Hello!

Well-received earnings from Amazon and Intel are helping. to lead stocks markets higher this morning. The QQQs are higher by about 0.8%. Whether this bounce in the market holds is anyone’s guess, but as mentioned here on the Orbit going back to September, many traders were eyeing the $412 level in SPY during this selloff. We spoke about potential short positioning/hedges based on the expected move and when options were pricing the potential for that level to the downside. So now that that level has been reached, let’s look at the current expectations of options into year end:

SPY options are pricing about a 5-6% move into end of year. That means those looking for that year-end rally would be looking to catch a ride up to about the $435 level. And, if this level wasn’t to hold and the market got ugly into year-end, options are currently pricing about the $390 level. We’ll circle back with some year-end trade set-ups over the next few days.

Early Moves:

- Amazon.com Inc (AMZN) +5.11%

- Sanofi-Aventis S.A. ADR (SNY) -15.90%

- Intel Corp (INTC) +7.04%

- Ford Motor Company (F) -4.14%

- Enphase Energy Inc (ENPH) -15.92%

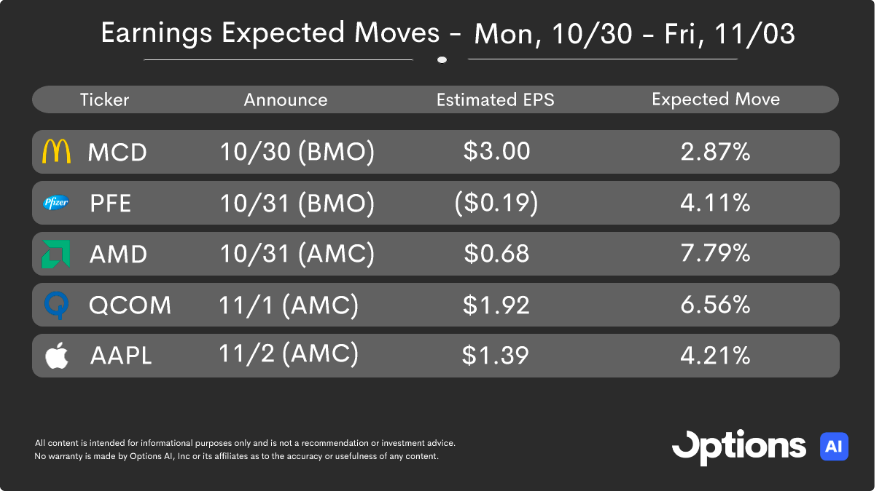

- Apple Inc (AAPL) -0.23%

- Rivian Automotive Inc Cl A (RIVN) +2.41%

- Adv Micro Devices (AMD) +2.43%

Economic Calendar:

At 10:00 AM (EST) Michigan Consumer Sentiment (Oct) Estimates: 63%, Prior: 68.1%

Unusual Activity:ET (+1195%), META (+813%), DKNG (+657%), AMZN (+570%), INTC (+509%), GOOGL (+408%), MSTR (+402%), AVGO (+370%), AAPL (+361%), EBAY (+318%), MU (+306%), MRK (+281%), PANW (+275%), ADBE (+274%), AMD (+273%)

Follow The Orbit on Twitter and Youtube

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC