Hello!

Futures are pointing to a lower open. That has not been the trend during the past two weeks which has seen mostly green opens. As mentioned in The Orbit yesterday, with IV at these low levels the market’s default setting tends to be a creep higher. In order for the market to reverse trend and for IV to pop, it would typically need to stack several down days in a row, likely with an acceleration each day, enough to get market participants to start reaching for protective puts. If red opens like this get bought intraday it would be indicative of that slow grind gamma backdrop where there’s still stock to be bought lower on red days and not a ton of put buying.

The two big stories of the day are the FOMC minutes release this afternoon and then Nvidia earnings after the close.

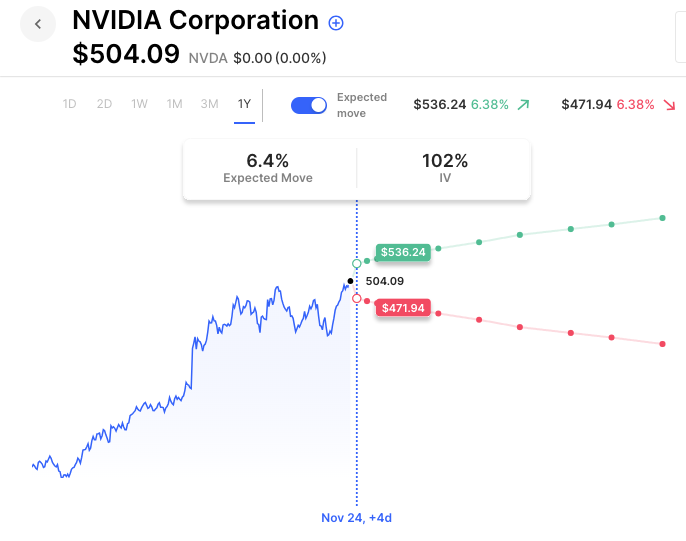

Going into the day, options are pricing about a 6.5% move. That seems to be the options market splitting the difference between earnings that saw little to no move while other quarters saw moves of more than 20%. Here are the 4 most recent earnings actual moves: 0%, +24%, +14%, and -1%.

Trending

Sibanye Gold Ltd ADR (SBSW) -22.88%

Morphosys Ag ADR (MOR) -24.57%

American Eagle Outfitters (AEO) -14.48%

Zoom Video Communications Cl A (ZM) -1.59%

Best Buy Company (BBY) -5.51%

Realpha Tech Corp (AIRE) -16.83%

Abercrombie & Fitch Company (ANF) -5.99%

Dick’s Sporting Goods Inc (DKS) +7.39%

Today’s Earnings Highlights:

NVIDIA Corporation (NVDA) Expected Move: 6.38%

Autodesk, Inc. (ADSK) Expected Move: 5.40%

HP Inc. (HPQ) Expected Move: 5.17%

Nordstrom, Inc. (JWN) Expected Move: 11.21%

Economic Calendar:

At 10:00 AM (EST) Existing Home Sales MoM (Oct) Impact: Medium

At 02:00 PM (EST) FOMC Minutes Impact: High

Unusual Options Volume:

KSS (+973%), BBY (+965%), SAN (+965%), AI (+838%), LUMN (+621%), GPS (+619%), JWN (+585%), MSFT (+508%), COIN (+501%), MSTR (+475%), MARA (+472%), PLTR (+469%), PENN (+466%), WMT (+459%), NVDA (+422%), ROKU (+383%), ZM (+377%), SQQQ (+344%), AMAT (+335%)

Follow The Orbit on Twitter and Youtube

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC