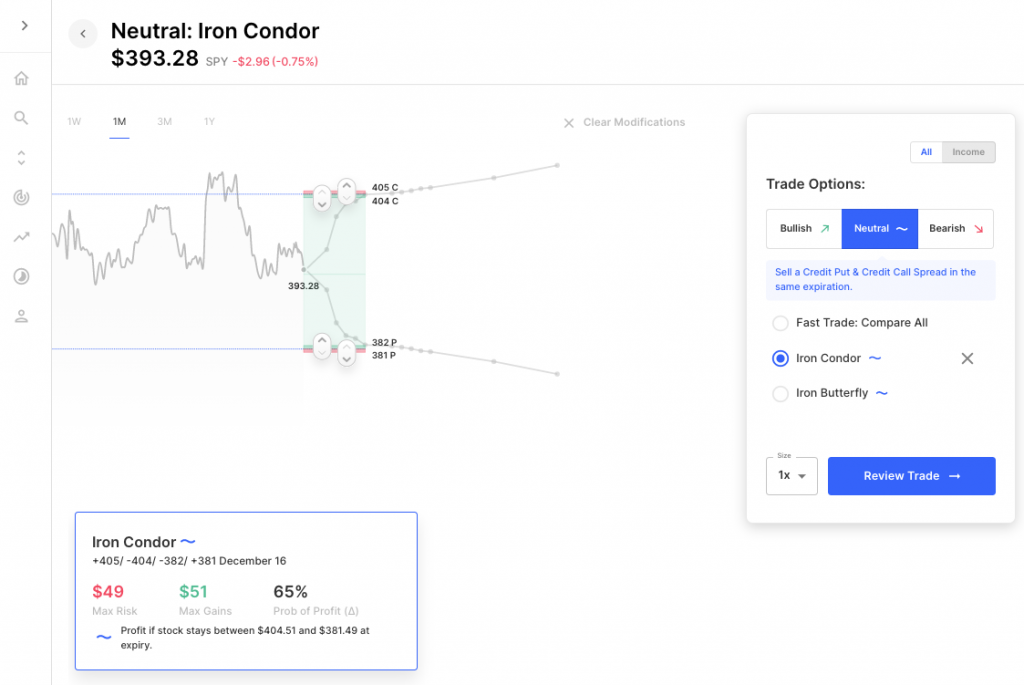

To illustrate the move for this week, an Iron Condor set at the expected move would be max gain if SPY closed the week between $382 and $405. That’s near where the latest rally stalled and well below recent lows of the past few weeks. Here’s how that looks on the chart:

Expected Moves for This Week (via Options AI free tools)

- SPY 2.8%

- QQQ 3.4%

- IWM 3.2%

- DIA 2.3%

Economic Calendar

- Tuesday – CPI

- Wednesday – Fed Rate Decision (expectations: 50 basis points), Powell Press Conference

- Thursday – Retail Sales

Earnings This Week

Expected moves for companies reporting this week. Recent moves indicate what the stock did in its past few reports (starting with the most recent). Also included is the 30-day (forward) IV vs the 1-year actual (realized, historical), which gives a sense of how options are pricing the moves relative to how the stock has traded over the past year.

Data is via the Options AI Earnings Calendar and other companies can be found at the link (many free-to-use tools).

Monday

- Oracle ORCL / Expected Move: 6.8% / Recent moves: -1%, +10%, +2% (30d IV vs 1yr: +34)

- Coupa COUP / Expected Move: 12.3% / Recent moves: +18%, +3%, -19% (30d IV vs 1yr: -7)

Wednesday

- Trip.com TCOM / Expected Move: 6.8% / Recent moves: +5%, +11%, +2%, -8% (30d IV vs 1yr: -15)

Thursday

- Adobe ADBE / Expected Move: 7.4% / Recent moves: -3%, -1%, -9%, -10% (30d IV vs 1yr: +8)

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.