Market View

Last Week – A bad week that somehow got worse.

The week started off weak for stocks with rising treasury yields and fears of a more aggressive Fed, and got worse on Friday with a bank failure. SPY was lower by 4.5%, a move way beyond what options were pricing. Option vol spiked with the sell-off, with the VIX closing the week near 25, up from 18.50.

This Week – Eyes on banks, treasury yields, a CPI and the Fed reaction to turmoil.

SPY options are pricing about a 2.6% move for the week, much higher than last week’s 1.6%. IV now the highest it’s been in 2023. The last time the VIX was 25 was in December of 2022. To say this is a critical week for markets on the macro front would be an understatement. Options were already looking forward to an important CPI report for signs of the Fed’s next moves, but a banking failure last week, largely a result of aggressive Fed moves, throws some chaos into the FOMC guessing game.

Friday’s equity sell-off came alongside a sharp decline in short-term treasury yields, moves that would typically have been in opposite directions over the past 6 months. But the failure of Silicon Valley Bank on Friday saw a flight to safety in short-term treasuries, as well as a sudden sentiment shift that the Fed may need to pause sooner than later to avoid a bigger banking crisis. Now, after stepping in with a backstop, and smaller banks still selling off, things may have shifted again. The bond market reaction this week will be one to watch, especially after this week’s CPI. A cool print could give the Fed some breathing room to pause soon. A hot print and they find themselves between a rock and a hard place.

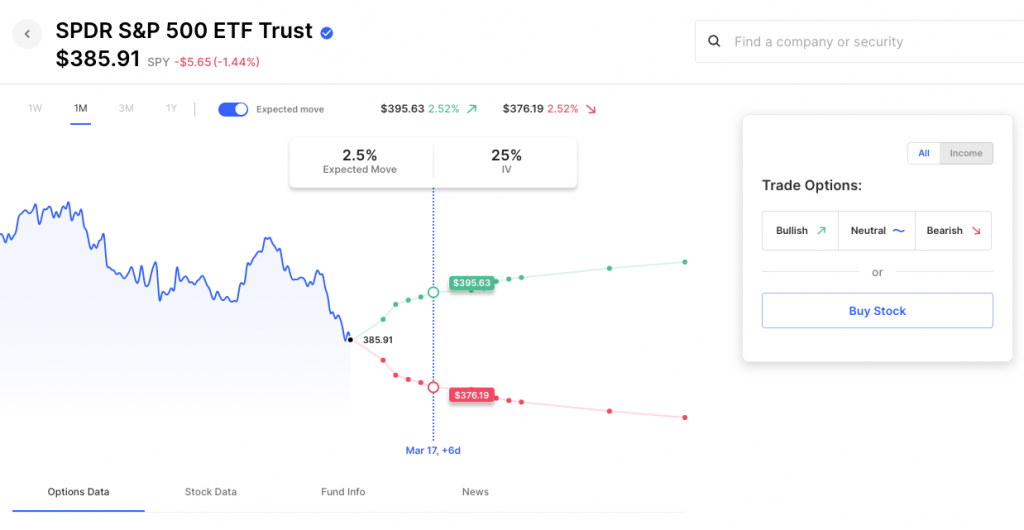

Here’s this week’s SPY levels for a 2.5% expected move, about $376 on the downside and $396 on the upside. $376 would match the lows going back to December 28th, 2022, and would mean new lows for 2023:

Expected Moves for This Week (via Options AI free tools)

- SPY 2.5%

- QQQ 2.8%

- IWM 3.2%

- DIA 2.1%

Economic Calendar

- Tuesday – CPI

- Wednesday – Retail Sales

- Thursday – Initial Jobless Claims, Housing Starts

- Friday – Consumer Sentiment

Weekly Expected Moves (in the News) (via Options AI free tools)

- XLF 3.9%

- KRE 7.7%

- TLT 2.2%

Earnings This Week

Via the Options AI Earnings Calendar. Expected move, weekly IV, and prior earnings moves (starting with most recent).

Wednesday

- Adobe ADBE / Expected Move: 5.9% / Recent moves: -3%, -17%, -3%, +3%

Thursday

- Dollar General DG / Expected Move: 4% / Recent moves: -8%, -1%, +14%, +5%

- FedEx FDX / Expected Move: 5.3% / Recent moves: -3%, +1%, -1%, +1%

Friday

- Xpeng XPEV / Expected Move: 11% / Recent moves: +47%, -6%, -6%, 0%

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.