Hello!

A very impressive rally in the market last week of nearly 6%. The SPX is now just 5% away from its July highs. With that move higher (and with the FOMC, Jobs number, and many of the mega-cap companies having now reported earnings) implied vol got smoked. The VIX fell from 22 to 15 in the past week, with options now pricing moves below historical averages into year-end. Options were pricing a nearly 7% move into year-end as of last week. Following the 6% rally in a week options have compressed to now pricing just a 4% move into Dec 29. Whether that was too far too fast for a falling VIX remains to be seen. As is often the case with a quick bounce in the market vol collapses so fast options really underprice the moves higher. That is until (if) the collapsing vol creates so much long gamma in the market it even slows moves higher into a slow grind.

This week will be one to watch for any change in that IV/Gamma backdrop. 0DTE moves in SPX are now just north of a half a percent a day for the upcoming week. That is down from the more than 1% daily moves options were pricing just a week ago. That’s something to be cognizant of, especially those employing income from option strategies. Does the lower vol become self-fulfilling and do we start to see small moves day to day? Or did vol fall too far too fast, pricing in a year end slow grind through the Holidays a few weeks too early? We’ll see.

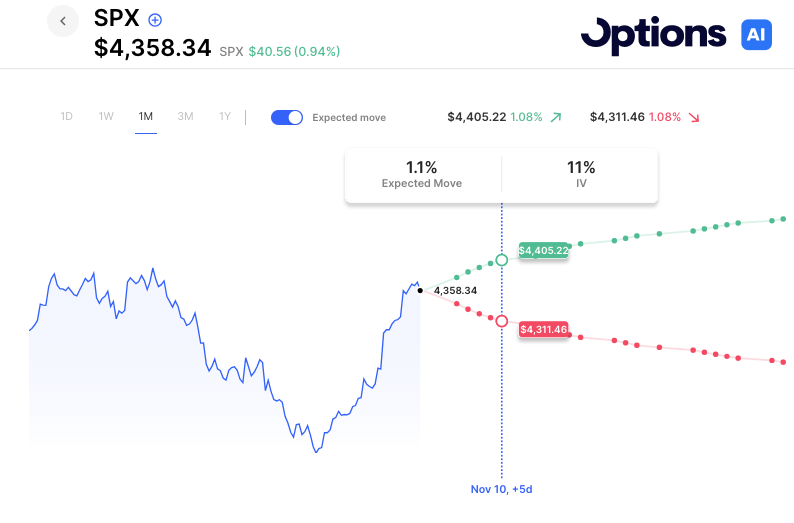

SPX

Expected move this week: 1.2%

At the money IV: 11

0DTE expected moves: 0.6%

Year end expected move: 3.7%

Levels (roughly) 4200-4520

Economic Calendar

Wednesday – Powell Speech

Thursday – Initial Jobless Claims

Friday – UoM Consumer Sentiment

Earnings Expected Moves

Monday

VRTX Vertex Pharmaceuticals Incorporated 3.0%

FANG Diamondback Energy, Inc. 2.9%

BNTX BioNTech SE 6.7%

BAM Brookfield Asset Management Inc. 6.5%

Tuesday

GILD Gilead Sciences, Inc. 3.1%

UBER Uber Technologies, Inc. 6.5%

DVN Devon Energy Corporation 4.9%

CPNG Coupang, Inc. 6.9%

DDOG Datadog, Inc. 9.4%

RIVN Rivian Automotive, Inc. 10.3%

Wednesday

DIS The Walt Disney Company 5.4%

BIIB Biogen Inc .3.5%

WBD Warner Bros. Discovery, Inc .7.8%

TTWO Take-Two Interactive Software, Inc. 6.0%

HUBS HubSpot, Inc. 8.8%

CELH Celsius Holdings, Inc. 11.7%

MGM MGM Resorts International 5.4%

TWLO Twilio Inc. 10.2%

RL Ralph Lauren Corporation 6.8%

CART Instacart 8.2%

AFRM Affirm Holdings, Inc. 13.7%

DUOL Duolingo, Inc. 10.0%

COHR Coherent, Inc. 10.0%

LYFT Lyft, Inc. 12.4%

UA Under Armour, Inc. 12.1%

AMC AMC Entertainment Holdings, Inc. 12.8%

MARA Marathon Digital Holdings, Inc. 10.0%

Thursday

U Unity Software Inc.11.6%

TTD The Trade Desk 10.5%

AZN AstraZeneca PLC 3.1%

GRAB Grab Holdings Limited 7.5%

WYNN Wynn Resorts, Limited 4.5%

YETI YETI Holdings, Inc. 8.8%

Friday

PSNY Polestar Automotive Holding UK PLC 14.3%

Full lists here: Options AI Free Tools.

Follow The Orbit on Twitter and Youtube

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC