The Broader Markets

Last Week – SPY finished last week 3.5% higher (or about $16). That was more than the 2.4% (or $11) options were pricing for the week. Implied volatility fell sharply with the move higher in the market.

This Week – SPY options are pricing a 1.3% move (about $6 in either direction) for the upcoming week. With the SPY $471 that is a range of about $465 to $477.

Implied Volatility – The VIX ended Friday around 18, down sharply from 30 the prior week. That means expected moves quickly went from historically high to more in line with historical averages in a few days.

Expected Moves for This Week (Via Options AI)

- SPY 1.3% (about $6)

- QQQ 1.8% (about $5)

- IWM 2.5% (about $5.50)

- DIA 1.4% (about $5)

As mentioned last week:

“If the market were to find footing implied volatility could quickly contract, although on some of the higher moves last week volatility stayed bid, as expectations for short-term swings remained high. The VIX is now in backwardation, meaning front month volatility is now slightly higher than outer months. But even outer months are historically high.”

Volatility did quickly contract. The SPY ended the week up $16 but most bullish long premium strategies needed that large move higher with options already pricing an $11 move.

VIX futures are now back to a fairly steep contango after a brief spell of backwardation. December VIX futures dropped from 28.50 to 20, while Jan and Feb dropped from around 28 to about 23. May dropped from 27.50 to 25.50. Volatility assumptions for the next week few weeks are now lower than assumptions for January and beyond.

In the News

Crypto

Bitcoin enters the new week in about the same spot as last week, just below 50k. Options were pricing about an 8% move last week, it stayed in about a 5% range. Options are pricing about a 6.5% move this week (options expiring Friday the 17th), slightly less than last week. ETH options are implying about an 8% expected move this week.

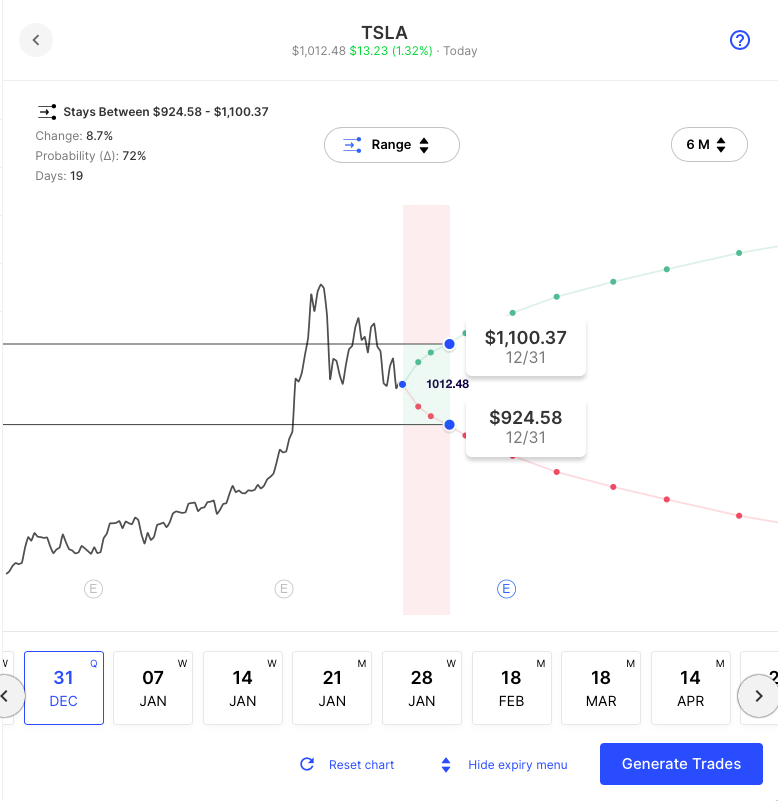

Tesla

Tesla closed last week near the low end of its recent range. Options are implying about a 9% move into year end which corresponds to about $1100 on the upside and about $925 on the downside. Via Options AI:

Expected Moves for Companies Reporting Earnings

The expected moves link to the Options AI Calendar. Recent moves on prior earnings start with the prior quarter. Earnings announcements are light this week as we’re at the tail end of the earnings season.

Thursday

Adobe ADBE / Expected Move: 5.3% / Recent moves: -3%, +3%, -2%

FedEx FDX/ Expected Move: 4.9% / Recent moves: -9%, -4%, +6%

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC a registered broker-dealer.