Hello

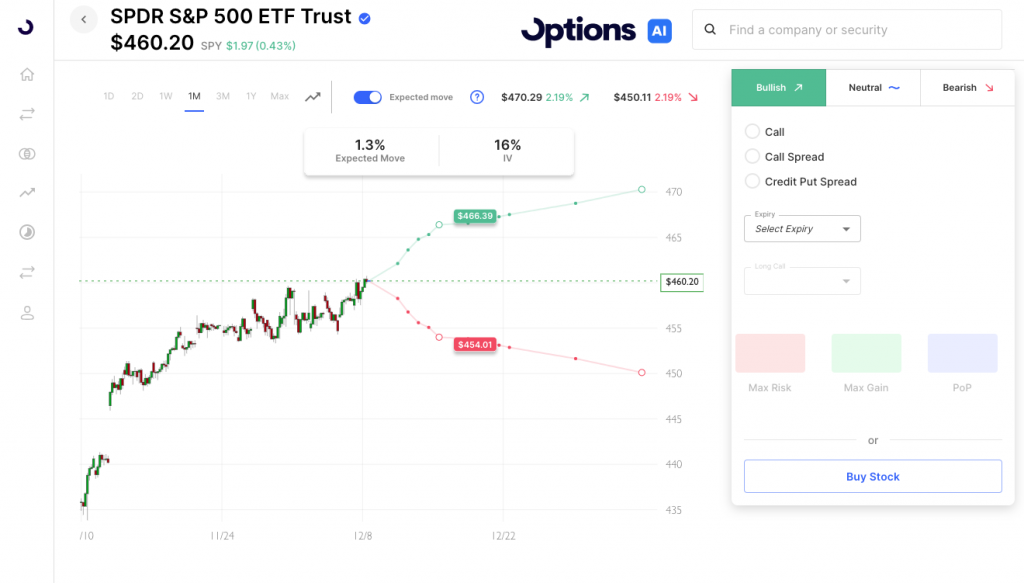

SPY/SPX was up slightly on the week, inside the expected move. The VIX at 12.30 sits at a multi-year (and pre-Covid) low. However, this week’s vol and expectations for movement are a bit more than recent weeks as we see both a CPI report on Tuesday and an FOMC decision, and more importantly a Powell press conference on Wednesday. After the midweek data and fed speak we go into holiday/year-end mode where we see if stocks can finish the year on the highs or we see some profit-taking. Expectations for moves into year-end are narrow with SPX vol in the low teens. The expected move into year-end for the SPX is just 2%. Those looking to avoid selling stocks will find inexpensive hedges in the options market. Those looking to position bullishly into the new year will find the same to the upside. Jan vol in SPY is just 12 at the money, 13 in Feb and 14 in March. The highest IV in the near future is for this week.

Earnings highlights this week include Oracle on Monday, Adobe on Wednesday and Costco on Thursday.

Expected Moves Week / 0DTE

- SPY/SPX: 1.3% / 0.5%

- QQQ: 1.8% / 0.6%

- IWM: 2.3% / 0.9%

Economic Calendar

- Tuesday – CPI

- Wednesday – PPI, FOMC Rate Decision, Powell Press Conference

- Thursday – ECB Rate Decision, US Retail Sales,

Earnings Expected Moves

Monday

- ORCL Oracle Corporation 5.3%

- CASY Casey’s General Stores, Inc. 4.4%

Wednesday

- ADBE Adobe Inc. 5.3%

Thursday

- COST Costco Wholesale Corporation 2.6%

- LEN Lennar Corporation 5.6%

- JBL Jabil Inc.

Friday

- DRI Darden Restaurants, Inc. 3.6%

Follow The Orbit on Twitter and Youtube

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC