Good morning!

- MSFT and GOOGL report after the close

- SPOT is lower by about 6% on its report. Options priced about 8%

Happy mega-cap AI day to all those that celebrate as both Microsoft and Alphabet report after the close. Currently, options are pricing about a 5% move for both stocks.

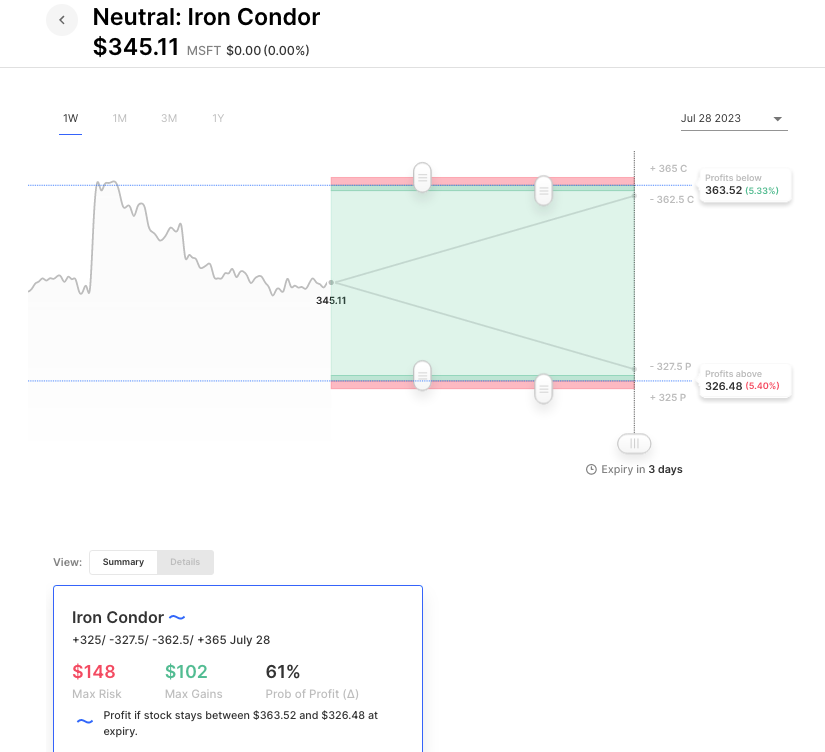

MSFT stock has given up all the gains from its mid-July gap higher. The 5% expected move lines up near those highs to the upside and to the monthly lows on the downside. An Iron Condor based on those levels would profit as long as MSFT was between 326.50 and 363.50 on Friday, lining up pretty close to those support and resistance levels. If the stock busts out of that range the risk is about 1.50 to 1 on this 2.5 wide example.

Pre-Market Movers:

- Electra Battery Materials Corp (ELBM) +64.23%

- Bullfrog Ai Holdings Inc (BFRG) +49.42%

- Nio Inc ADR (NIO) +4.43%

- AMC Entertainment Holdings (AMC) -7.87%

- General Motors Company (GM) -0.25%

- Verizon Communications Inc (VZ) +2.38%

- Stoke Therapeutics Inc (STOK) -21.83%

- Spotify Technology S.A. (SPOT) -5.77%

- General Electric Company (GE) +3.67%

- Microsoft Corp (MSFT) +0.97%

- Alphabet Cl A (GOOGL) +0.49%

Today’s Earnings Highlights:

- Microsoft Corporation (MSFT) Expected Move: 4.80%

- Alphabet Inc. (GOOGL) Expected Move: 4.93%

- Visa Inc. (V) Expected Move: 2.69%

- Texas Instruments Incorporated (TXN) Expected Move: 3.74%

- Verizon Communications Inc. (VZ) Expected Move: 4.25%

- Raytheon Technologies Corporation (RTX) Expected Move: 4.96%

- General Electric Company (GE) Expected Move: 4.20%

- 3M Company (MMM) Expected Move: 3.91%

- Spotify Technology S.A. (SPOT) Expected Move: 9.20%

- Snap Inc. (SNAP) Expected Move: 19.61%

Full list here: Options AI Earnings Calendar

Economic Calendar:

- At 09:00 AM (EST) S&P/Case-Shiller Home Price YoY (May) Estimates: -2.2, Prior: -1.7

- At 09:00 AM (EST) S&P/Case-Shiller Home Price MoM (May) Estimates: 1.2, Prior: 1.7

- At 10:00 AM (EST) CB Consumer Confidence (Jul) Estimates: 111.8, Prior: 109.7

Scanner Highlights:

- Overbought (RSI): JPM (79), AMC (78), COST (77), BAC (76), MS (76), PRU (76)

- Oversold (RSI): DIS (41), FL (41), AXP (42)

- High IV: AMC (+249%), NKLA (+215%), TMC (+175%), SNAP (+155%), SAVE (+153%)

- Unusual Options Volume: AMC (+929%), SPOT (+837%), GM (+636%), LOW (+615%), GPS (+547%), GME (+538%), GE (+497%)

Full lists here: Options AI Free Tools.

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.