Hello!

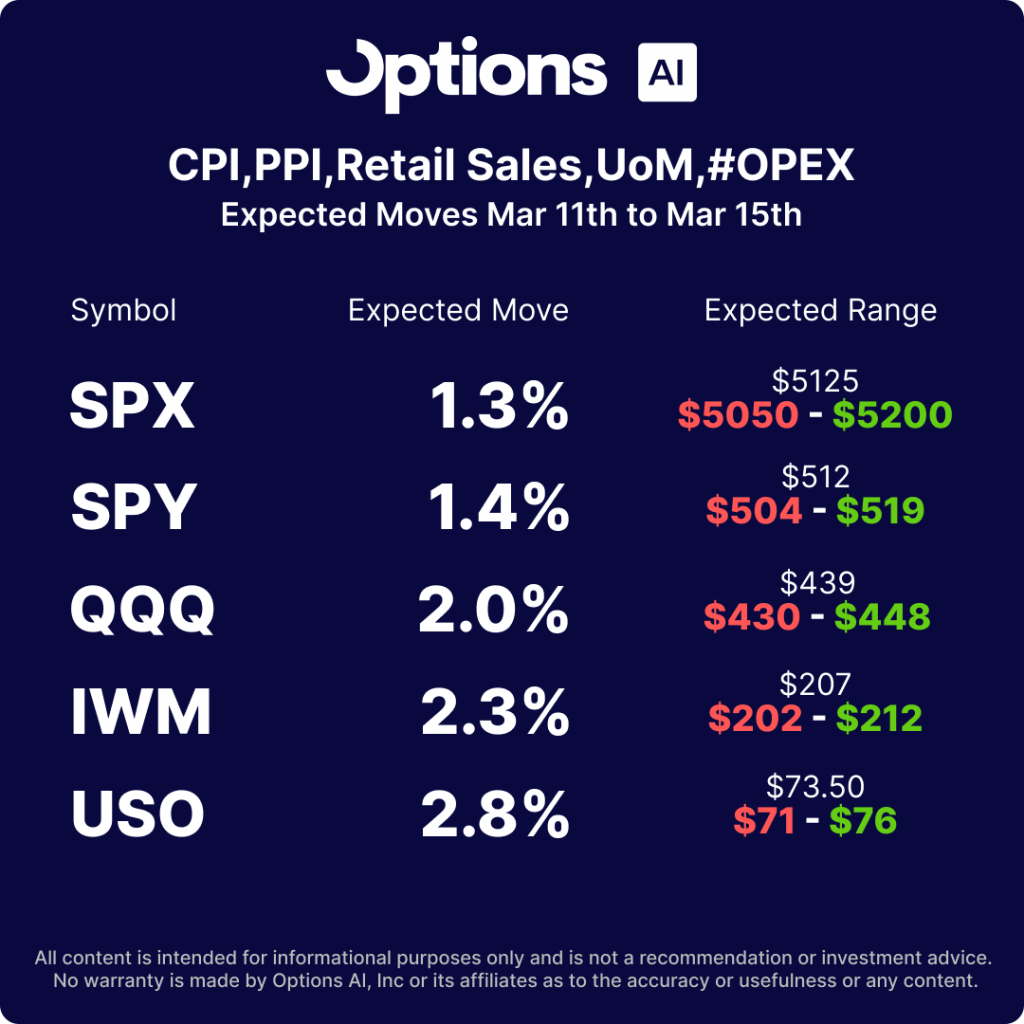

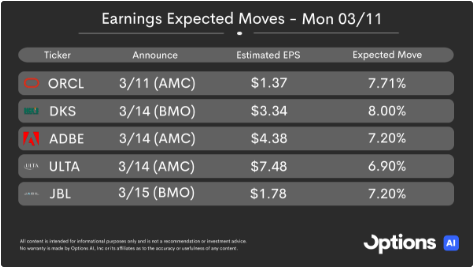

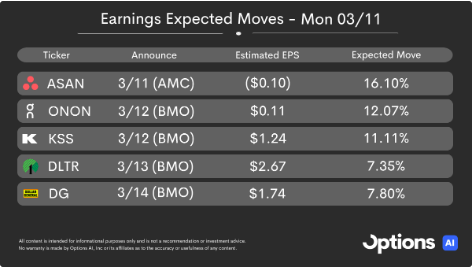

Today’s Orbit is a deep dive into the pop in IV, some of these nasty intra-day swings we’ve been seeing and what to be careful of as a short duration premium seller. Especially with #CPI #PPI and option expiry on the docket. Also, we look at how despite the $VIX pop, vol is actually quite low in a lot of these post earnings symbols. Therefore, if you were looking to position directionally, or hedge, you haven’t really missed out on low IV in most names.

We also look at expiration, which we’ll cover a little more as the week progresses. But, tldr version, volatile reactions to the economic numbers this week have a chance of really turning gamma negative into expiry further exacerbating these moves into Friday. ( a muted response would turn recent option buyers quickly into sellers into Friday doing the opposite to the gamma backdrop). We’ll see what happens and talk about it!

Mentioned $SPX $SPY $QQQ $AAPL $NVDA $SMCI $AVGO $MSFT $ORCL $ADBE $DKS and more. Hope you enjoy!

Reminder: Free Webinars with Brandon Wendell

I’m pleased to announce that a friend of The Orbit, Brandon Wendell, is hosting free webinars this week, where he’ll detail his 0DTE SPX trading using the Options AI platform. Below are the sign-up links, and a little more about Brandon and WealthBuilders HQ:

Dates and Times:

March 11th @ 12pm EST

Meet Brandon Wendell

Wealth Builders HQ coach Brandon Wendell will be teaching a free one-hour class on trading the SPX. He will reveal an amazing “Zero Days to Expiration” Strategy that you’ve likely never seen before.

Brandon has an extensive track record as a trader and a coach. He has been trading the market for more than 25 years. He has experience operating a trading room, as well as running a corporate hedge fund. He also holds a Certified Market Technician’s certificate – one of about 4,000 in the world.

Registration URL: https://2hourtrade.wealthbuildershq.com/sign-up

Follow The Orbit on Twitter and Youtube

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC