The Broader Markets

Last Week – The SPY declined 3.1% last week, following a decline of 4.3% the week before. Once again the decline was more than the 2.2% move options were pricing.

This Week – SPY options are pricing a 2% move for the upcoming (4-day) week.

Implied Volatility / VIX – The VIX closed the week near 26, unchanged on the week. Volatility may have been higher if not for having to price in a 3-day weekend.

Expected Moves for This Week (via Options AI)

- SPY 2% (+/- $8)

- QQQ 2.6% (+/- $8)

- IWM 2.5% (+/- $4.50)

- DIA 1.7% (+/- $5.50)

In the News

Although somewhat expected, gas supplies to Europe were cut off this weekend by Russia. As US markets were closed for the long weekend, European stocks opened lower on Monday as well as a lower Euro, with energy prices trading higher. Equities finished higher than their opening reaction lows of the day.

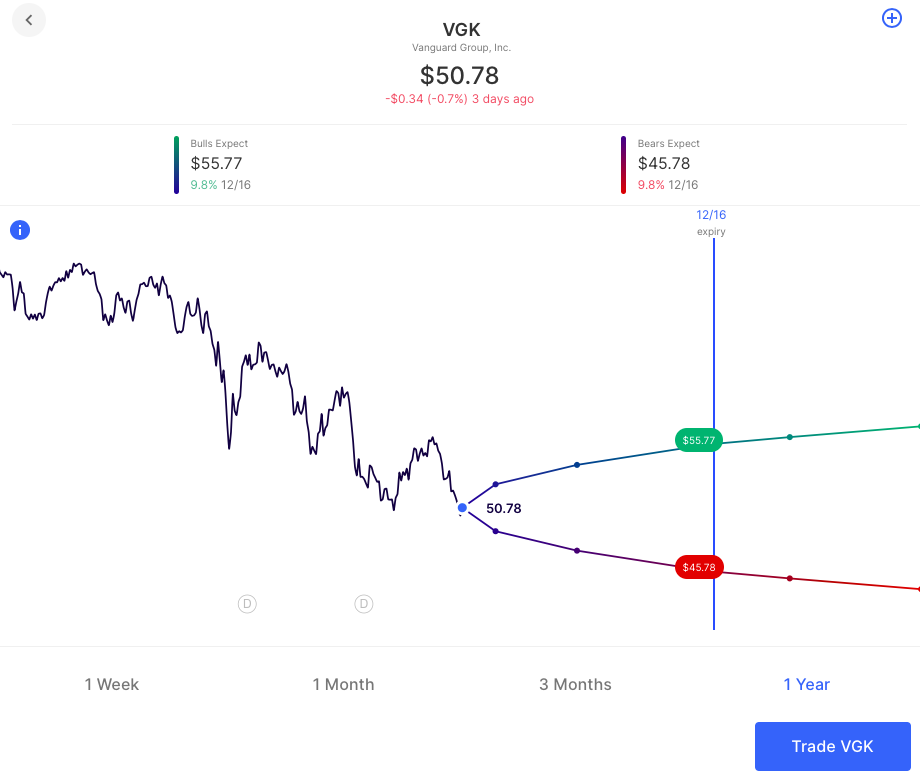

VGK (European stock ETF) options are pricing about a 10-11% move into year-end, slightly more of a move than SPY options are pricing (9%).

Education

6 Option Spread Strategies to Know

Earnings

Links below go to the Options AI Earnings Calendar where you can see the other companies each day and click through to see charts (free to use). Recent earnings moves (actual) start with the most recent:

- Coupa COUP / Expected Move: 11.3% / Recent moves: +3%, -20%, -3%

- NIO NIO / Expected Move: 8.5% / Recent moves: -8%, -10%, -3%

- Gamestop GME / Expected Move: 12.2% / Recent moves: +10%, +4%, -10%

- DocuSign DOCU / Expected Move: 16.5% / Recent moves: -25%, -20%, -42%

- Zscaler ZS / Expected Move: 11% / Recent moves: +13%, -16%, +4%

- Restoration Hardware RH / Expected Move: 8.5% / Recent moves: +1%, -13%, +5%

- FuelCel FCEL / Expected Move: 10% / Recent moves: -7%, +10%, -13%

Option trading without the legwork: get started with an Options AI platform subscription today!

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.