Good Morning!

Futures are lower for the second straight day to start off August. Two bits of news o the economic front, the first is a Fitch downgrade of US long-term debt, the second is the ADP jobs number which beat analyst expectations but was down from the prior month. The 1 and 2-year treasury yields are down slightly this morning, the 10-year is up slightly.

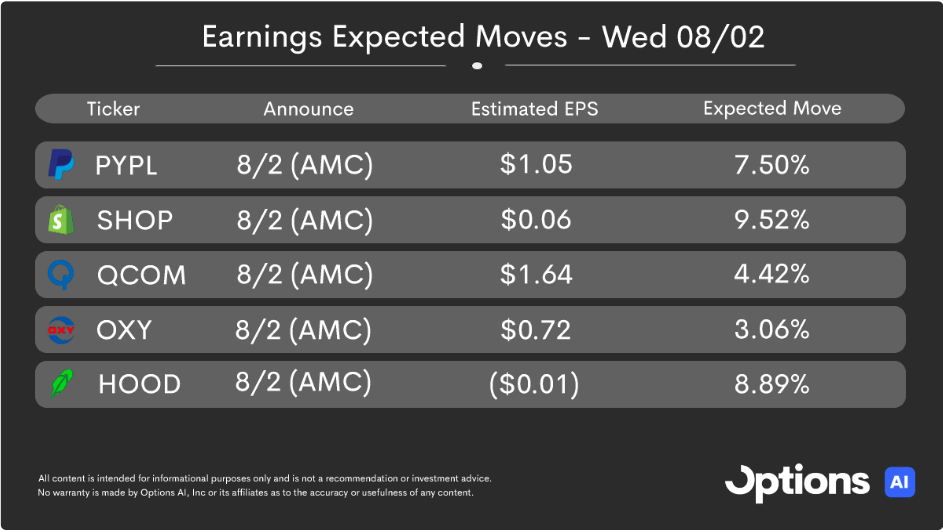

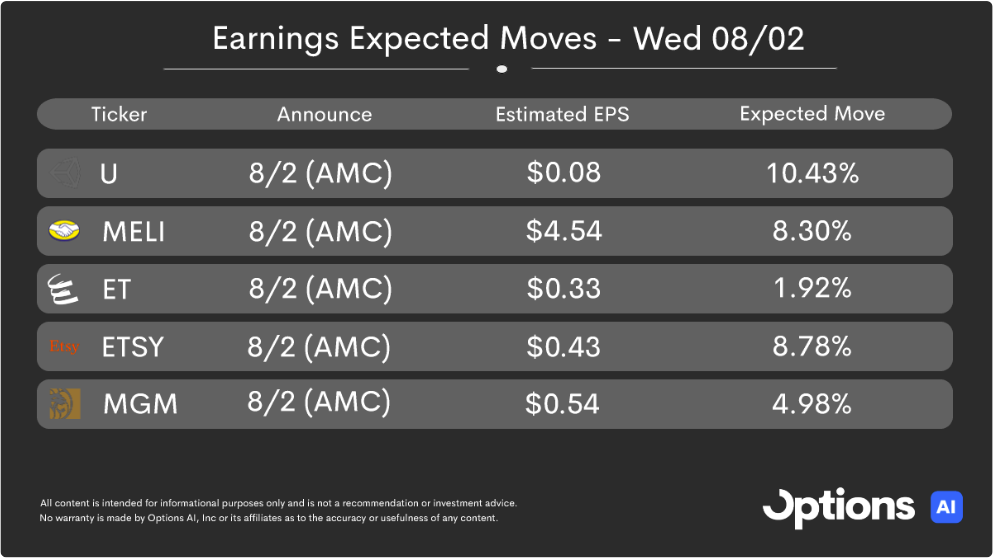

The market will still be mostly focused on earnings this week until the NFP jobs number on Friday morning. Tomorrow is the mega-cap heavy day with Amazon and Apple reporting, but today has some names of interest after the close. Below are the estimates with expected moves. To see the full list, updated expected moves and compare to prior realized moves be sure to check in on the Options AI calendar.

Pre-Market Movers:

Tupperware Corp (TUP) -13%

Advanced Health Intelligence Ltd ADR (AHI) +34%

Adamis Pharmaceuticl (ADMP) -39%

Vertiv Holdings Llc. (VRT) +25%

Options AI Scanner Highlights:

Overbought (RSI): CAT (82), JWN (77), ROKU (76), CMCSA (75), PLTR (73)

Oversold (RSI): MRNA (34), JBLU (34), AAL (38), CHWY (38)

High IV: LUMN (+188%), SAVE (+158%), HOOD (+115%), ETSY (+114%)

Unusual Options Volume: CAT (+1181%), PINS (+1053%), SBUX (+761%), UBER (+711%), AMD (+684%), MTCH (+546%), AVGO (+524%)

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.