Hello!

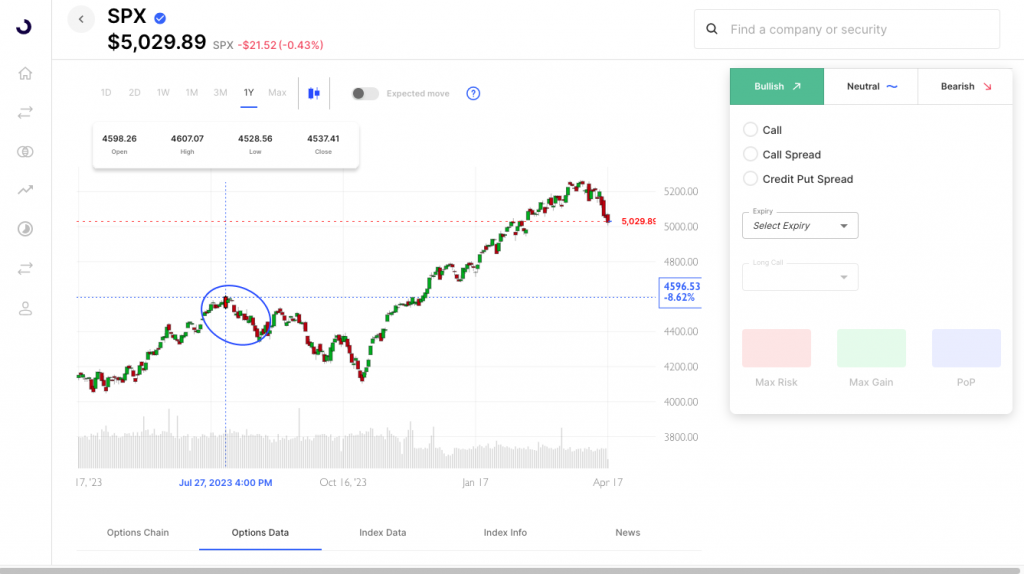

On today’s Orbit we’re going to take a step back and look a bit at the market as a whole. With SPX near 5000 today that marks about a -5% decline from the recent highs. As an analogy for this current situation of rising yields, equity weakness, and rising implied vol in options, let’s go back to last Summer… starting with the $SPX, which entered August and proceeded to decline 5%:

Proceeding that SPX decline, TLT was about 100, the VIX was about 13. On the decline VIX spiked to about 18:

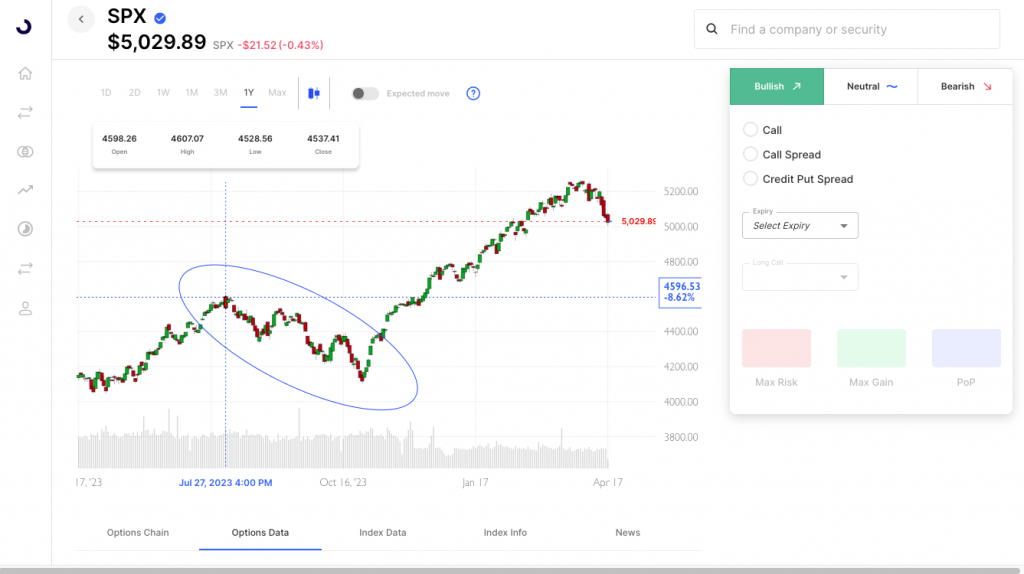

Yields paused their spike for a brief period, TLT rallied slightly, and the SPX rallied, covering about a 50% retracement of the recent sell-off. The VIX actually compressed back to 13 or so. Had yields reached their high that may have been the end of it, but the picked up steam again, with TLT doing a nasty decline from there:

With that second wave, SPX declined another 5-6%, and with it the VIX popped even higher, from 13 to about 21. Stocks found buyers once again down about 6% with VIX 21, and tried once again to retrace about 50% of the most recent decline, not quite getting there.

$TLT bottomed shortly after, but $SPX had one more low in it, with another 5% decline. With that the VIX had one higher high, topping out around 23.

The total SPX decline was only about 11% or so, but consisted of three (roughly) 5% declines interrupted by 50% retracement rally attempts. SPX didn’t truly bottom until after TLT did.

The VIX round tripped 13 to 18 to 13 to 21 to 16 to 23 before topping out and heading back to lows. In that history, VIX spikes above 20 represented signals of a near term bottom, but in this case each was temporary, and stocks repeated their decline a total of 3 times to put in a 10% correction. But those spikes also represented option premium selling opportunities, and the lows perhaps another chance at inexpensive hedges.

In a nutshell, the VIX can be a signal of a near term bottom during a sell-off. But until the underlying conditions that are causing the selling change, those bottoms, while tradeable, may not be the final low. Traders positioning directionally or on momentum can keep an eye on VIX, and potentially enter at those moments with credit put spreads or even at times debit call spreads. But they should also have an eye on some of the other factors at the moment, like USO, TLT (and even shorter duration yields), as we’ve been talking about on The Orbit lately.

As a sidenote, USO has declined over the past week, and TLT is up the past two days, while stocks are still red and near a 5% decline. The VIX is at 18 as of this post, and got as high as 19.

We’ll follow up over the next few days on the Orbit with an eye on all these factors and its effect on option premiums, and market moves from this important 5000 SPX level, and a VIX near 20.

Follow The Orbit on Twitter and Youtube

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC