Hello!

The CPI came in cooler than expected and futures are sharply higher to start the day. This number completes the picture traders and investors were hoping and betting on over the past several week’s rally in the market. The story went: A Fed done raising rates, a job market that isn’t hot, but isn’t crashing, inflation continuing to cool, and treasury yields having already topped out. That story appears to be complete for now.

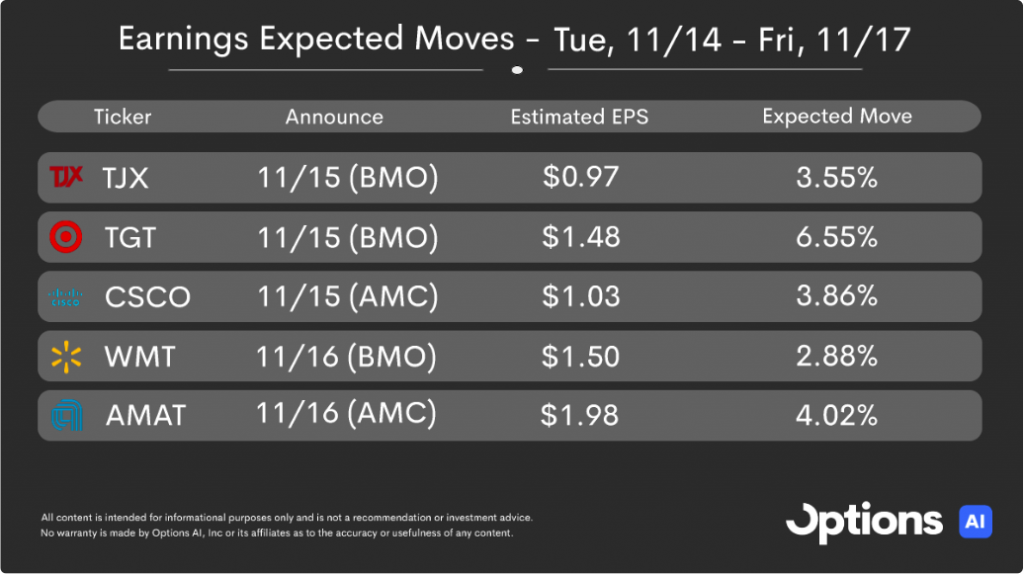

Whether that is a buy the rumor, sell the news situation now, or it’s a situation where so many investors got left on the sidelines of this rally and have to play catch up now, is the next story in the market, and will play out into year-end. What is already true is implied vol in the market is low and expectations for large moves after today are quite low. For traders that means being very aware of how tight expected move strikes are, especially to the upside, and for directional traders to be prepared to not see massive moves in stocks without a catalyst.

Movers/Trending

Invo Bioscience Inc (INVO) +34.78%

Tesla Inc (TSLA) +1.67%

Sea Ltd ADR (SE) -11.69%

On Holding Ag Cl A (ONON) -7.27%

Fisker Inc (FSR) -19.22%

Snap Inc (SNAP) +5.58%

Nvidia Corp (NVDA) +0.58%

Rivian Automotive Inc Cl A (RIVN) +0.86%

Draftkings Inc (DKNG) -1.07%

Economic Calendar:

At 12:45 PM (EST) Fed Goolsbee Speech Impact: Medium

Unusual Volume (% increase from avg.):

ENB (+1057%), BAX (+975%), TAN (+967%), FSR (+956%), SE (+783%), TSN (+701%), BLNK (+613%), HD (+598%), WKHS (+578%), BA (+556%), LLY (+541%), ONON (+491%), TTD (+486%), U (+454%), PLUG (+422%), PFE (+419%), CRWD (+406%), UPS (+384%), TGT (+352%), NVDA (+349%), PANW (+329%), SNOW (+317%), AI (+316%), BUD (+296%), EBAY (+283%), AMD (+266%), MARA (+263%), MRNA (+253%), KSS (+250%)

Follow The Orbit on Twitter and Youtube

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC