Market View

Last Week – SPY rose 4.7% last week, outpacing to the upside the 2.7% move options were pricing. With that move higher implied volatility of options compressed slightly with the VIX now under 30. This week sees some of the largest cap tech stocks report. Microsoft, Apple, Amazon, Alphabet and Meta lead a busy week of earnings, with those 5 companies alone representing about 25% of the S&P 500. The dollar strength factors that have affected some reports already will recieve attention in Amazon’s report.

On the economic calendar, we’ll see GDP, Housing Prices and Consumer Confidence.

This Week – SPY options are pricing about a 2.5% move for the upcoming week. That implies a move of just under $10 in either direction. The VIX closed last week at 29.7, its lowest levels since the first week of October, but still historically high.

Expected Moves for This Week (via Options AI)

- SPY 2.5% (+/- $10)

- QQQ 3.3% (+/- $9)

- IWM 3% (+/- $5)

- DIA 2.2% (+/- $7)

Economic Calendar

- Tuesday – Case Shiller Home Prices, Consumer Confidence

- Thursday – US GDP

Selling the Move vs Selling IV

With implied volatility high the past few weeks we’ve detailed some trade strategies that try to take advantage of, or at least mitigate the inflated cost of options in this environment. With some of the largest market cap companies in the stock market reporting this week, it’s a good time to detail the difference between what high IV does to the expected move, and how much a stock needs to move in order for long premium trades to work, or for short premium trades to fail, versus selling high IV as a strategy in and of itself.

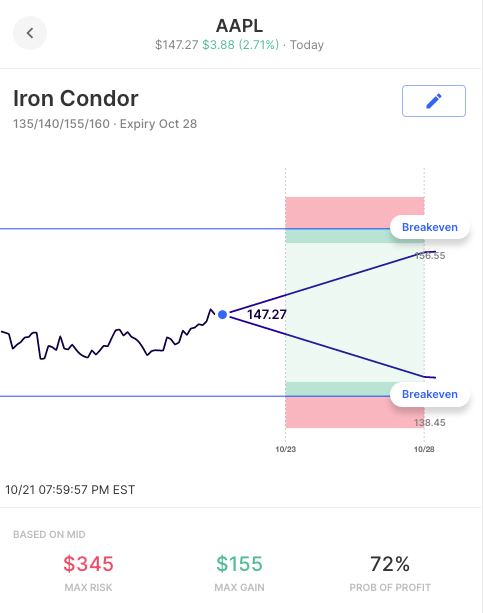

Using Apple (AAPL), which reports this week as an example, we’ll look at the difference between selling the earnings moves, and selling high IV, by comparing two Iron Condors at different expiries. The first condor, is set at the expected move for this week, with short strikes at 140, and 155, vs AAPL’s Friday close near $147. The second Condor, expires Dec 18th, and the expected move short strikes set at 135, and 160.

The Condor expiring this week is a pure expected move strategy. If AAPL stays within the breakevens of 138.50, and 158.50, the trade makes money. Outside of that range, the strategy loses money. The level of IV is less important than the pure move AAPL makes this week on earnings. The trade is fairly binary.

However, with the Dec 18th condor being $10 wider, it’s less about the move and more about selling high IV in AAPL into earnings (as well as high IV overall in the market). The likelihood of AAPL moving beyond this trade’s breakeven of 132.50 and 162.50 on earnings is not as likely, and therefore the trade is less binary about the move itself, and is more a strategy to sell high IV into earnings, with the idea that the trade could be closed for less in the weeks after, with IV lower.

Earnings This Week

Expected moves for companies reporting this week. Recent moves indicate what the stock did in its past few reports (starting with the most recent). Data is via the Options AI Earnings Calendar and other companies can be found at the link (free to use).

Tuesday

- Alphabet GOOGL / Expected Move: 5.7% / Recent moves: +8%, -4%, +8%, +5%

- Microsoft MSFT / Expected Move: 4.7% / Recent moves: +7%, +5%, 3%, +4%

- United Parcel UPS / Expected Move: 6.8% / Recent moves: -3%, -3% +14%, +7%

- General Motors GM / Expected Move: 5.7% / Recent moves: +4%, +2%, -1%, -5%

Wednesday

- Boeing BA / Expected Move: 5.1% / Recent moves: 0%, -8%, -5%, -2%

- Meta META / Expected Move: 10.9% / Recent moves: -5%, +18%, -26%, -4%

- Ford F / Expected Move: 6.4% / Recent moves: +6%, -2%, -10%, +9%

- ServiceNow NOW / Expected Move: 6.9% / Recent moves: -3%, +8%, +9%, +3%

Thursday

- Apple AAPL / Expected Move: 4.5% / Recent moves: +3%, -4%, +7%, -2%

- Amazon AMZN / Expected Move: 4.5% / Recent moves: +10%, -14%, +14%, -2%

- Shopify SHOP / Expected Move: 4.5% / Recent moves: +12%, -15%, -16%, +7%

- Intel INTC / Expected Move: 7.5% / Recent moves: -9%, -7%, -7%

Friday

- Exxon Mobile XOM / Expected Move: 3.8% / Recent moves: +5%, -2%, +6%, 0%

- Chevron CVX / Expected Move: 3.9% / Recent moves: +9%, -3%, -4%, +1%

Our options trading videos teach you everything you need to learn options trading, covering buying and selling options, spreads and more.

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.