Good morning!

Reflecting the IV “pop” for yesterday’s $SPY options, the #0DTE expected move was 0.7% vs 14 IV. Still low, but higher than we’ve been seeing. Post FOMC that closed 10 IV for an expected move today of just 0.4% today. Futures are already higher by double that. Traders got caught sleeping on FOMC+1 combined with GDP & earnings.

Pre-Market Movers:

- Mallinckrodt Plc (MNK) +80.95%

- Carnival Corp (CCL) +5.33%

- Meta Platforms Inc (META) +9.93%

- Xpeng Inc ADR (XPEV) +8.48%

- Southwest Airlines Company (LUV) -5.41%

- Bristol-Myers Squibb Company (BMY) -2.76%

- Silicon Motion Techn ADR (SIMO) -11.23%

- Royal Caribbean Cruises Ltd (RCL) +8.18%

- Jetblue Airways Cp (JBLU) -1.28%

- Biohaven Ltd (BHVN) -24.37%

Today’s Earnings Highlights:

- Mastercard Incorporated (MA) Expected Move: 2.34%

- AbbVie Inc. (ABBV) Expected Move: 3.39%

- McDonald’s Corporation (MCD) Expected Move: 2.38%

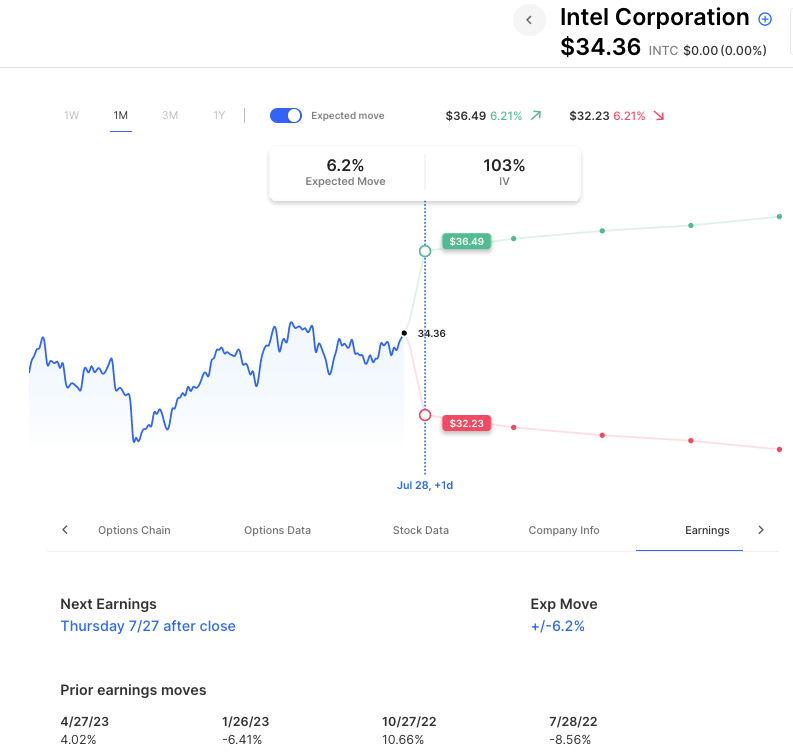

- Intel Corporation (INTC) Expected Move: 6.30%

- Royal Caribbean Cruises Ltd. (RCL) Expected Move: 9.07%

- Enphase Energy, Inc. (ENPH) Expected Move: 9.62%

- Southwest Airlines Co. (LUV) Expected Move: 6.72%

- Roku, Inc. (ROKU) Expected Move: 9.86%

Full list here: Options AI Earnings Calendar

Economic Calendar:

- At 08:30 AM (EST) GDP Growth Rate QoQ Adv (Q2) Estimates: 1.8, Prior: 2

- At 08:30 AM (EST) GDP Price Index QoQ Adv (Q2) Estimates: 3, Prior: 4.1

- At 08:30 AM (EST) Durable Goods Orders MoM (Jun) Estimates: 1, Prior: 1.7

- At 08:30 AM (EST) Durable Goods Orders Ex Transp MoM (Jun) Estimates: 0, Prior: 0.6

- At 08:30 AM (EST) Continuing Jobless Claims (Jul/15) Estimates: 1750, Prior: 1754

- At 08:30 AM (EST) Initial Jobless Claims (Jul/22) Estimates: 235, Prior: 228

- At 08:30 AM (EST) Personal Spending MoM (Jun) Estimates: 0.4, Prior: 0.1

- At 08:30 AM (EST) Personal Income (MoM) (Jun) Estimates: 0.5, Prior: 0.4

Options AI Scanner Highlights:

- Overbought (RSI): UNP (86), COST (78), JPM (75), JNJ (75), DIA (75), ABNB (75)

- Oversold (RSI): SPXU (29), SPXS (29), SNAP (35), SQQQ (39), SPOT (40), MRK (43)

- High IV: PLTR (+122%), KSS (+117%), PENN (+116%), LUV (+116%), TMUS (+116%), JNJ (+114%), EBAY (+114%), JBLU (+113%)

- Unusual Options Volume: TDOC (+1339%), BA (+1010%), EBAY (+935%), MSFT (+676%), SNAP (+621%), PACW (+560%), JNJ (+487%), SNOW (+450%), SPOT (+428%), CROX (+425%)

Full lists here: Options AI Free Tools.

Chart of the Day

INTC options are pricing about a 6.2% move for earnings. That’s a smaller move than 3 out of the 4 last earnings, that saw +4%, -6%, +11% -9%.

Full lists here: Options AI Free Tools.

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.